Silicon Valley Bank Results Presentation Deck

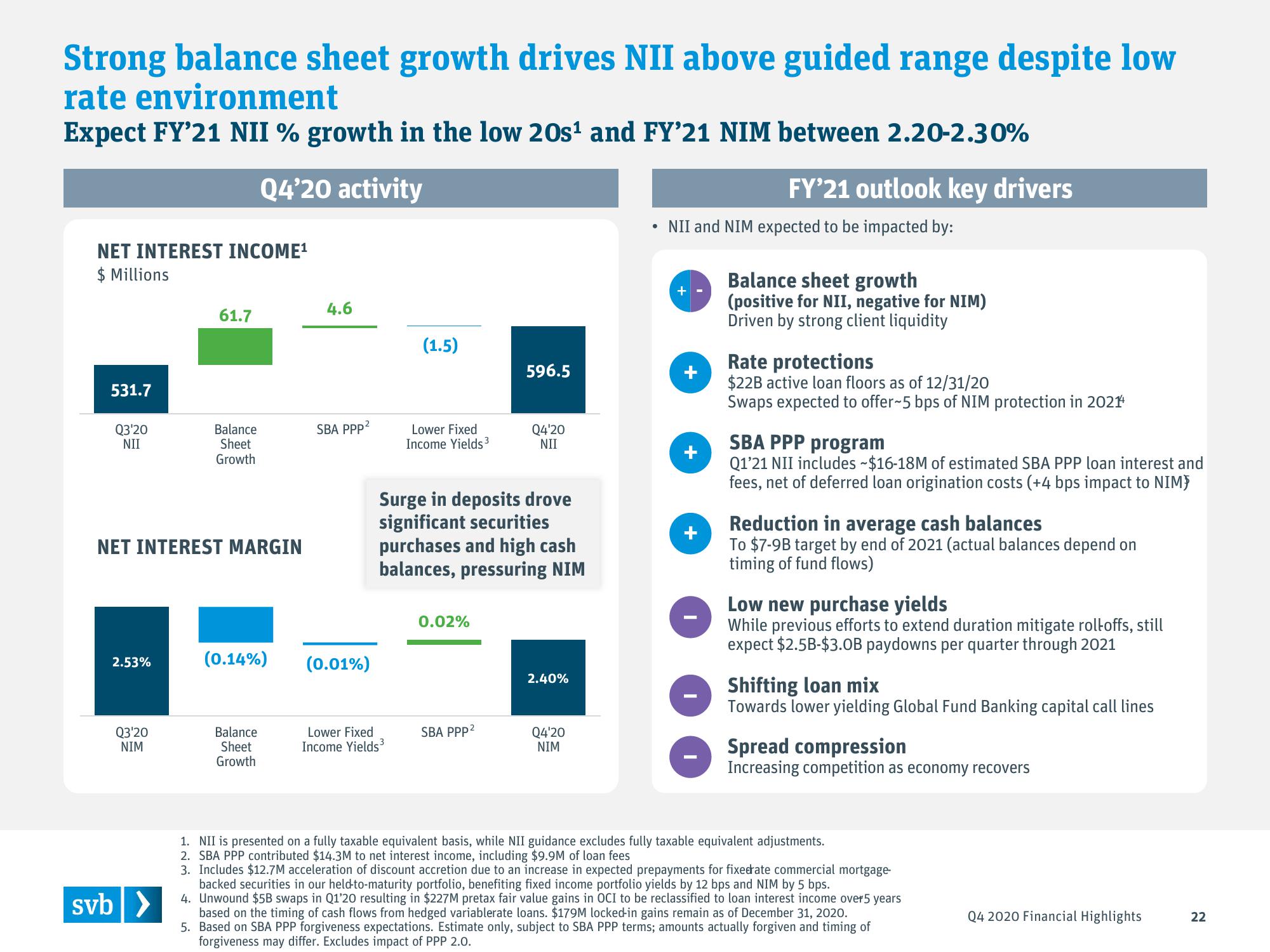

Strong balance sheet growth drives NII above guided range despite low

rate environment

Expect FY'21 NII % growth in the low 20s¹ and FY'21 NIM between 2.20-2.30%

Q4'20 activity

NET INTEREST INCOME¹

$ Millions

531.7

Q3'20

NII

2.53%

NET INTEREST MARGIN

Q3'20

NIM

61.7

svb>

Balance

Sheet

Growth

(0.14%)

Balance

Sheet

Growth

4.6

SBA PPP²

(0.01%)

(1.5)

Lower Fixed

Income Yields³

Lower Fixed

Income Yields 3

Surge in deposits drove

significant securities

purchases and high cash

balances, pressuring NIM

0.02%

596.5

SBA PPP²

Q4'20

NII

2.40%

Q4'20

NIM

• NII and NIM expected to be impacted by:

+

+

+

FY'21 outlook key drivers

+

Balance sheet growth

(positive for NII, negative for NIM)

Driven by strong client liquidity

Rate protections

$22B active loan floors as of 12/31/20

Swaps expected to offer~5 bps of NIM protection in 2021¹

SBA PPP program

Q1'21 NII includes ~$16-18M of estimated SBA PPP loan interest and

fees, net of deferred loan origination costs (+4 bps impact to NIM)

Reduction in average cash balances

To $7-9B target by end of 2021 (actual balances depend on

timing of fund flows)

Low new purchase yields

While previous efforts to extend duration mitigate rolloffs, still

expect $2.5B-$3.OB paydowns per quarter through 2021

Shifting loan mix

Towards lower yielding Global Fund Banking capital call lines

Spread compression

Increasing competition as economy recovers

1. NII is presented on a fully taxable equivalent basis, while NII guidance excludes fully taxable equivalent adjustments.

2. SBA PPP contributed $14.3M to net interest income, including $9.9M of loan fees

3. Includes $12.7M acceleration of discount accretion due to an increase in expected prepayments for fixedate commercial mortgage-

backed securities in our held-to-maturity portfolio, benefiting fixed income portfolio yields by 12 bps and NIM by 5 bps.

4. Unwound $5B swaps in Q1'20 resulting in $227M pretax fair value gains in OCI to be reclassified to loan interest income over 5 years

based on the timing of cash flows from hedged variablerate loans. $179M locked-in gains remain as of December 31, 2020.

5. Based on SBA PPP forgiveness expectations. Estimate only, subject to SBA PPP terms; amounts actually forgiven and timing of

forgiveness may differ. Excludes impact of PPP 2.0.

Q4 2020 Financial Highlights

22View entire presentation