Crowdstrike Investor Day Presentation Deck

GAAP net loss attributable to CrowdStrike

Stock based compensation expense

Amortization of acquired intangible assets

Acquisition-related expenses

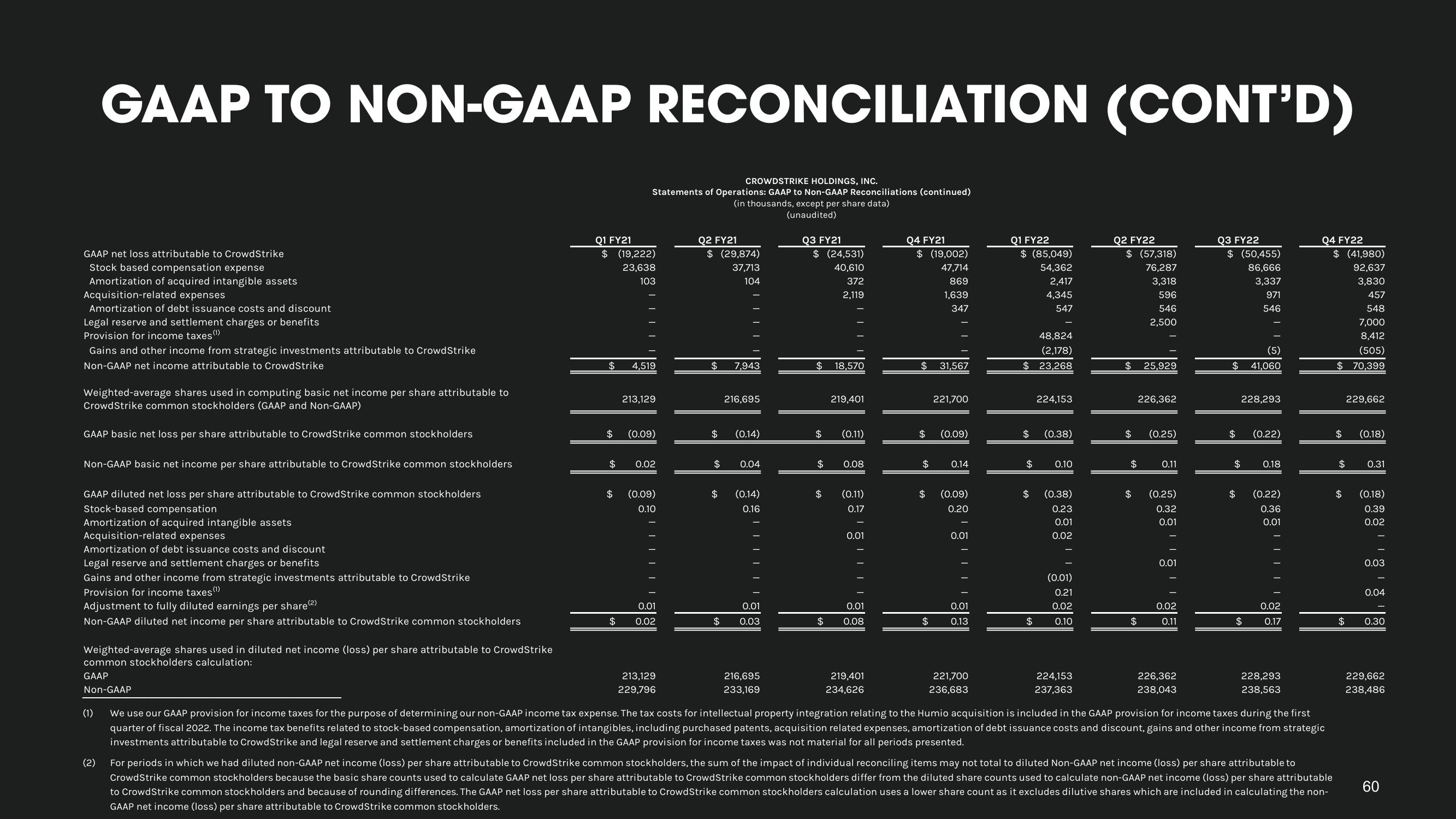

GAAP TO NON-GAAP RECONCILIATION (CONT'D)

Amortization of debt issuance costs and discount

Legal reserve and settlement charges or benefits

Provision for income taxes (¹)

Gains and other income from strategic investments attributable to CrowdStrike

Non-GAAP net income attributable to Crowd Strike

Weighted-average shares used in computing basic net income per share attributable to

CrowdStrike common stockholders (GAAP and Non-GAAP)

GAAP basic net loss per share attributable to CrowdStrike common stockholders

Non-GAAP basic net income per share attributable to Crowd Strike common stockholders

GAAP diluted net loss per share attributable to CrowdStrike common stockholders

Stock-based compensation

Amortization of acquired intangible assets

Acquisition-related expenses

Amortization of debt issuance costs and discount

Legal reserve and settlement charges or benefits

Gains and other income from strategic investments attributable to Crowd Strike

Provision for income taxes (1)

Adjustment to fully diluted earnings per share(²)

Non-GAAP diluted net income per share attributable to CrowdStrike common stockholders

Weighted-average shares used in diluted net income (loss) per share attributable to CrowdStrike

common stockholders calculation:

GAAP

Non-GAAP

(1)

(2)

Q1 FY21

$ (19,222)

23,638

103

$

CROWDSTRIKE HOLDINGS, INC.

Statements of Operations: GAAP to Non-GAAP Reconciliations (continued)

(in thousands, except per share data)

(unaudited)

$

4,519

$ (0.09)

$

213,129

0.02

$ (0.09)

0.10

0.01

0.02

213,129

229,796

Q2 FY21

$ (29,874)

$

$

$

$

37,713

104

7,943

216,695

(0.14)

0.04

(0.14)

0.16

0.01

$ 0.03

216,695

233,169

Q3 FY21

$ (24,531)

40,610

372

2,119

$ 18,570

$

$

$

219,401

(0.11)

0.08

(0.11)

0.17

0.01

0.01

0.08

219,401

234,626

Q4 FY21

$ (19,002)

47,714

869

1,639

347

H

$

31,567

$

221,700

$ (0.09)

0.14

$ (0.09)

0.20

0.01

0.01

$ 0.13

221,700

236,683

Q1 FY22

$ (85,049)

54,362

2,417

4,345

547

48,824

(2,178)

$ 23,268

$

$

$

224,153

(0.38)

0.10

(0.38)

0.23

0.01

0.02

(0.01)

0.21

0.02

0.10

224,153

237,363

Q2 FY22

$ (57,318)

76,287

3,318

596

546

2,500

$ 25,929

226,362

$ (0.25)

$

GA

$

0.11

(0.25)

0.32

0.01

0.01

0.02

0.11

226,362

238,043

Q3 FY22

$ (50,455)

86,666

3,337

(5)

$ 41,060

971

546

228,293

$ (0.22)

$

$

0.18

$ (0.22)

0.36

0.01

0.02

0.17

228,293

238,563

Q4 FY22

We use our GAAP provision for income taxes for the purpose of determining our non-GAAP income tax expense. The tax costs for intellectual property integration relating to the Humio acquisition is included in the GAAP provision for income taxes during the first

quarter of fiscal 2022. The income tax benefits related to stock-based compensation, amortization of intangibles, including purchased patents, acquisition related expenses, amortization of debt issuance costs and discount, gains and other income from strategic

investments attributable to CrowdStrike and legal reserve and settlement charges or benefits included in the GAAP provision for income taxes was not material for all periods presented.

For periods in which we had diluted non-GAAP net income (loss) per share attributable to Crowd Strike common stockholders, the sum of the impact of individual reconciling items may not total to diluted Non-GAAP net income (loss) per share attributable to

CrowdStrike common stockholders because the basic share counts used to calculate GAAP net loss per share attributable to CrowdStrike common stockholders differ from the diluted share counts used to calculate non-GAAP net income (loss) per share attributable

to CrowdStrike common stockholders and because of rounding differences. The GAAP net loss per share attributable to CrowdStrike common stockholders calculation uses a lower share count as it excludes dilutive shares which are included in calculating the non-

GAAP net income (loss) per share attributable to CrowdStrike common stockholders.

$ (41,980)

92,637

3,830

457

548

7,000

8,412

(505)

$70,399

$ (0.18)

229,662

$ 0.31

A

$

(0.18)

0.39

0.02

0.03

0.04

0.30

229,662

238,486

60View entire presentation