HHR Investor Presentation Deck

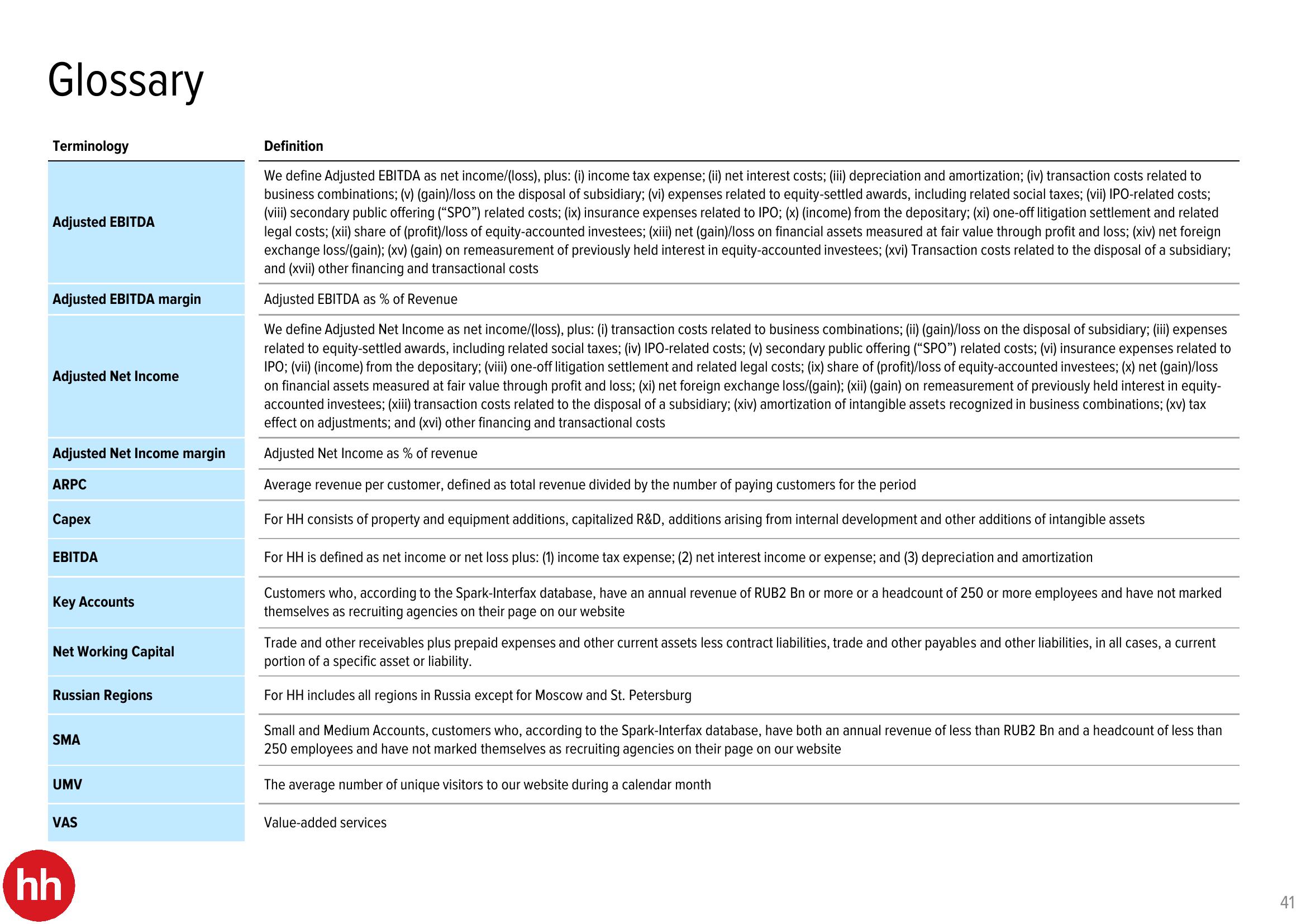

Glossary

Terminology

Adjusted EBITDA

Adjusted EBITDA margin

Adjusted Net Income

Adjusted Net Income margin

ARPC

Capex

EBITDA

Key Accounts

Net Working Capital

Russian Regions

SMA

UMV

VAS

hh

Definition

We define Adjusted EBITDA as net income/(loss), plus: (i) income tax expense; (ii) net interest costs; (iii) depreciation and amortization; (iv) transaction costs related to

business combinations; (v) (gain)/loss on the disposal of subsidiary; (vi) expenses related to equity-settled awards, including related social taxes; (vii) IPO-related costs;

(viii) secondary public offering ("SPO") related costs; (ix) insurance expenses related to IPO; (x) (income) from the depositary; (xi) one-off litigation settlement and related

legal costs; (xii) share of (profit)/loss of equity-accounted investees; (xiii) net (gain)/loss on financial assets measured at fair value through profit and loss; (xiv) net foreign

exchange loss/(gain); (xv) (gain) on remeasurement of previously held interest in equity-accounted investees; (xvi) Transaction costs related to the disposal of a subsidiary;

and (xvii) other financing and transactional costs

Adjusted EBITDA as % of Revenue

We define Adjusted Net Income as net income/(loss), plus: (i) transaction costs related to business combinations; (ii) (gain)/loss on the disposal of subsidiary; (iii) expenses

related to equity-settled awards, including related social taxes; (iv) IPO-related costs; (v) secondary public offering ("SPO") related costs; (vi) insurance expenses related to

IPO; (vii) (income) from the depositary; (viii) one-off litigation settlement and related legal costs; (ix) share of (profit)/loss of equity-accounted investees; (x) net (gain)/loss

on financial assets measured at fair value through profit and loss; (xi) net foreign exchange loss/(gain); (xii) (gain) on remeasurement of previously held interest in equity-

accounted investees; (xiii) transaction costs related to the disposal of a subsidiary; (xiv) amortization of intangible assets recognized in business combinations; (xv) tax

effect on adjustments; and (xvi) other financing and transactional costs

Adjusted Net Income as % of revenue

Average revenue per customer, defined as total revenue divided by the number of paying customers for the period

For HH consists of property and equipment additions, capitalized R&D, additions arising from internal development and other additions of intangible assets

For HH is defined as net income or net loss plus: (1) income tax expense; (2) net interest income or expense; and (3) depreciation and amortization

Customers who, according to the Spark-Interfax database, have an annual revenue of RUB2 Bn or more or a headcount of 250 or more employees and have not marked

themselves as recruiting agencies on their page on our website

Trade and other receivables plus prepaid expenses and other current assets less contract liabilities, trade and other payables and other liabilities, in all cases, a current

portion of a specific asset or liability.

For HH includes all regions in Russia except for Moscow and St. Petersburg

Small and Medium Accounts, customers who, according to the Spark-Interfax database, have both an annual revenue of less than RUB2 Bn and a headcount of less than

250 employees and have not marked themselves as recruiting agencies on their page on our website

The average number of unique visitors to our website during a calendar month

Value-added services

41View entire presentation