IGI SPAC Presentation Deck

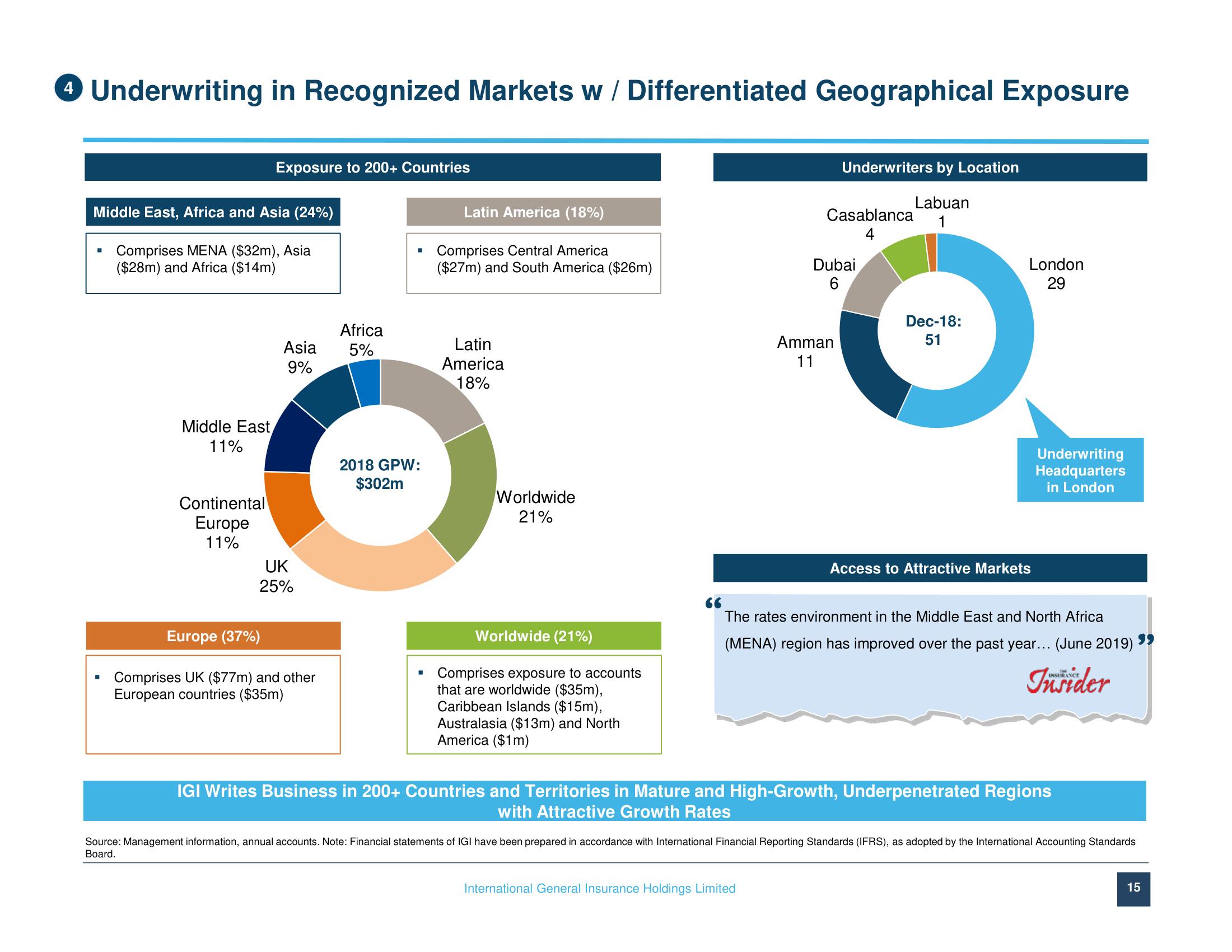

4 Underwriting in Recognized Markets w/ Differentiated Geographical Exposure

Middle East, Africa and Asia (24%)

Comprises MENA ($32m), Asia

($28m) and Africa ($14m)

Middle East

11%

Continental

Europe

11%

Exposure to 200+ Countries

Europe (37%)

Asia

9%

UK

25%

▪ Comprises UK ($77m) and other

European countries ($35m)

Africa

5%

2018 GPW:

$302m

Latin America (18%)

Comprises Central America

($27m) and South America ($26m)

Latin

America

18%

Worldwide

21%

Worldwide (21%)

Comprises exposure to accounts

that are worldwide ($35m),

Caribbean Islands ($15m),

Australasia ($13m) and North

America ($1m)

Underwriters by Location

Labuan

Casablanca 1

4

Dubai

6

Amman

11

International General Insurance Holdings Limited

Dec-18:

51

London

29

Access to Attractive Markets

Underwriting

Headquarters

in London

The rates environment in the Middle East and North Africa

(MENA) region has improved over the past year... (June 2019)

INSURANCE

Insider

IGI Writes Business in 200+ Countries and Territories in Mature and High-Growth, Underpenetrated Regions

with Attractive Growth Rates

Source: Management information, annual accounts. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards

Board.

15View entire presentation