Embracer Group Mergers and Acquisitions Presentation Deck

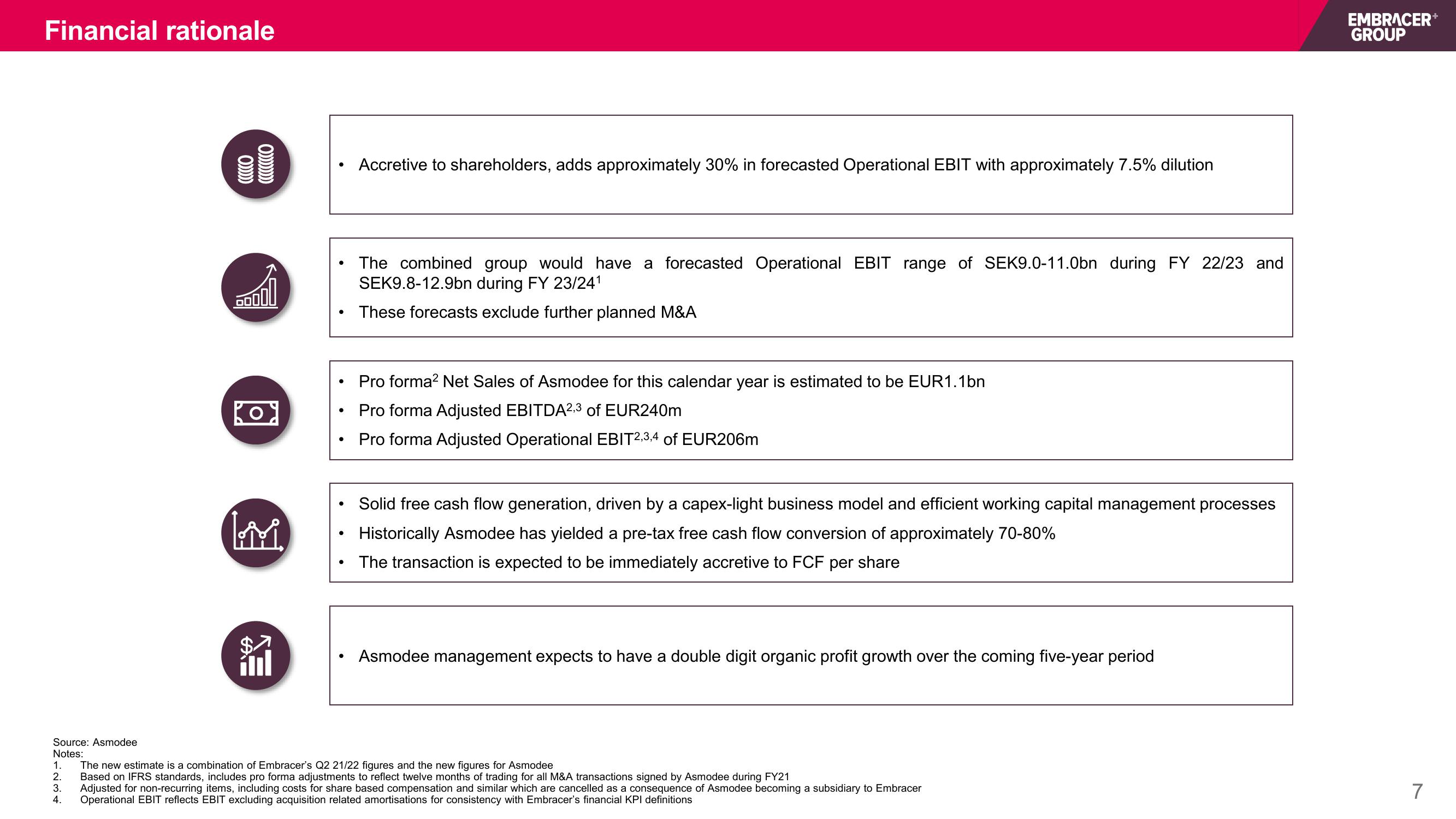

Financial rationale

Source: Asmodee

Notes:

1.

2.

3.

4.

O

O

BOOOD

54

6

Lii

inl

●

●

●

●

●

●

●

Accretive to shareholders, adds approximately 30% in forecasted Operational EBIT with approximately 7.5% dilution

The combined group would have a forecasted Operational EBIT range of SEK9.0-11.0bn during FY 22/23 and

SEK9.8-12.9bn during FY 23/24¹

These forecasts exclude further planned M&A

Pro forma² Net Sales of Asmodee for this calendar year is estimated to be EUR1.1bn

Pro forma Adjusted EBITDA2,3 of EUR240m

Pro forma Adjusted Operational EBIT2,3,4 of EUR206m

Solid free cash flow generation, driven by a capex-light business model and efficient working capital management processes

Historically Asmodee has yielded a pre-tax free cash flow conversion of approximately 70-80%

The transaction is expected to be immediately accretive to FCF per share

Asmodee management expects to have a double digit organic profit growth over the coming five-year period

The new estimate is a combination of Embracer's Q2 21/22 figures and the new figures for Asmodee

Based on IFRS standards, includes pro forma adjustments to reflect twelve months of trading for all M&A transactions signed by Asmodee during FY21

Adjusted for non-recurring items, including costs for share based compensation and similar which are cancelled as a consequence of Asmodee becoming a subsidiary to Embracer

Operational EBIT reflects EBIT excluding acquisition related amortisations for consistency with Embracer's financial KPI definitions

EMBRACER+

GROUP

7View entire presentation