OpenText Investor Presentation Deck

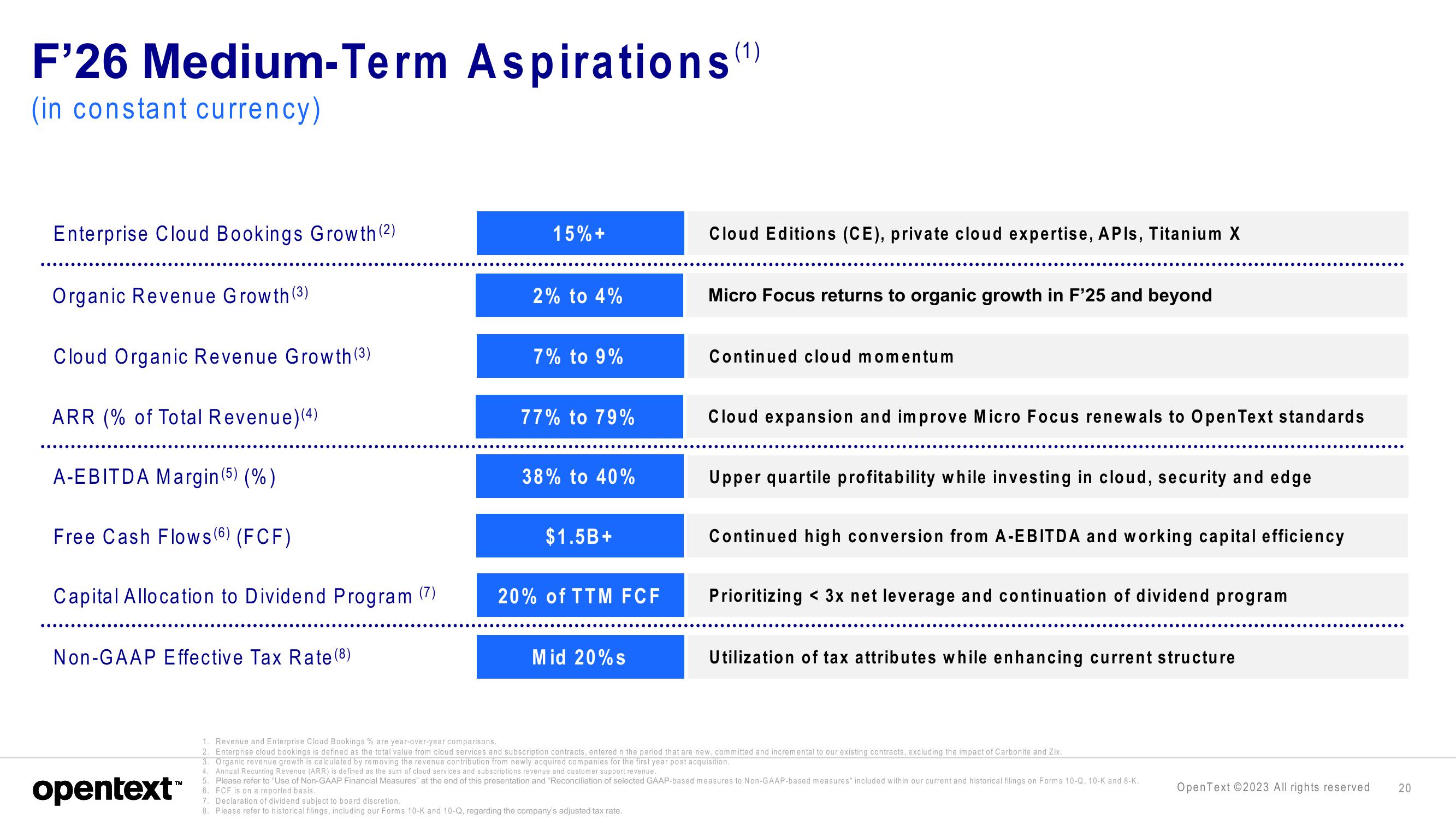

F'26 Medium-Term Aspirations()

(in constant currency)

Enterprise Cloud Bookings Growth (2)

Organic Revenue Growth (3)

Cloud Organic Revenue Growth (3)

ARR (% of Total Revenue) (4)

A-EBITDA Margin (5) (%)

Free Cash Flows(6) (FCF)

Capital Allocation to Dividend Program (7)

Non-GAAP Effective Tax Rate (8)

opentext™

15% +

2% to 4%

7% to 9%

77% to 79%

38% to 40%

$1.5B+

20% of TTM FCF

Mid 20% s

Cloud Editions (CE), private cloud expertise, APIs, Titanium X

7. Declaration of dividend subject to board discretion.

8. Please refer to historical filings, including our Forms 10-K and 10-Q, regarding the company's adjusted tax rate.

Micro Focus returns to organic growth in F'25 and beyond

Continued cloud momentum

Cloud expansion and improve Micro Focus renewals to Open Text standards

Upper quartile profitability while investing in cloud, security and edge

Continued high conversion from A-EBITDA and working capital efficiency

Prioritizing < 3x net leverage and continuation of dividend program

Utilization of tax attributes while enhancing current structure

1. Revenue and Enterprise Cloud Bookings % are year-over-year comparisons.

2 Enterprise cloud bookings is defined as the total value from cloud services and subscription contracts, entered in the period that are new, committed and incremental to our existing contracts, excluding the impact of Carbonite and Zix.

3. Organic revenue growth is calculated by removing the revenue contribution from newly acquired companies for the first year post acquisition.

4 Annual Recurring Revenue (ARR) is defined as the sum of cloud services and subscriptions revenue and customer support revenue.

5

Please refer to "Use of Non-GAAP Financial Measures" at the end of this presentation and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures" included within our current and historical filings on Forms 10-Q, 10-K and 8-K..

6 FCF is on a reported basis.

OpenText ©2023 All rights reserved

......

20View entire presentation