UBS Mergers and Acquisitions Presentation Deck

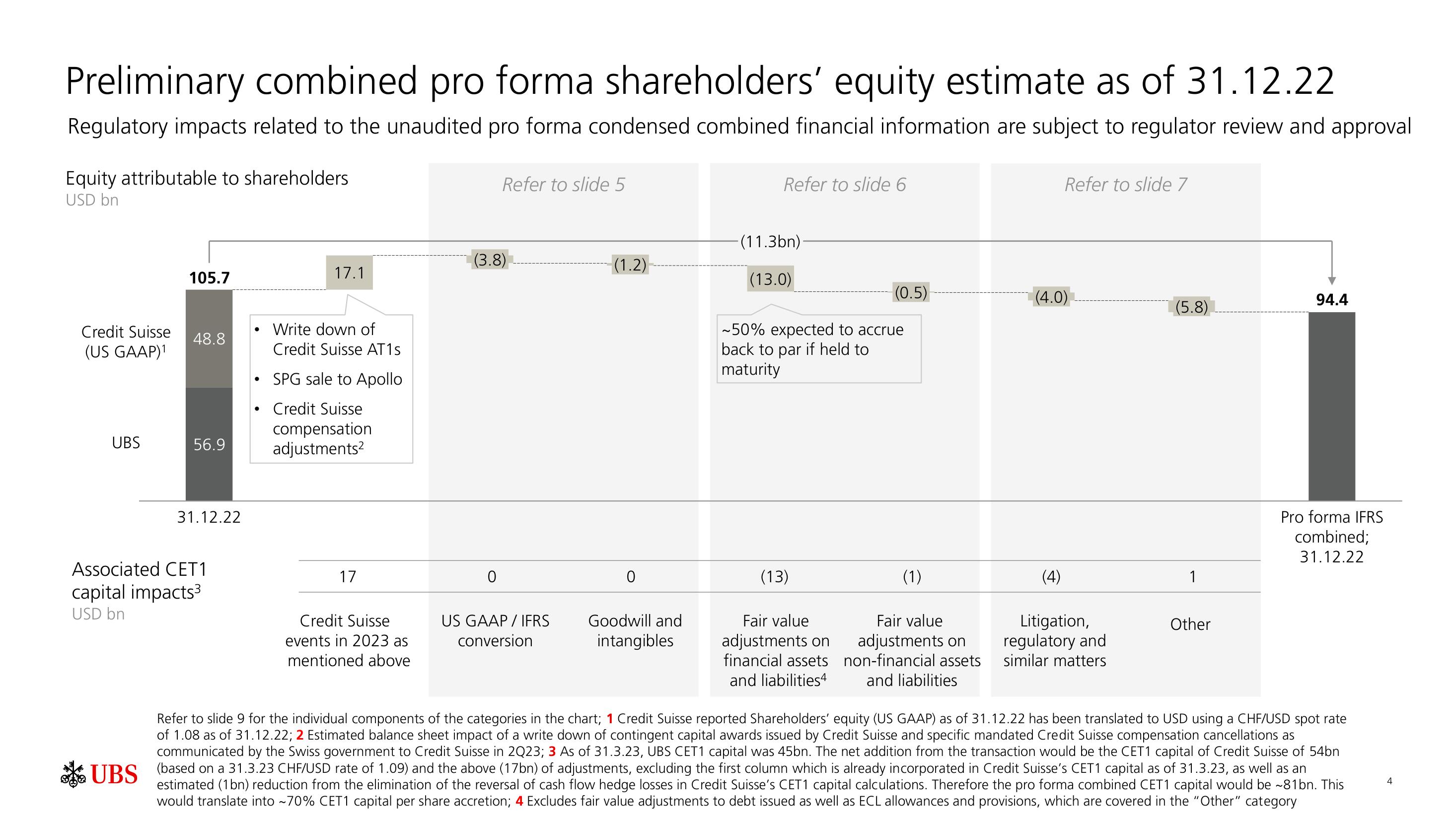

Preliminary combined pro forma shareholders' equity estimate as of 31.12.22

Regulatory impacts related to the unaudited pro forma condensed combined financial information are subject to regulator review and approval

Equity attributable to shareholders

USD bn

Credit Suisse

(US GAAP)1

UBS

105.7

48.8

56.9

31.12.22

Associated CET1

capital impacts³

USD bn

17.1

Write down of

Credit Suisse AT1s

SPG sale to Apollo

Credit Suisse

compensation

adjustments²

17

Credit Suisse

events in 2023 as

mentioned above

Refer to slide 5

(3.8)

0

US GAAP / IFRS

conversion

(1.2)

0

Goodwill and

intangibles.

Refer to slide 6

(11.3bn).

(13.0)

~50% expected to accrue

back to par if held to

maturity

(13)

(0.5)

Fair value

adjustments on

financial assets

and liabilities4

(1)

Fair value

adjustments on

non-financial assets

and liabilities

Refer to slide 7

(4.0)

(4)

Litigation,

regulatory and

similar matters

(5.8)

1

Other

94.4

Pro forma IFRS

combined;

31.12.22

Refer to slide 9 for the individual components of the categories in the chart; 1 Credit Suisse reported Shareholders' equity (US GAAP) as of 31.12.22 has been translated to USD using a CHF/USD spot rate

of 1.08 as of 31.12.22; 2 Estimated balance sheet impact of a write down of contingent capital awards issued by Credit Suisse and specific mandated Credit Suisse compensation cancellations as

communicated by the Swiss government to Credit Suisse in 2Q23; 3 As of 31.3.23, UBS CET1 capital was 45bn. The net addition from the transaction would be the CET1 capital of Credit Suisse of 54bn

UBS (based on a 31.3.23 CHF/USD rate of 1.09) and the above (17bn) of adjustments, excluding the first column which is already incorporated in Credit Suisse's CET1 capital as of 31.3.23, as well as an

estimated (1bn) reduction from the elimination of the reversal of cash flow hedge losses in Credit Suisse's CET1 capital calculations. Therefore the pro forma combined CET1 capital would be ~81bn. This

would translate into ~70% CET1 capital per share accretion; 4 Excludes fair value adjustments to debt issued as well as ECL allowances and provisions, which are covered in the "Other" category

4View entire presentation