Q2 FY24 Earnings Presentation

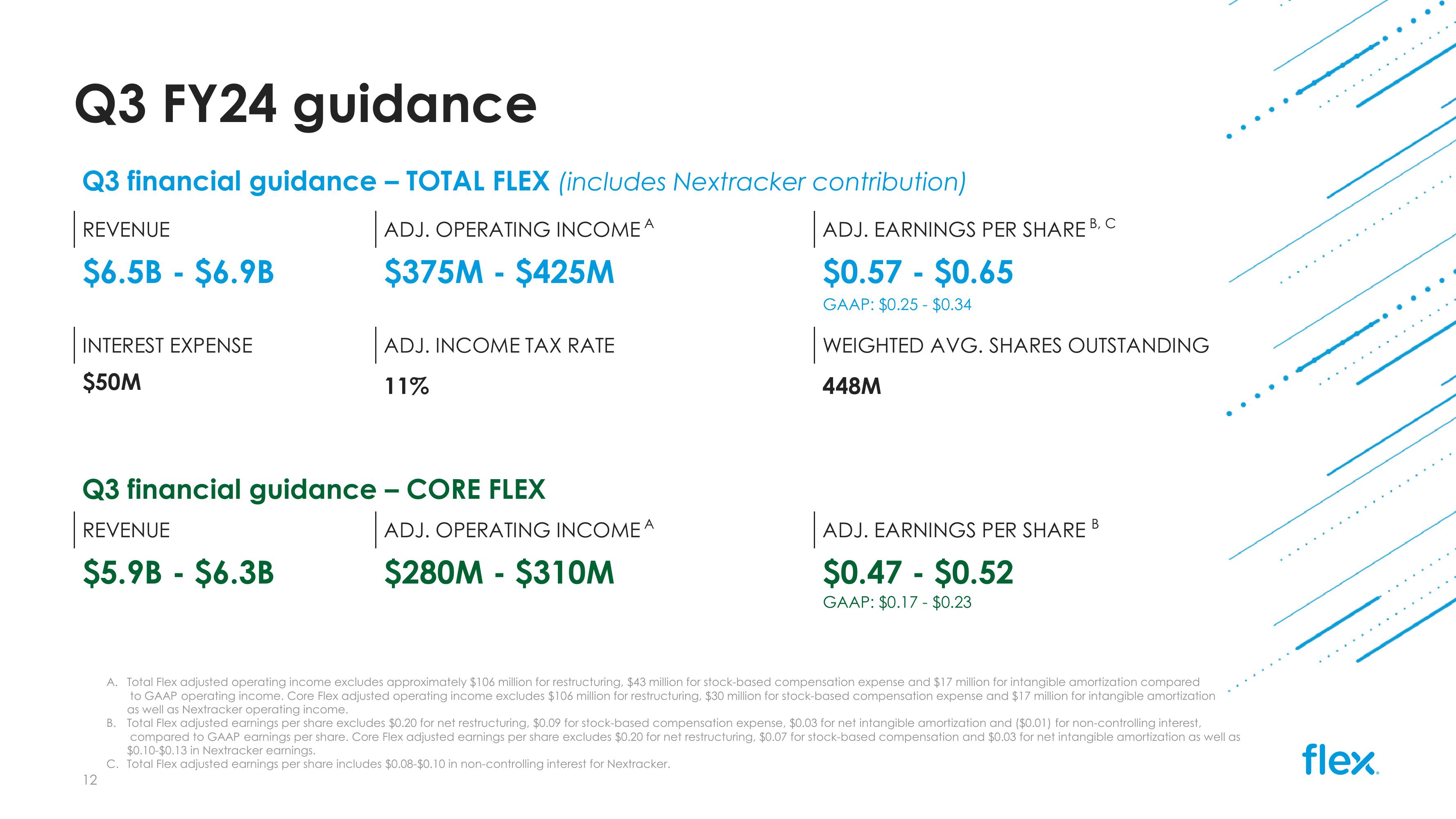

Q3 FY24 guidance

Q3 financial guidance – TOTAL FLEX (includes Nextracker contribution)

REVENUE

$6.5B $6.9B

-

-

ADJ. OPERATING INCOME A

$375M - $425M

| ADJ. EARNINGS PER SHARE B. C

$0.57 - $0.65

GAAP: $0.25 - $0.34

WEIGHTED AVG. SHARES OUTSTANDING

INTEREST EXPENSE

$50M

ADJ. INCOME TAX RATE

11%

448M

Q3 financial guidance - CORE FLEX

REVENUE

-

$5.9B $6.3B

ADJ. OPERATING INCOME A

$280M - $310M

| ADJ. EARNINGS PER SHARE

$0.47 - $0.52

GAAP: $0.17 - $0.23

12

A. Total Flex adjusted operating income excludes approximately $106 million for restructuring, $43 million for stock-based compensation expense and $17 million for intangible amortization compared

to GAAP operating income. Core Flex adjusted operating income excludes $106 million for restructuring, $30 million for stock-based compensation expense and $17 million for intangible amortization

as well as Nextracker operating income.

B. Total Flex adjusted earnings per share excludes $0.20 for net restructuring, $0.09 for stock-based compensation expense, $0.03 for net intangible amortization and ($0.01) for non-controlling interest,

compared to GAAP earnings per share. Core Flex adjusted earnings per share excludes $0.20 for net restructuring, $0.07 for stock-based compensation and $0.03 for net intangible amortization as well as

$0.10-$0.13 in Nextracker earnings.

C. Total Flex adjusted earnings per share includes $0.08-$0.10 in non-controlling interest for Nextracker.

flexView entire presentation