Blackwells Capital Activist Presentation Deck

I

I

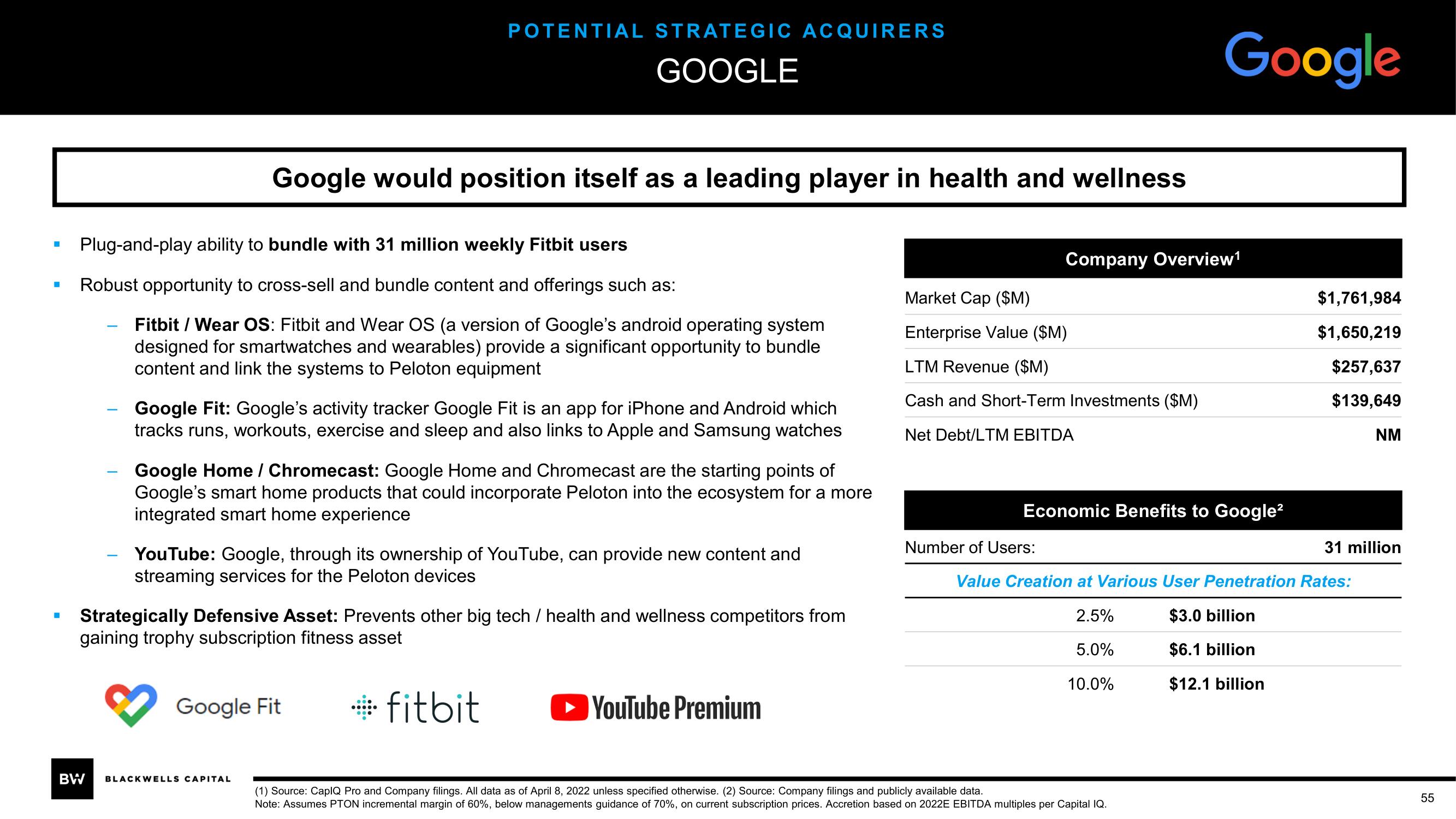

Google would position itself as a leading player in health and wellness

Plug-and-play ability to bundle with 31 million weekly Fitbit users

Robust opportunity to cross-sell and bundle content and offerings such as:

Fitbit / Wear OS: Fitbit and Wear OS (a version of Google's android operating system

designed for smartwatches and wearables) provide a significant opportunity to bundle

content and link the systems to Peloton equipment

POTENTIAL STRATEGIC ACQUIRERS

GOOGLE

Google Fit: Google's activity tracker Google Fit is an app for iPhone and Android which

tracks runs, workouts, exercise and sleep and also links to Apple and Samsung watches

Google Home / Chromecast: Google Home and Chromecast are the starting points of

Google's smart home products that could incorporate Peloton into the ecosystem for a more

integrated smart home experience

YouTube: Google, through its ownership of YouTube, can provide new content and

streaming services for the Peloton devices

Strategically Defensive Asset: Prevents other big tech / health and wellness competitors from

gaining trophy subscription fitness asset

Google Fit

BW BLACKWELLS CAPITAL

fitbit

► YouTube Premium

Market Cap ($M)

Enterprise Value ($M)

LTM Revenue ($M)

Cash and Short-Term Investments ($M)

Net Debt/LTM EBITDA

Company Overview¹

Number of Users:

Google

Economic Benefits to Google²

(1) Source: CapIQ Pro and Company filings. All data as of April 8, 2022 unless specified otherwise. (2) Source: Company filings and publicly available data.

Note: Assumes PTON incremental margin of 60%, below managements guidance of 70%, on current subscription prices. Accretion based on 2022E EBITDA multiples per Capital IQ.

$1,761,984

$1,650,219

$257,637

$139,649

Value Creation at Various User Penetration Rates:

$3.0 billion

2.5%

5.0%

$6.1 billion

10.0%

$12.1 billion

NM

31 million

55View entire presentation