W3BCLOUD SPAC

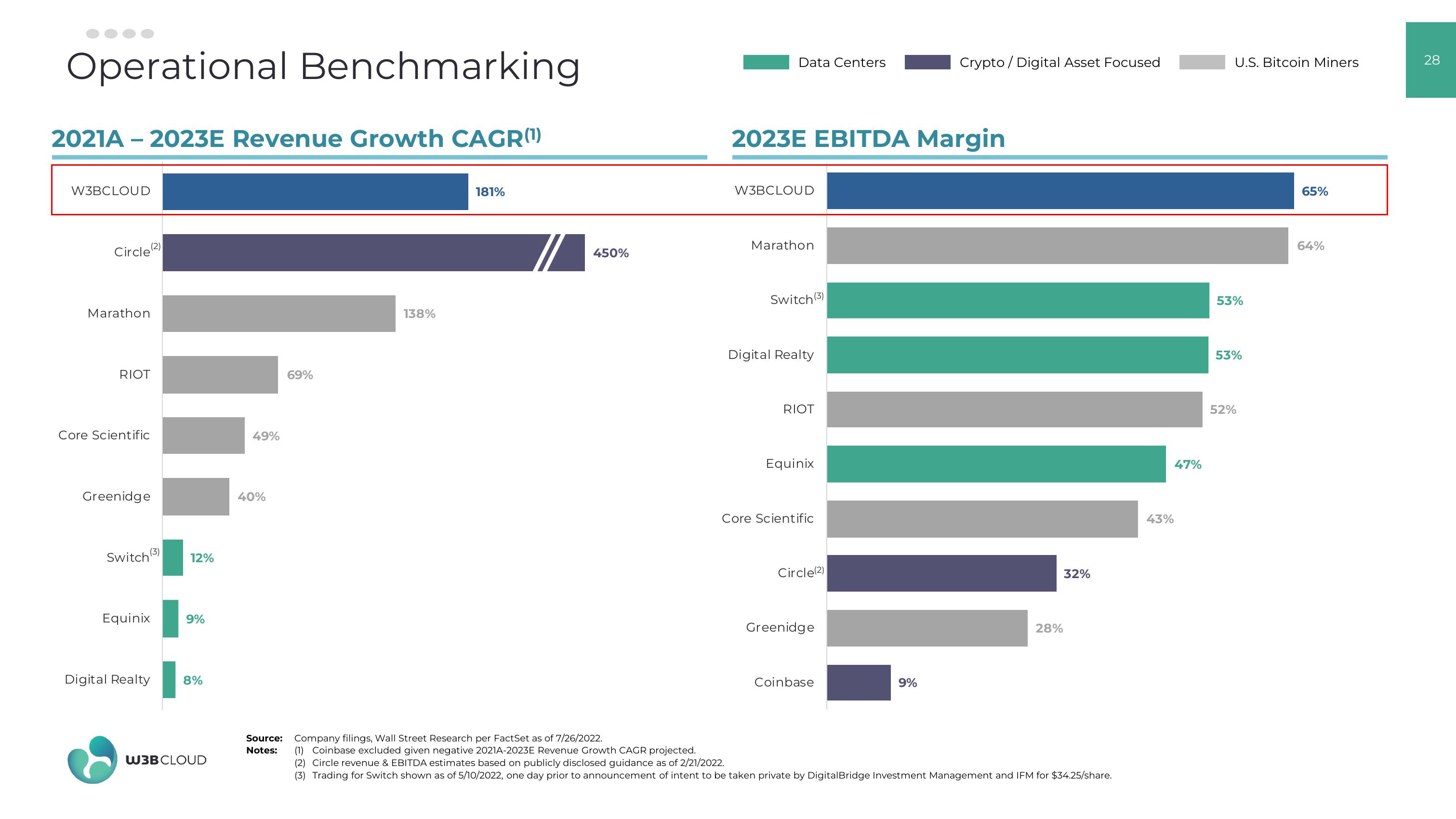

Operational Benchmarking

2021A - 2023E Revenue Growth CAGR(¹)

W3BCLOUD

Circle (2)

Marathon

RIOT

Core Scientific

Greenidge

Switch

(3)

Equinix

Digital Realty

12%

9%

8%

W3B CLOUD

49%

40%

69%

138%

181%

450%

Source: Company filings, Wall Street Research per FactSet as of 7/26/2022.

Notes:

Data Centers

2023E EBITDA Margin

W3BCLOUD

Marathon

Switch (3)

Digital Realty

RIOT

Equinix

Core Scientific

Circle(2)

Greenidge

Coinbase

Crypto/ Digital Asset Focused

9%

28%

32%

(1) Coinbase excluded given negative 2021A-2023E Revenue Growth CAGR projected.

(2) Circle revenue & EBITDA estimates based on publicly disclosed guidance as of 2/21/2022.

(3) Trading for Switch shown as of 5/10/2022, one day prior to announcement of intent to be taken private by Digital Bridge Investment Management and IFM for $34.25/share.

43%

47%

U.S. Bitcoin Miners

53%

53%

52%

65%

64%

28View entire presentation