Bunzl Results Presentation Deck

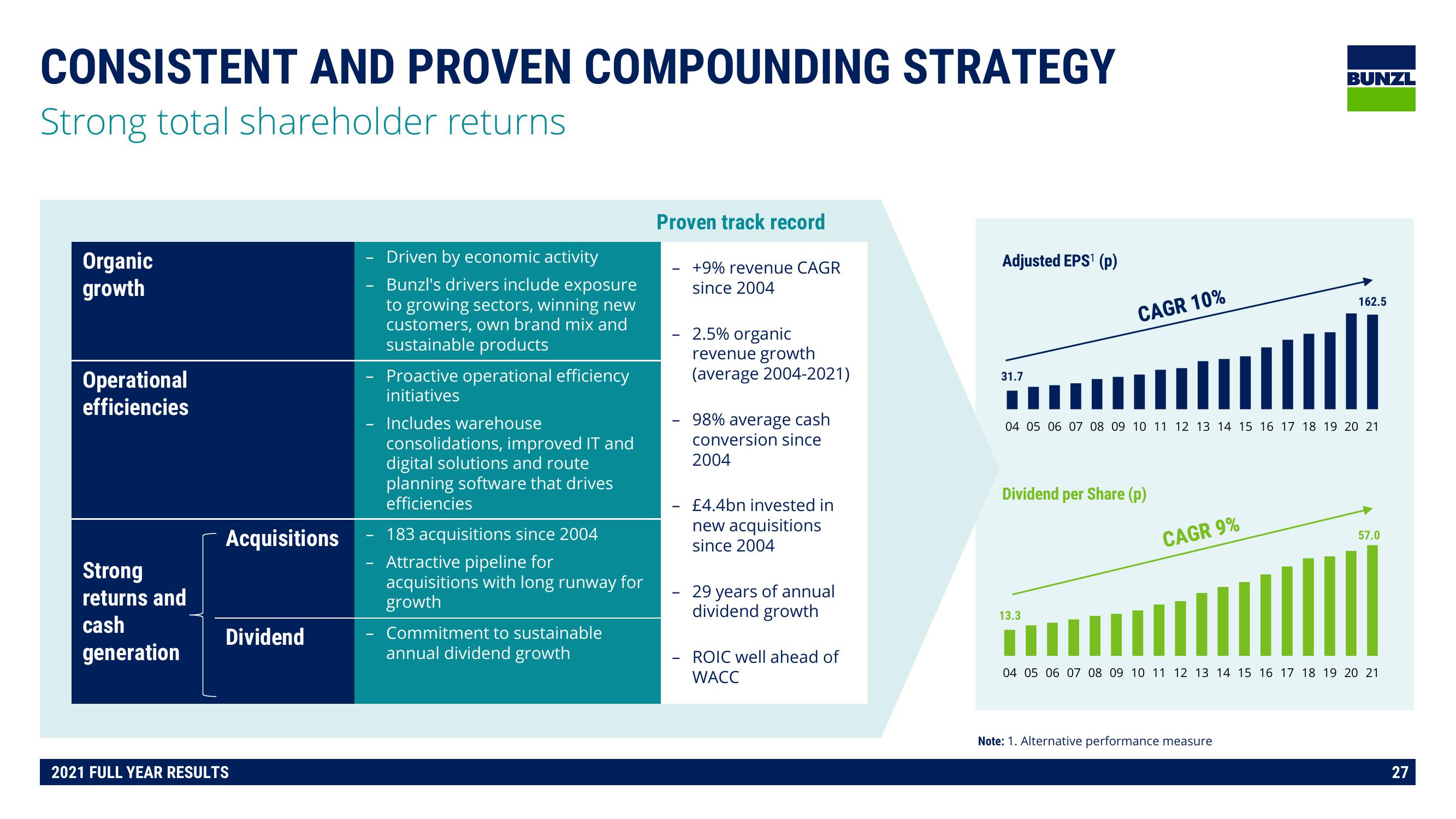

CONSISTENT AND PROVEN COMPOUNDING STRATEGY

Strong total shareholder returns

Organic

growth

Operational

efficiencies

Strong

returns and

cash

generation

Acquisitions

Dividend

2021 FULL YEAR RESULTS

- Driven by economic activity

Bunzl's drivers include exposure

to growing sectors, winning new

customers, own brand mix and

sustainable products

Proactive operational efficiency

initiatives

- Includes warehouse

consolidations, improved IT and

digital solutions and route

planning software that drives

efficiencies

- 183 acquisitions since 2004

Attractive pipeline for

acquisitions with long runway for

growth

Commitment to sustainable

annual dividend growth

Proven track record

+9% revenue CAGR

since 2004

2.5% organic

revenue growth

(average 2004-2021)

98% average cash

conversion since

2004

£4.4bn invested in

new acquisitions

since 2004

29 years of annual

dividend growth

ROIC well ahead of

WACC

Adjusted EPS¹ (p)

31.7

CAGR 10%

Dividend per Share (p)

13.3

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

CAGR 9%

BUNZL

162.5

Note: 1. Alternative performance measure

57.0

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

27View entire presentation