OpenText Investor Day Presentation Deck

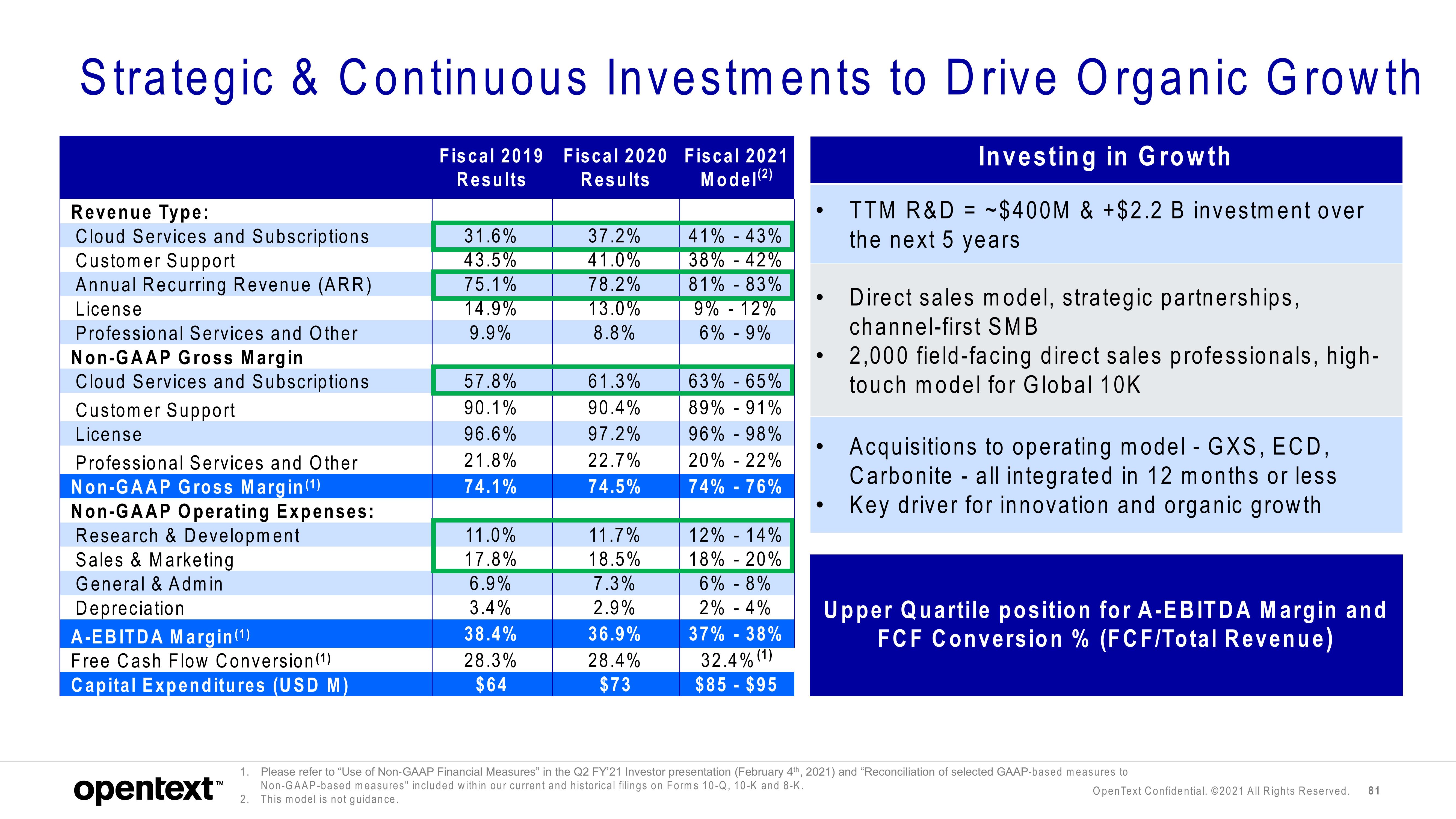

Strategic & Continuous Investments to Drive Organic Growth

Fiscal 2019 Fiscal 2020 Fiscal 2021

Results

Investing in Growth

Results

Model(2)

TTM R&D = $400M & +$2.2 B investment over

the next 5 years

Revenue Type:

Cloud Services and Subscriptions

Customer Support

Annual Recurring Revenue (ARR)

License

Professional Services and Other

Non-GAAP Gross Margin

Cloud Services and Subscriptions

Customer Support

License

Professional Services and Other

Non-GAAP Gross Margin (¹)

Non-GAAP Operating Expenses:

Research & Development

Sales & Marketing

General & Admin

Depreciation

EBITDA Margin(1)

Free Cash Flow Conversion (1)

Capital Expenditures (USD M)

opentext™

31.6%

43.5%

75.1%

14.9%

9.9%

57.8%

90.1%

96.6%

21.8%

74.1%

11.0%

17.8%

6.9%

3.4%

38.4%

28.3%

$64

37.2%

41.0%

78.2%

13.0%

8.8%

61.3%

90.4%

97.2%

22.7%

74.5%

11.7%

18.5%

7.3%

2.9%

36.9%

28.4%

$73

41% -43%

38% -42%

81% - 83%

9% -12%

6% -9%

63% - 65%

89% - 91%

96% - 98%

20% -22%

74% -76%

12% -14%

18% - 20%

6% -8%

2% -4%

37% -38%

32.4% (1)

$85 - $95

●

Direct sales model, strategic partnerships,

channel-first SMB

2,000 field-facing direct sales professionals, high-

touch model for Global 10K

Acquisitions to operating model - GXS, ECD,

Carbonite all integrated in 12 months or less

Key driver for innovation and organic growth

Upper Quartile position for A-EBITDA Margin and

FCF Conversion % (FCF/Total Revenue)

1 Please refer to "Use of Non-GAAP Financial Measures" in the Q2 FY'21 Investor presentation (February 4th, 2021) and "Reconciliation of selected GAAP-based measures to

Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K.

2. This model is not guidance.

Open Text Confidential. ©2021 All Rights Reserved. 81View entire presentation