AT&T Results Presentation Deck

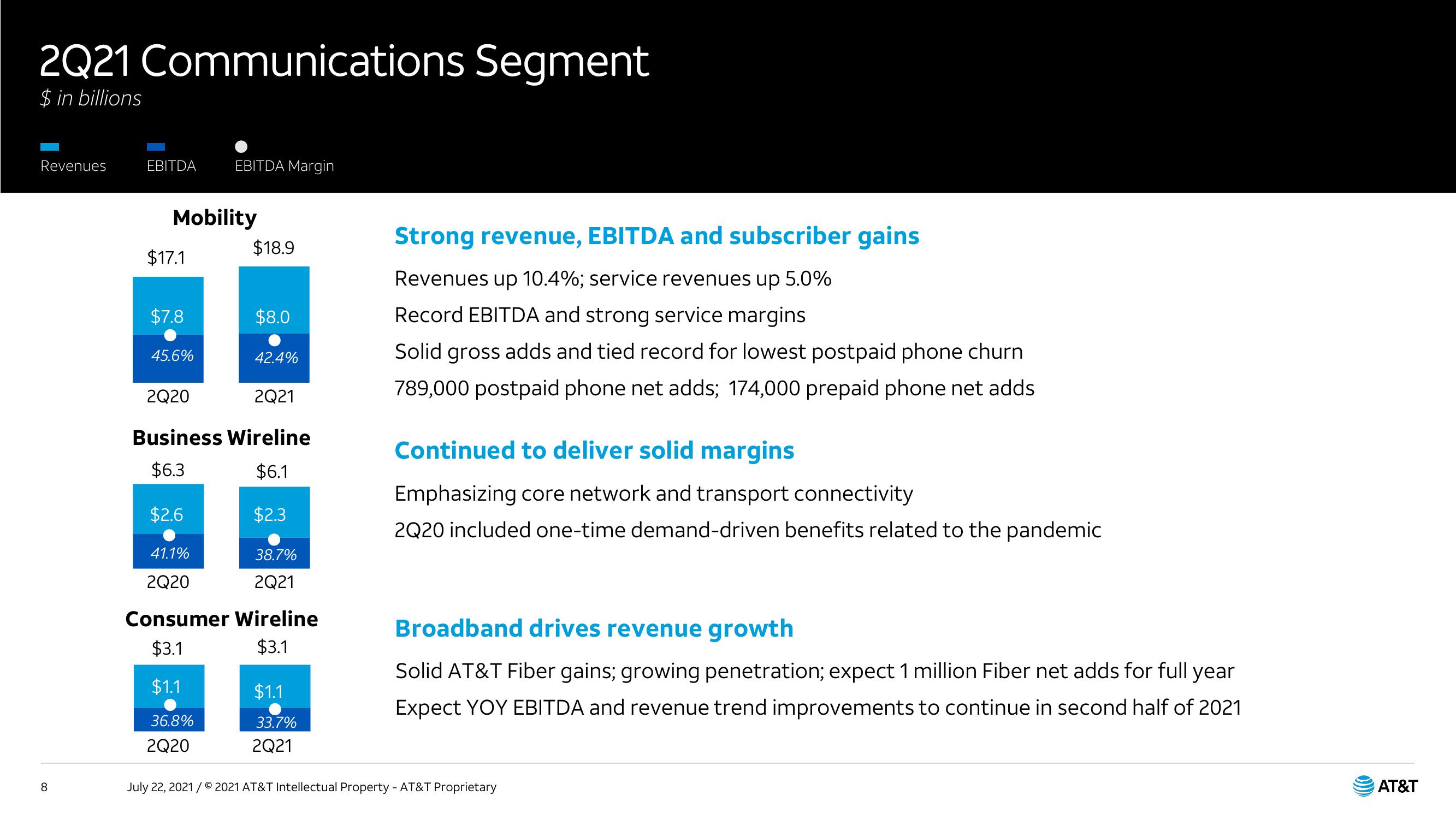

2Q21 Communications Segment

$ in billions

Revenues

8

EBITDA EBITDA Margin

Mobility

$17.1

$7.8

45.6%

$2.6

41.1%

2Q20

$18.9

2Q20

2Q21

Business Wireline

$6.1

$6.3

$2.3

$8.0

$1.1

36.8%

2Q20

42.4%

38.7%

2Q21

Consumer Wireline

$3.1

$3.1

$1.1

33.7%

2Q21

Strong revenue, EBITDA and subscriber gains

Revenues up 10.4%; service revenues up 5.0%

Record EBITDA and strong service margins

Solid gross adds and tied record for lowest postpaid phone churn

789,000 postpaid phone net adds; 174,000 prepaid phone net adds

Continued to deliver solid margins

Emphasizing core network and transport connectivity

2Q20 included one-time demand-driven benefits related to the pandemic

Broadband drives revenue growth

Solid AT&T Fiber gains; growing penetration; expect 1 million Fiber net adds for full year

Expect YOY EBITDA and revenue trend improvements to continue in second half of 2021

July 22, 2021/ © 2021 AT&T Intellectual Property - AT&T Proprietary

AT&TView entire presentation