Antero Midstream Partners Investor Presentation Deck

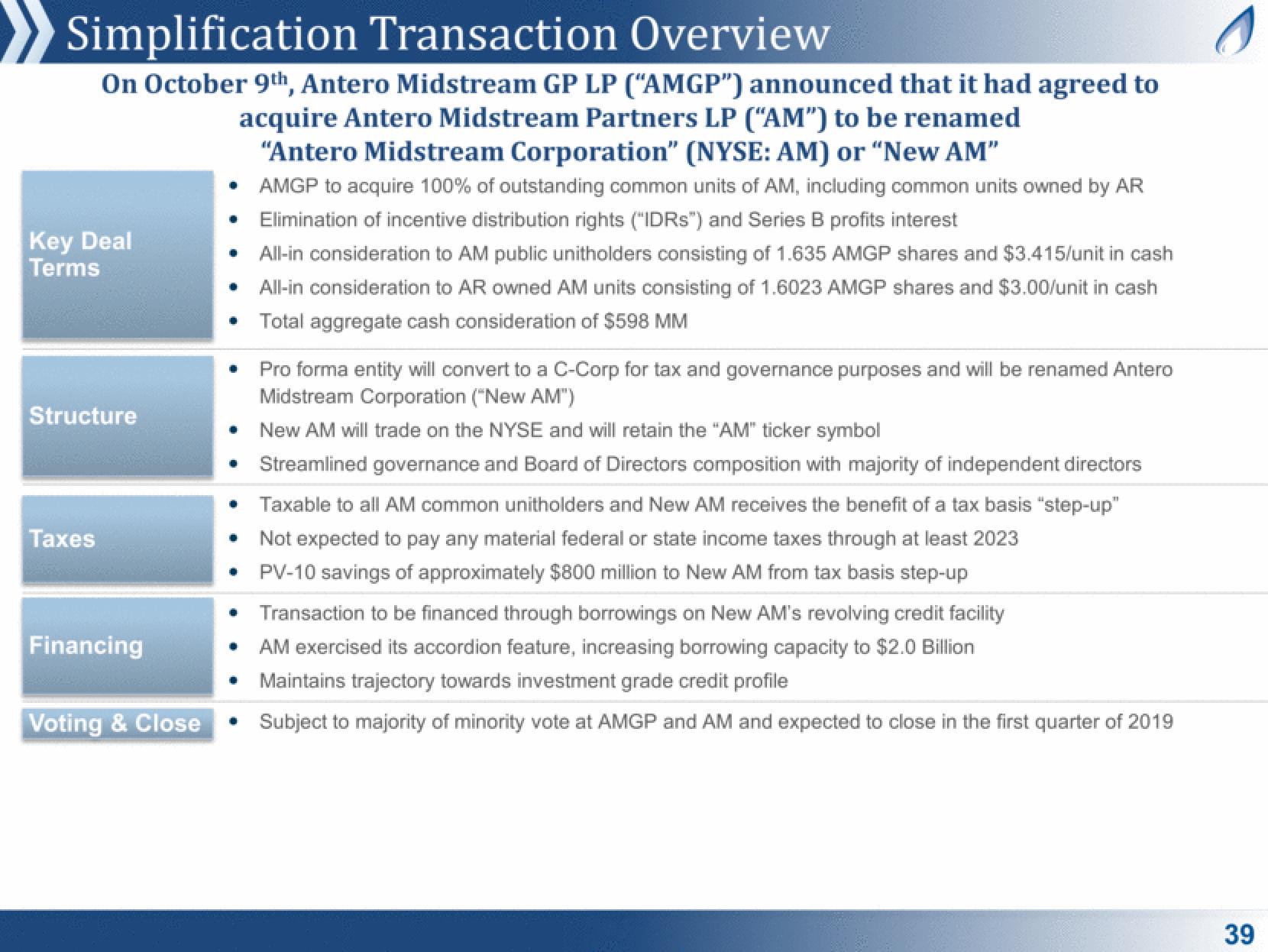

Simplification Transaction Overview

s

On October 9th, Antero Midstream GP LP ("AMGP") announced that it had agreed to

acquire Antero Midstream Partners LP ("AM") to be renamed

"Antero Midstream Corporation" (NYSE: AM) or "New AM"

• AMGP to acquire 100% of outstanding common units of AM, including common units owned by AR

Elimination of incentive distribution rights ("IDRs") and Series B profits interest

• All-in consideration to AM public unitholders consisting of 1.635 AMGP shares and $3.415/unit in cash

• All-in consideration to AR owned AM units consisting of 1.6023 AMGP shares and $3.00/unit in cash

Total aggregate cash consideration of $598 MM

Key Deal

Terms

Structure

Taxes

Financing

Voting & Close

Pro forma entity will convert to a C-Corp for tax and governance purposes and will be renamed Antero

Midstream Corporation ("New AM")

New AM will trade on the NYSE and will retain the "AM" ticker symbol

• Streamlined governance and Board of Directors composition with majority of independent directors

Taxable to all AM common unitholders and New AM receives the benefit of a tax basis "step-up"

Not expected to pay any material federal or state income taxes through at least 2023

• PV-10 savings of approximately $800 million to New AM from tax basis step-up

• Transaction to be financed through borrowings on New AM's revolving credit facility

AM exercised its accordion feature, increasing borrowing capacity to $2.0 Billion

• Maintains trajectory towards investment grade credit profile

Subject to majority of minority vote at AMGP and AM and expected to close in the first quarter of 2019

39View entire presentation