Credit Suisse Results Presentation Deck

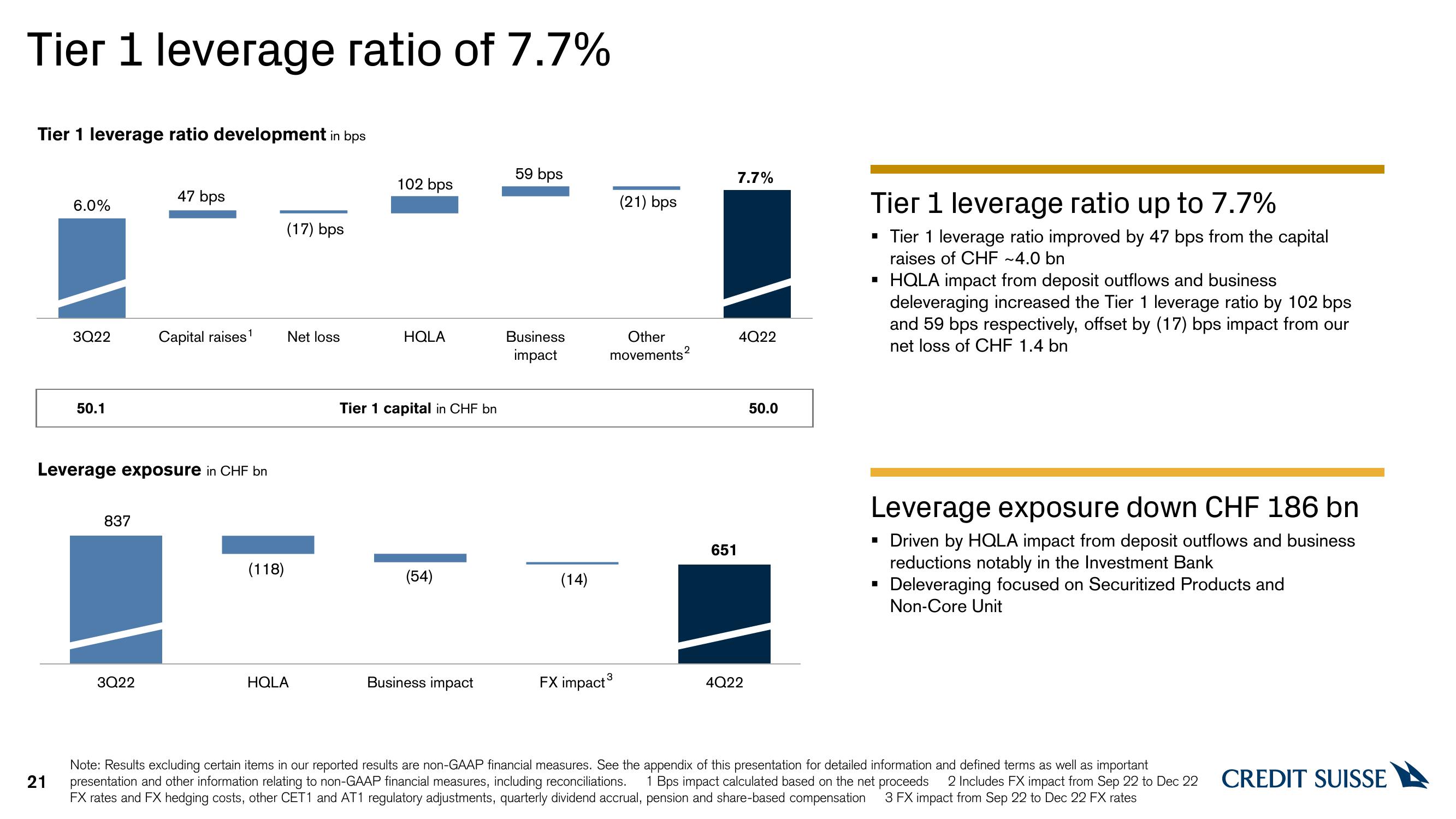

Tier 1 leverage ratio of 7.7%

Tier 1 leverage ratio development in bps

6.0%

21

3Q22

50.1

Leverage exposure in CHF bn

837

47 bps

3Q22

Capital raises¹

(118)

(17) bps

Net loss

HQLA

102 bps

HQLA

Tier 1 capital in CHF bn

(54)

Business impact

59 bps

Business

impact

(14)

(21) bps

Other

movements ²

2

3

FX impact ³

7.7%

651

4Q22

4Q22

50.0

Tier 1 leverage ratio up to 7.7%

▪ Tier 1 leverage ratio improved by 47 bps from the capital

raises of CHF ~4.0 bn

■

HQLA impact from deposit outflows and business

deleveraging increased the Tier 1 leverage ratio by 102 bps

and 59 bps respectively, offset by (17) bps impact from our

net loss of CHF 1.4 bn

Leverage exposure down CHF 186 bn

▪ Driven by HQLA impact from deposit outflows and business

reductions notably in the Investment Bank

Deleveraging focused on Securitized Products and

Non-Core Unit

■

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Bps impact calculated based on the net proceeds 2 Includes FX impact from Sep 22 to Dec 22 CREDIT SUISSE

FX rates and FX hedging costs, other CET1 and AT1 regulatory adjustments, quarterly dividend accrual, pension and share-based compensation 3 FX impact from Sep 22 to Dec 22 FX ratesView entire presentation