Vivid Seats SPAC Presentation Deck

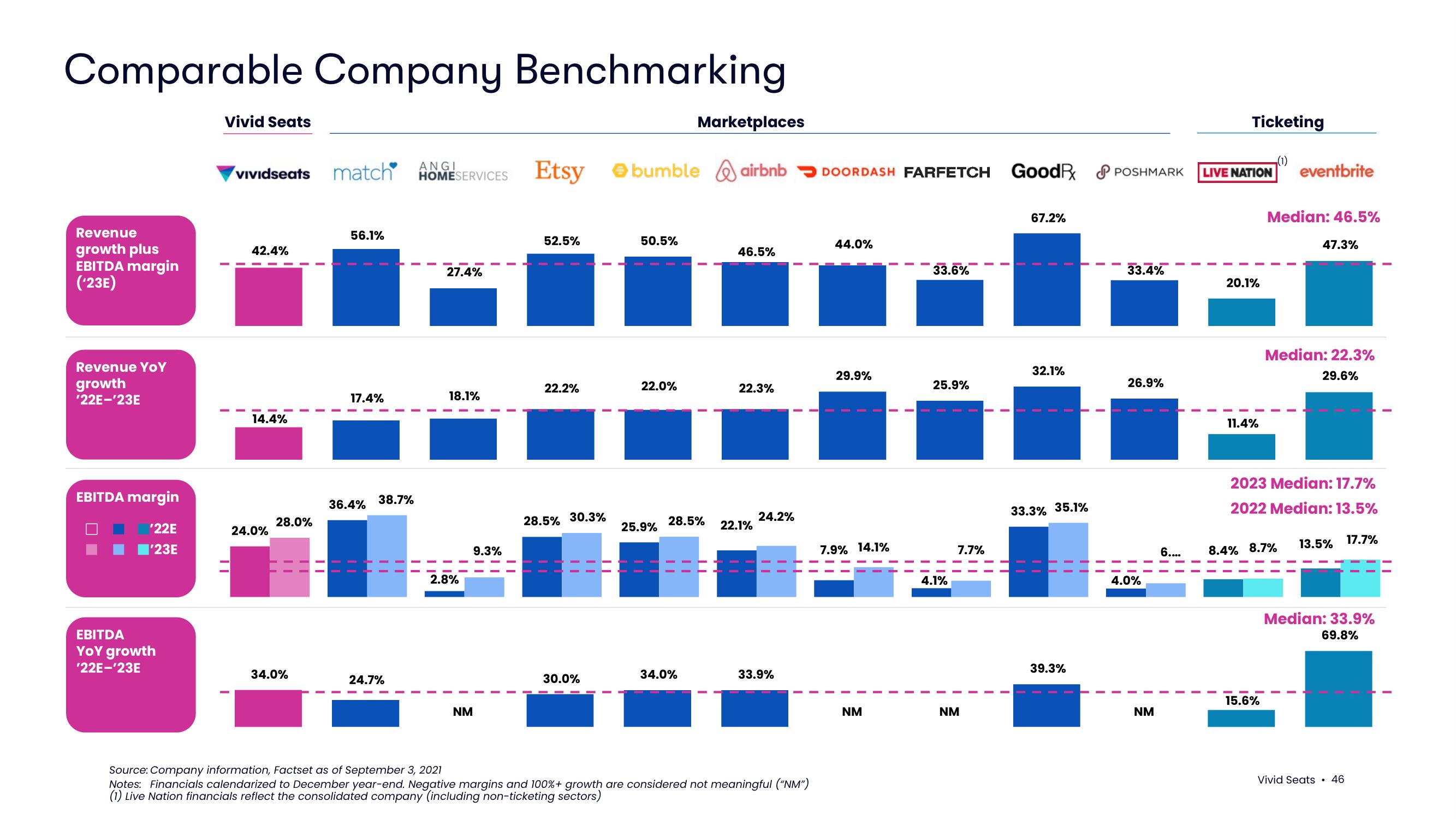

Comparable Company Benchmarking

Revenue

growth plus

EBITDA margin

('23E)

Revenue YoY

growth

'22E-'23E

EBITDA margin

'22E

I'23E

EBITDA

YoY growth

'22E-'23E

Vivid Seats

II

Vividseats match

42.4%

14.4%

24.0%

28.0%

34.0%

56.1%

17.4%

36.4%

38.7%

24.7%

ANGI

HOMESERVICES

27.4%

18.1%

2.8%

NM

9.3%

11

Etsy

52.5%

22.2%

28.5%

30.3%

30.0%

bumble airbnb DOORDASH FARFETCH GoodR POSHMARK

50.5%

22.0%

25.9%

Marketplaces

28.5%

34.0%

46.5%

22.3%

22.1%

24.2%

33.9%

Source: Company information, Factset as of September 3, 2021

Notes: Financials calendarized to December year-end. Negative margins and 100% + growth are considered not meaningful ("NM")

(1) Live Nation financials reflect the consolidated company (including non-ticketing sectors)

44.0%

29.9%

7.9% 14.1%

NM

33.6%

25.9%

4.1%

7.7%

NM

67.2%

32.1%

33.3% 35.1%

39.3%

33.4%

26.9%

4.0%

NM

6....

Ticketing

LIVE NATION eventbrite

20.1%

11.4%

Median: 46.5%

15.6%

47.3%

Median: 22.3%

29.6%

2023 Median: 17.7%

2022 Median: 13.5%

8.4% 8.7%

13.5% 17.7%

Median: 33.9%

69.8%

Vivid Seats 46View entire presentation