Sonos Results Presentation Deck

Strong Opex Leverage While Continuing to Invest in R&D

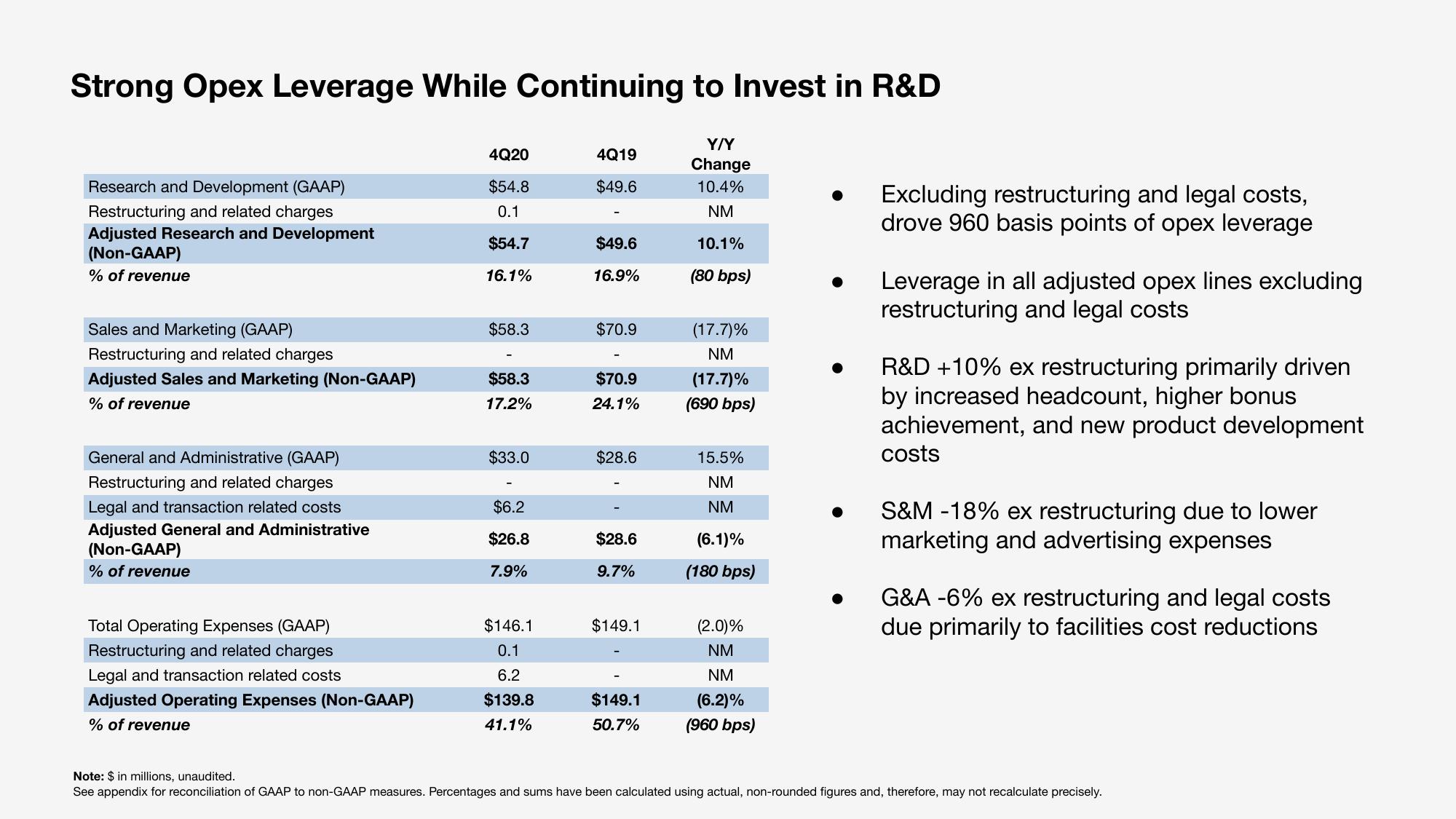

Research and Development (GAAP)

Restructuring and related charges

Adjusted Research and Development

(Non-GAAP)

% of revenue

Sales and Marketing (GAAP)

Restructuring and related charges

Adjusted Sales and Marketing (Non-GAAP)

% of revenue

General and Administrative (GAAP)

Restructuring and related charges

Legal and transaction related costs

Adjusted General and Administrative

(Non-GAAP)

% of revenue

Total Operating Expenses (GAAP)

Restructuring and related charges

Legal and transaction related costs

Adjusted Operating Expenses (Non-GAAP)

% of revenue

4Q20

$54.8

0.1

$54.7

16.1%

$58.3

$58.3

17.2%

$33.0

$6.2

$26.8

7.9%

$146.1

0.1

6.2

$139.8

41.1%

4Q19

$49.6

$49.6

16.9%

$70.9

$70.9

24.1%

$28.6

$28.6

9.7%

$149.1

$149.1

50.7%

Y/Y

Change

10.4%

NM

10.1%

(80 bps)

(17.7)%

NM

(17.7)%

(690 bps)

15.5%

NM

NM

(6.1)%

(180 bps)

(2.0)%

NM

NM

(6.2)%

(960 bps)

Excluding restructuring and legal costs,

drove 960 basis points of opex leverage

Leverage in all adjusted opex lines excluding

restructuring and legal costs

R&D +10% ex restructuring primarily driven

by increased headcount, higher bonus

achievement, and new product development

costs

S&M -18% ex restructuring due to lower

marketing and advertising expenses

G&A -6% ex restructuring and legal costs

due primarily to facilities cost reductions

Note: $ in millions, unaudited.

See appendix for reconciliation of GAAP to non-GAAP measures. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.View entire presentation