Azerion SPAC Presentation Deck

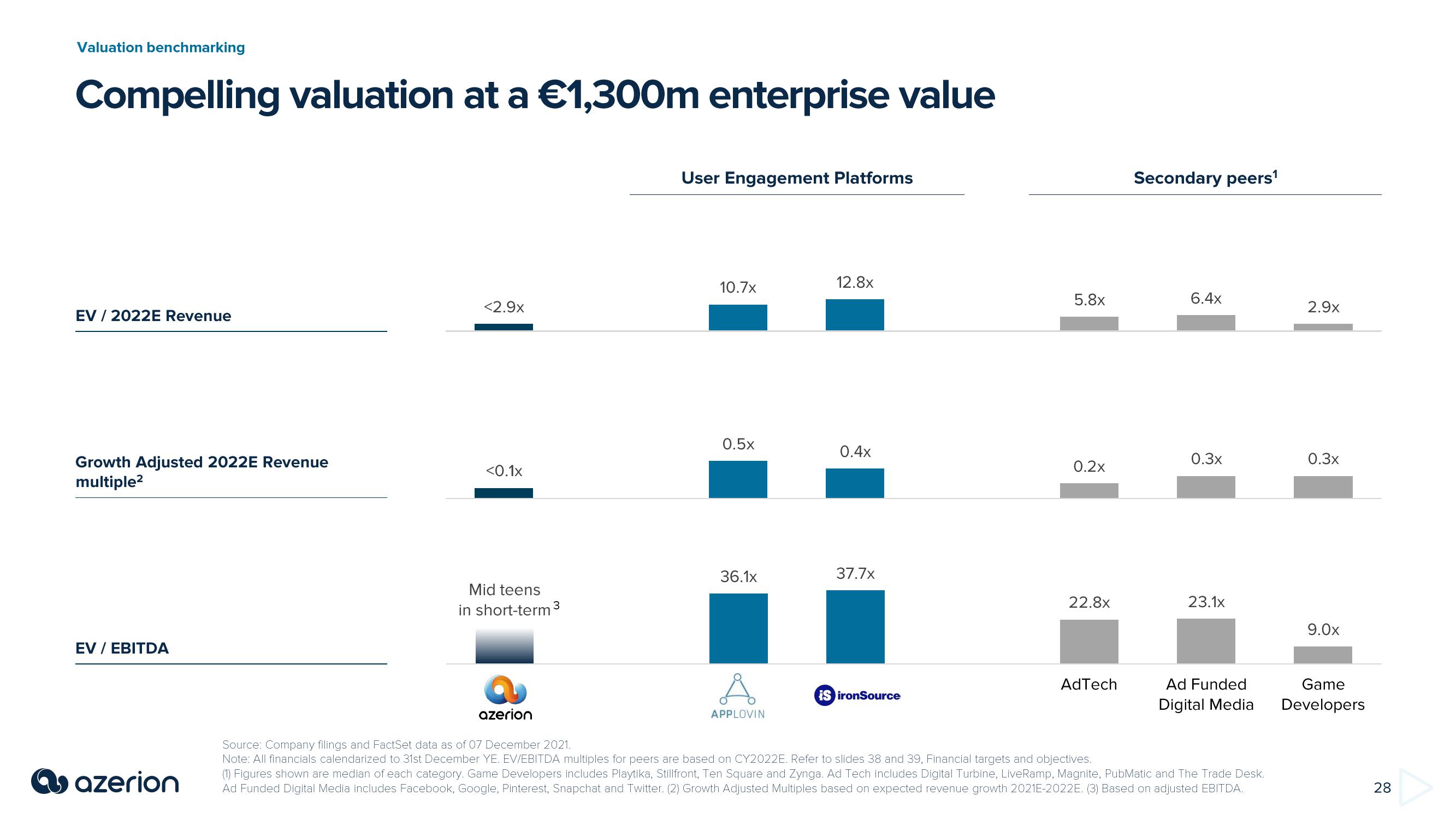

Valuation benchmarking

Compelling valuation at a €1,300m enterprise value

EV / 2022E Revenue

Growth Adjusted 2022E Revenue

multiple²

EV / EBITDA

azerion

<2.9x

<0.1x

Mid teens

in short-term ³

User Engagement Platforms

10.7x

0.5x

36.1x

A

APPLOVIN

12.8x

0.4x

37.7x

iS ironSource

5.8x

0.2x

22.8x

AdTech

Secondary peers¹

6.4x

0.3x

23.1x

Ad Funded

Digital Media

azerion

Source: Company filings and FactSet data as of 07 December 2021.

Note: All financials calendarized to 31st December YE. EV/EBITDA multiples for peers are based on CY2022E. Refer to slides 38 and 39, Financial targets and objectives.

(1) Figures shown are median of each category. Game Developers includes Playtika, Stillfront, Ten Square and Zynga. Ad Tech includes Digital Turbine, LiveRamp, Magnite, PubMatic and The Trade Desk.

Ad Funded Digital Media includes Facebook, Google, Pinterest, Snapchat and Twitter. (2) Growth Adjusted Multiples based on expected revenue growth 2021E-2022E. (3) Based on adjusted EBITDA.

2.9x

0.3x

9.0x

Game

Developers

28View entire presentation