Vivid Seats Investor Presentation Deck

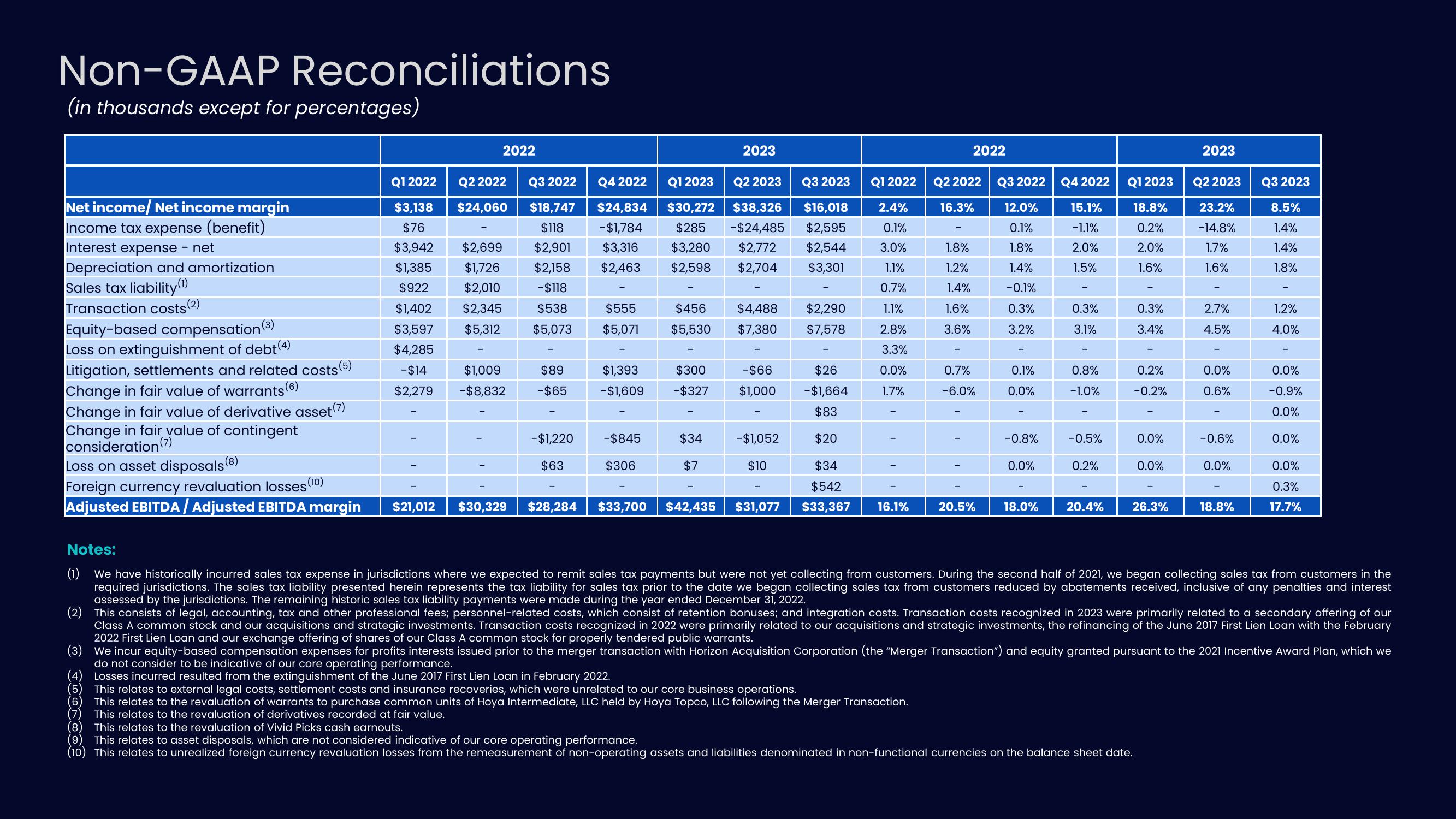

Non-GAAP Reconciliations

(in thousands except for percentages)

Net income/ Net income margin

Income tax expense (benefit)

Interest expense - net

Depreciation and amortization

Sales tax liability(¹)

Transaction costs (2)

Equity-based compensation (3)

Loss on extinguishment of debt(4)

Litigation, settlements and related costs (5)

Change in fair value of warrants (6)

-(7)

Change in fair value of derivative asset

Change in fair value of contingent

consideration (7)

Loss on asset disposals S (8)

(10)

Foreign currency revaluation losses

Adjusted EBITDA / Adjusted EBITDA margin

2022

Q1 2022 Q2 2022

$3,138 $24,060

$76

$3,942

$1,385

$922

$1,402

$3,597

$4,285

-$14 $1,009

$2,279 -$8,832

$2,699

$1,726

$2,010

$2,345

$5,312

Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023

$18,747 $24,834 $30,272 $38,326 $16,018

$118 -$1,784 $285 -$24,485 $2,595

$2,901 $3,316 $3,280 $2,772 $2,544

$2,158 $2,463

$2,598 $2,704 $3,301

-$118

$538 $555

$5,073 $5,071

$89

-$65

-$1,220

$63

$21,012 $30,329 $28,284

$1,393

- $1,609

-$845

$306

$456

$5,530

$300

-$327

2023

$34

$7

$4,488 $2,290

$7,380 $7,578

-$66

$26

$1,000 -$1,664

-$1,052

$10

$33,700 $42,435 $31,077

Q1 2022

2.4%

0.1%

3.0%

1.1%

0.7%

1.1%

2.8%

3.3%

0.0%

1.7%

$83

$20

$34

$542

$33,367 16.1%

2022

Q2 2022

16.3%

1.8%

1.2%

1.4%

1.6%

3.6%

This relates to external legal costs, settlement costs and insurance recoveries, which were unrelated to our core business operations.

This relates to the revaluation of warrants to purchase common units of Hoya Intermediate, LLC held by Hoya Topco, LLC followin the Merger Transaction.

This relates to the revaluation of derivatives recorded at fair value.

0.7%

-6.0%

20.5%

Q3 2022

12.0%

0.1%

1.8%

1.4%

-0.1%

0.3%

3.2%

0.1%

0.0%

-0.8%

0.0%

18.0%

Q4 2022

15.1%

-1.1%

2.0%

1.5%

0.3%

3.1%

0.8%

-1.0%

-0.5%

0.2%

Q1 2023

18.8%

0.2%

2.0%

1.6%

0.3%

3.4%

(5)

(7)

(8)

This relates to the revaluation of Vivid Picks cash earnouts.

(9) This relates to asset disposals, which are not considered indicative of our core operating performance.

(10) This relates to unrealized foreign currency revaluation losses from the remeasurement of non-operating assets and liabilities denominated in non-functional currencies on the balance sheet date.

0.2%

-0.2%

0.0%

0.0%

20.4% 26.3%

2023

Q2 2023

23.2%

-14.8%

1.7%

1.6%

2.7%

4.5%

0.0%

0.6%

-0.6%

0.0%

18.8%

Q3 2023

8.5%

1.4%

1.4%

1.8%

1.2%

4.0%

0.0%

-0.9%

0.0%

0.0%

Notes:

(1) We have historically incurred sales tax expense in jurisdictions where we expected to remit sales tax payments but were not yet collecting from customers. During the second half of 2021, we began collecting sales tax from customers in the

required jurisdictions. The sales tax liability presented herein represents the tax liability for sales tax prior to the date we began collecting sales tax from customers reduced by abatements received, inclusive of any penalties and interest

assessed by the jurisdictions. The remaining historic sales tax liability payments were made during the year ended December 31, 2022.

(2) This consists of legal, accounting, tax and other professional fees; personnel-related costs, which consist of retention bonuses; and integration costs. Transaction costs recognized in 2023 were primarily related to a secondary offering of our

Class A common stock and our acquisitions and strategic investments. Transaction costs recognized in 2022 were primarily related to our acquisitions and strategic investments, the refinancing of the June 2017 First Lien Loan with the February

2022 First Lien Loan and our exchange offering of shares of our Class A common stock for properly tendered public warrants.

(3) We incur equity-based compensation expenses for profits interests issued prior to the merger transaction with Horizon Acquisition Corporation (the "Merger Transaction") and equity granted pursuant to the 2021 Incentive Award Plan, which we

do not consider to be indicative of our core operating performance.

Losses incurred resulted from the extinguishment of the June 2017 First Lien Loan in February 2022.

0.0%

0.3%

17.7%View entire presentation