LSE Results Presentation Deck

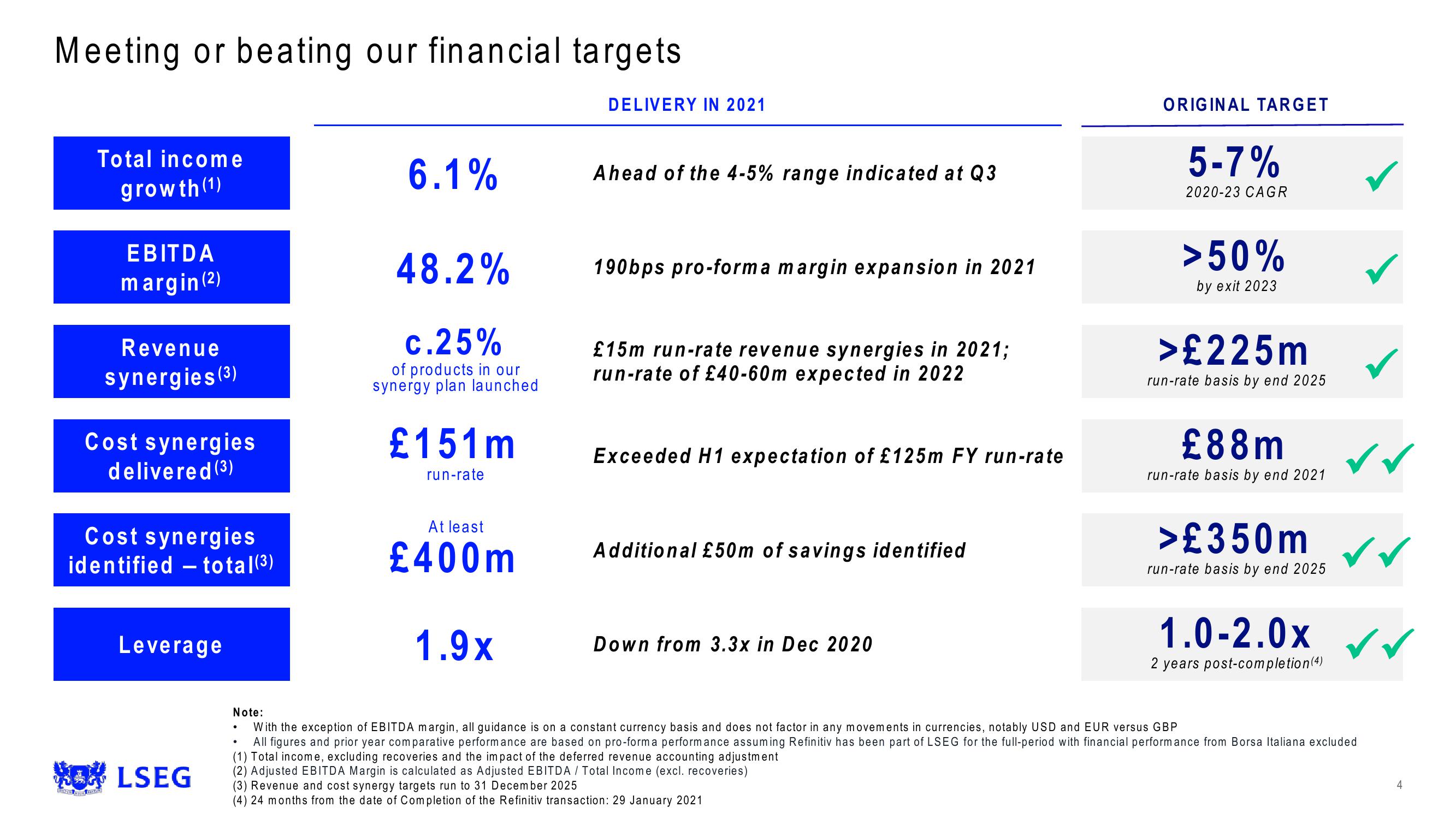

Meeting or beating our financial targets

Total income

growth (1)

EBITDA

margin (2²)

Revenue

synergies (³)

Cost synergies

delivered (3)

Cost synergies

identified - total(³)

Leverage

OLSEG

6.1%

48.2%

c.25%

of products in our

synergy plan launched

£151m

run-rate

At least

£400m

1.9x

DELIVERY IN 2021

Ahead of the 4-5% range indicated at Q3

190bps pro-forma margin expansion in 2021

£15m run-rate revenue synergies in 2021;

run-rate of £40-60m expected in 2022

Exceeded H1 expectation of £125m FY run-rate

Additional £50m of savings identified

Down from 3.3x in Dec 2020

ORIGINAL TARGET

5-7%

2020-23 CAGR

>50%

by exit 2023

>£225m

run-rate basis by end 2025

£88m

run-rate basis by end 2021

>£350m

run-rate basis by end 2025

1.0-2.0x

2 years post-completion(4)

✓ ✓

Note:

With the exception of EBITDA margin, all guidance is on a constant currency basis and does not factor in any movements in currencies, notably USD and EUR versus GBP

All figures and prior year comparative performance are based on pro-forma performance assuming Refinitiv has been part of LSEG for the full-period with financial performance from Borsa Italiana excluded

(1) Total income, excluding recoveries and the impact of the deferred revenue accounting adjustment

(2) Adjusted EBITDA Margin is calculated as Adjusted EBITDA / Total Income (excl. recoveries)

(3) Revenue and cost synergy targets run to 31 December 2025

(4) 24 months from the date of Completion of the Refinitiv transaction: 29 January 2021View entire presentation