HashiCorp Results Presentation Deck

Guidance

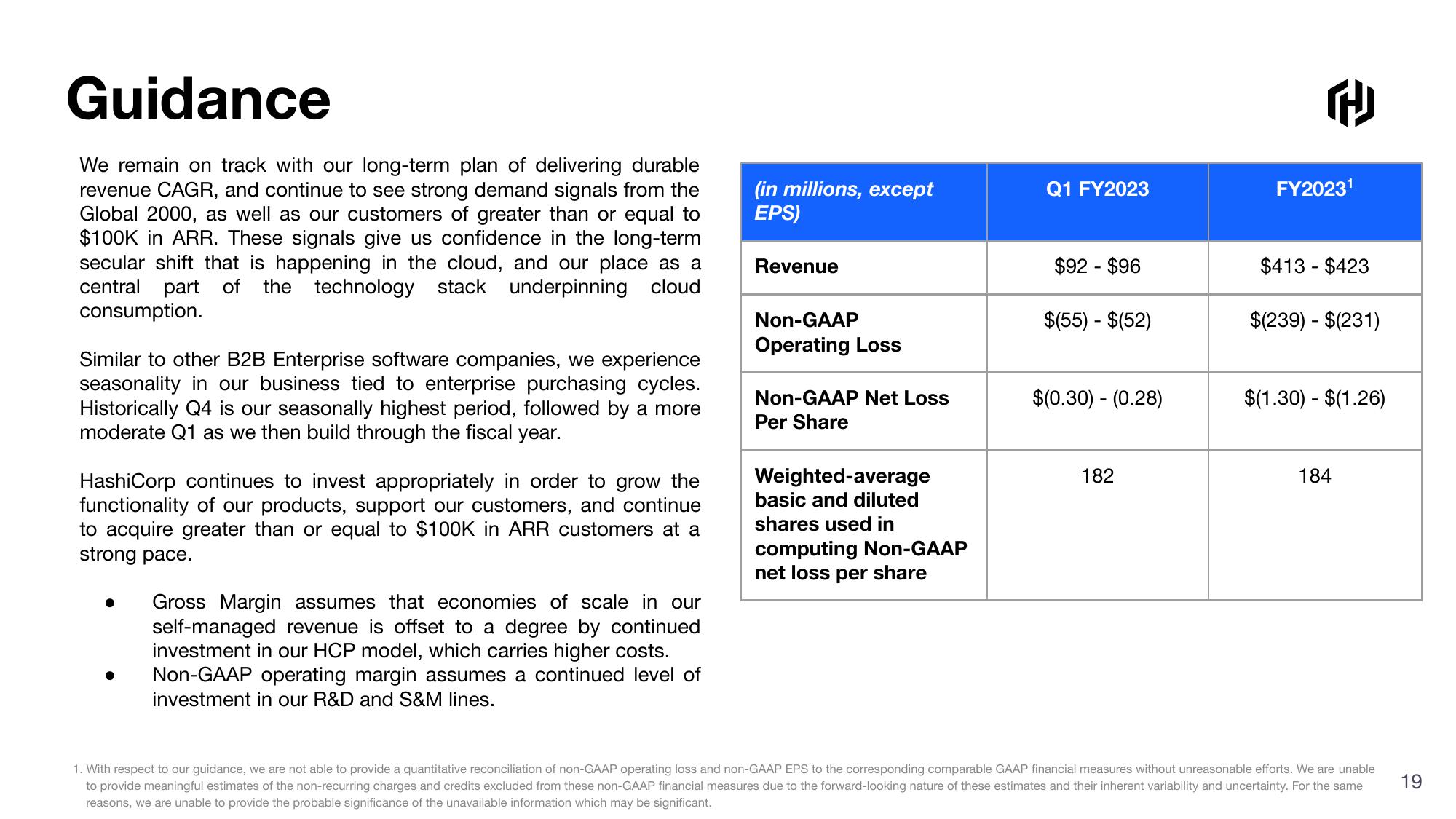

We remain on track with our long-term plan of delivering durable

revenue CAGR, and continue to see strong demand signals from the

Global 2000, as well as our customers of greater than or equal to

$100K in ARR. These signals give us confidence in the long-term

secular shift that is happening in the cloud, and our place as a

central part of the technology stack underpinning cloud

consumption.

Similar to other B2B Enterprise software companies, we experience

seasonality in our business tied to enterprise purchasing cycles.

Historically Q4 is our seasonally highest period, followed by a more

moderate Q1 as we then build through the fiscal year.

HashiCorp continues to invest appropriately in order to grow the

functionality of our products, support our customers, and continue

to acquire greater than or equal to $100K in ARR customers at a

strong pace.

Gross Margin assumes that economies of scale in our

self-managed revenue is offset to a degree by continued

investment in our HCP model, which carries higher costs.

Non-GAAP operating margin assumes a continued level of

investment in our R&D and S&M lines.

(in millions, except

EPS)

Revenue

Non-GAAP

Operating Loss

Non-GAAP Net Loss

Per Share

Weighted-average

basic and diluted

shares used in

computing Non-GAAP

net loss per share

Q1 FY2023

$92 - $96

$(55) - $(52)

$(0.30) - (0.28)

182

2

FY2023¹

$413 - $423

$(239) - $(231)

$(1.30) - $(1.26)

184

1. With respect to our guidance, we are not able to provide a quantitative reconciliation of non-GAAP operating loss and non-GAAP EPS to the corresponding comparable GAAP financial measures without unreasonable efforts. We are unable

to provide meaningful estimates of the non-recurring charges and credits excluded from these non-GAAP financial measures due to the forward-looking nature of these estimates and their inherent variability and uncertainty. For the same

reasons, we are unable to provide the probable significance of the unavailable information which may be significant.

19View entire presentation