First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

Focused Control on Expenses

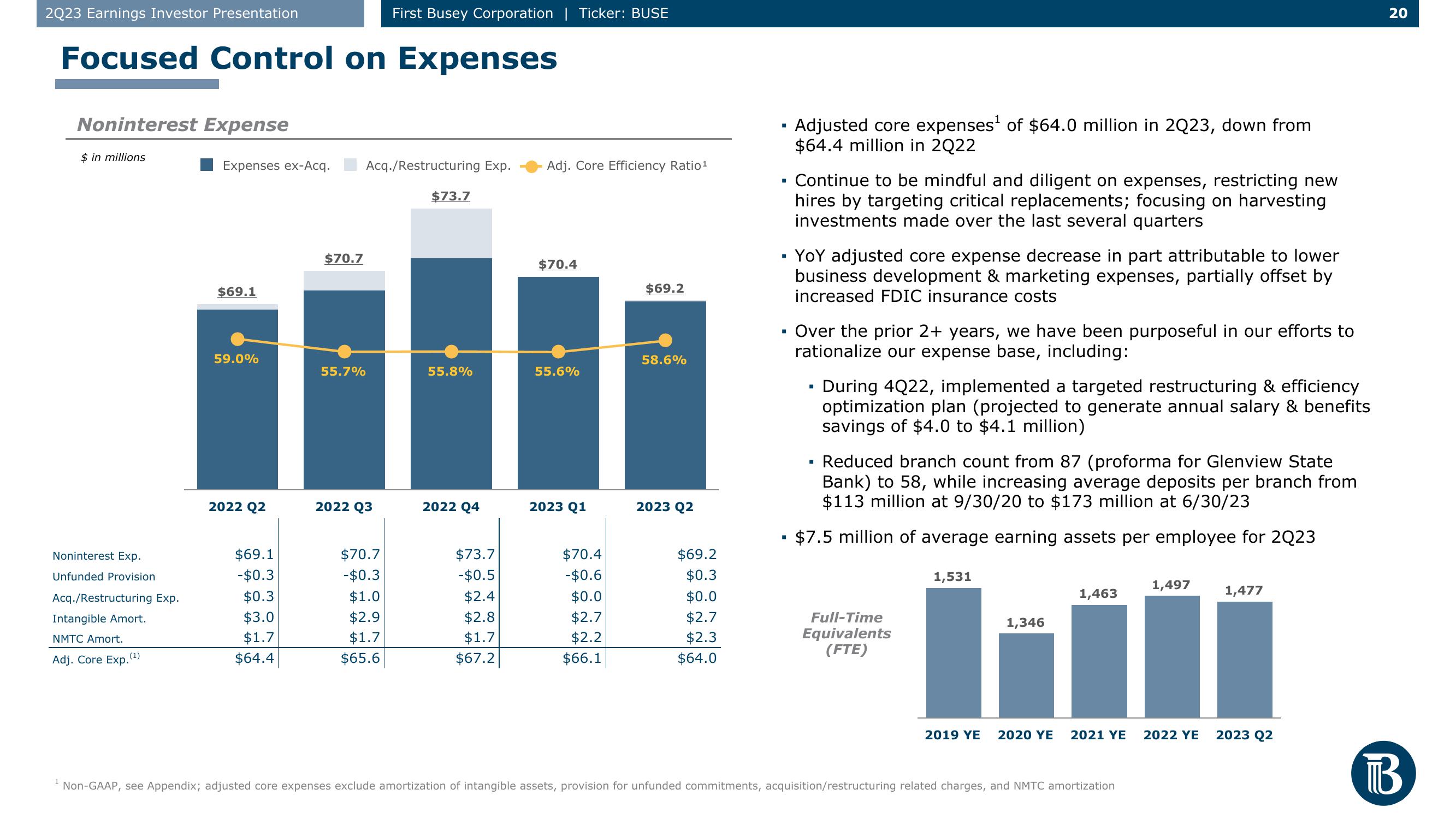

Noninterest Expense

$ in millions

Noninterest Exp.

Unfunded Provision

Acq./Restructuring Exp.

1

Intangible Amort.

NMTC Amort.

Adj. Core Exp. (¹)

Expenses ex-Acq.

$69.1

59.0%

2022 Q2

$69.1

- $0.3

$0.3

$3.0

$1.7

$64.4

$70.7

55.7%

Acq./Restructuring Exp.

2022 Q3

First Busey Corporation | Ticker: BUSE

$70.7

- $0.3

$1.0

$2.9

$1.7

$65.6

$73.7

55.8%

2022 Q4

$73.7

-$0.5

$2.4

$2.8

$1.7

$67.2

Adj. Core Efficiency Ratio ¹

$70.4

55.6%

2023 Q1

$70.4

-$0.6

$0.0

$2.7

$2.2

$66.1

$69.2

58.6%

2023 Q2

$69.2

$0.3

$0.0

$2.7

$2.3

$64.0

■

I

Adjusted core expenses¹ of $64.0 million in 2Q23, down from

$64.4 million in 2Q22

Continue to be mindful and diligent on expenses, restricting new

hires by targeting critical replacements; focusing on harvesting

investments made over the last several quarters

YOY adjusted core expense decrease in part attributable to lower

business development & marketing expenses, partially offset by

increased FDIC insurance costs

▪ Over the prior 2+ years, we have been purposeful in our efforts to

rationalize our expense base, including:

During 4Q22, implemented a targeted restructuring & efficiency

optimization plan (projected to generate annual salary & benefits

savings of $4.0 to $4.1 million)

Reduced branch count from 87 (proforma for Glenview State

Bank) to 58, while increasing average deposits per branch from

$113 million at 9/30/20 to $173 million at 6/30/23

$7.5 million of average earning assets per employee for 2Q23

Full-Time

Equivalents

(FTE)

1,531

1,346

1,463

2019 YE 2020 YE 2021 YE

Non-GAAP, see Appendix; adjusted core expenses exclude amortization of intangible assets, provision for unfunded commitments, acquisition/restructuring related charges, and NMTC amortization

1,497

2022 YE

1,477

2023 Q2

20

BView entire presentation