J.P.Morgan Software Investment Banking

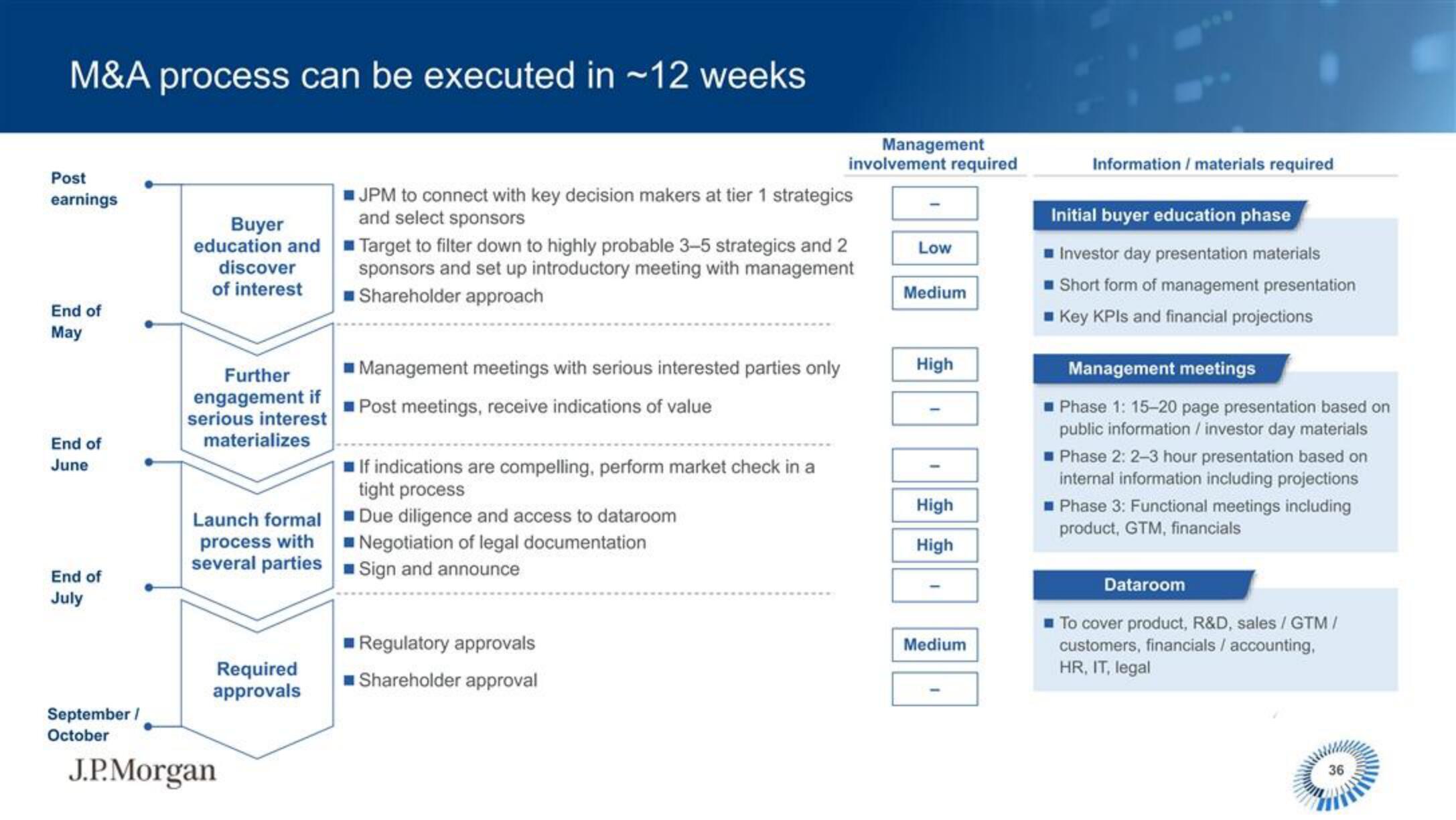

M&A process can be executed in ~12 weeks

Post

earnings

End of

May

End of

June

End of

July

September/

October

Buyer

education and

discover

of interest

Further

engagement if

serious interest

materializes

Launch formal

process with

several parties

Required

approvals

J.P.Morgan

JPM to connect with key decision makers at tier 1 strategics

and select sponsors

Target to filter down to highly probable 3-5 strategics and 2

sponsors and set up introductory meeting with management

Shareholder approach

Management meetings with serious interested parties only

Post meetings, receive indications of value

Management

involvement required

If indications are compelling, perform market check in a

tight process

Due diligence and access to dataroom

Negotiation of legal documentation

Sign and announce

Regulatory approvals

Shareholder approval

Low

Medium

High

1

High

High

Medium

Information / materials required

Initial buyer education phase

Investor day presentation materials

Short form of management presentation

Key KPIs and financial projections

Management meetings

Phase 1: 15-20 page presentation based on

public information / investor day materials

Phase 2: 2-3 hour presentation based on

internal information including projections

☐Phase 3: Functional meetings including

product, GTM, financials

Dataroom

To cover product, R&D, sales / GTM /

customers, financials /accounting,

HR, IT, legal

36View entire presentation