Investing in Private Credit

Corporate lending

Capital solutions

Theme: Emphasis on complex situations with high barriers to entry

Investment background

. Given the significant capital formation in middle market direct lending we prefer to focus on more idiosyncratic capital solutions

Ability to provide solutions for sponsor backed or sponsor-less corporates with bespoke financing needs

Opportunity set spans primary and secondary transactions across jurisdiction, currency, sector and company size

Target complex situations with barriers to entry, complexity can be due to any of the following:

Structure of the deal

Sector bias

Size of business

●

●

●

●

●

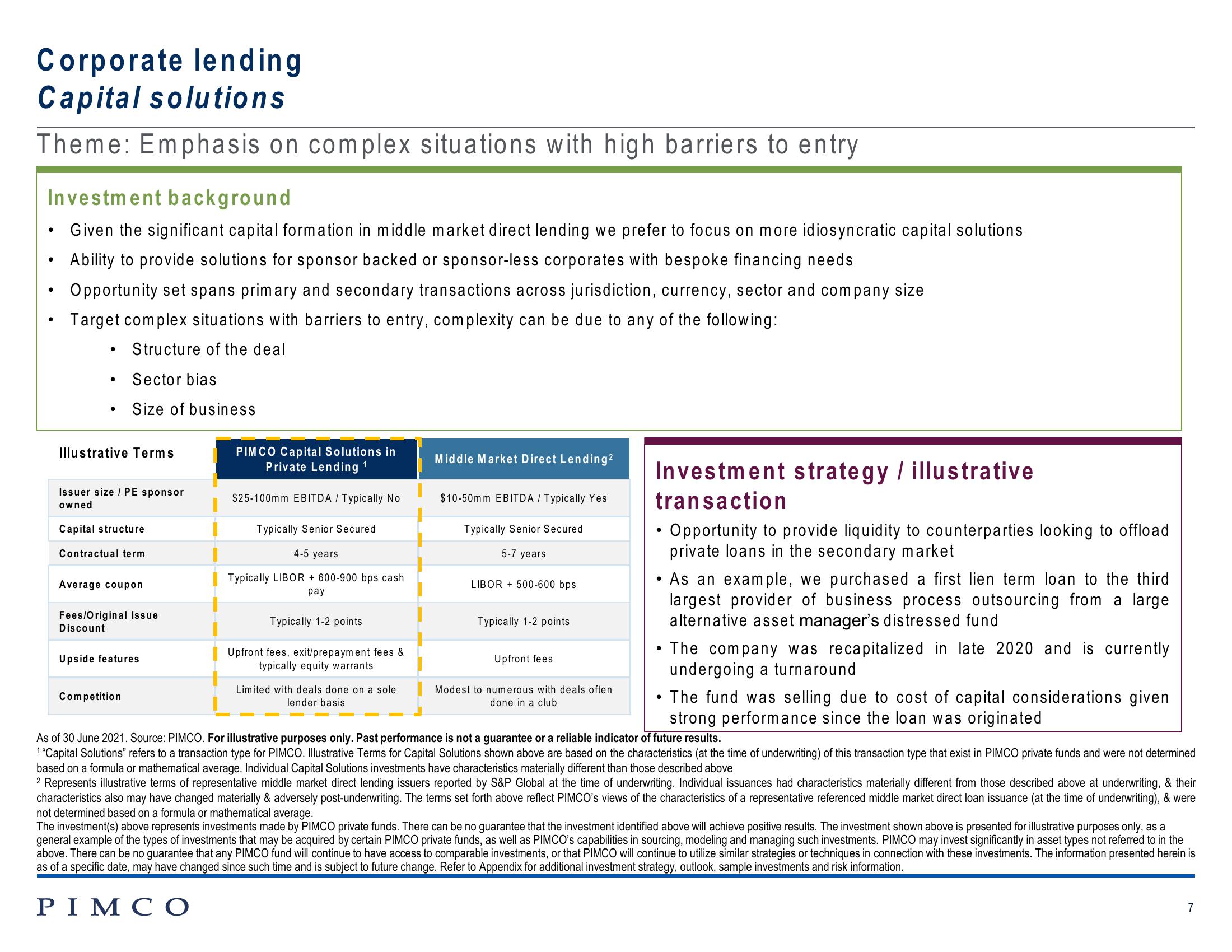

Illustrative Terms

Issuer size/ PE sponsor

owned

Capital structure

Contractual term

Average coupon

Fees/Original Issue

Discount

Upside features

Competition

PIMCO Capital Solutions in

Private Lending ¹

$25-100mm EBITDA/Typically No

Typically Senior Secured

4-5 years

Typically LIBOR + 600-900 bps cash

pay

Typically 1-2 points

Upfront fees, exit/prepayment fees &

typically equity warrants

Limited with deals done on a sole

lender basis

Middle Market Direct Lending²

$10-50mm EBITDA / Typically Yes

Typically Senior Secured

5-7 years

LIBOR + 500-600 bps

Typically 1-2 points

Upfront fees

Modest to numerous with deals often

done in a club

Investment strategy / illustrative

transaction

• Opportunity to provide liquidity to counterparties looking to offload

private loans in the secondary market

●

As an example, we purchased a first lien term loan to the third

largest provider of business process outsourcing from a large

alternative asset manager's distressed fund

The company was recapitalized in late 2020 and is currently

undergoing a turnaround

• The fund was selling due to cost of capital considerations given

strong performance since the loan was originated

As of 30 June 2021. Source: PIMCO. For illustrative purposes only. Past performance is not a guarantee or a reliable indicator of future results.

1 "Capital Solutions" refers to a transaction type for PIMCO. Illustrative Terms for Capital Solutions shown above are based on the characteristics (at the time of underwriting) of this transaction type that exist in PIMCO private funds and were not determined

based on a formula or mathematical average. Individual Capital Solutions investments have characteristics materially different than those described above

2 Represents illustrative terms of representative middle market direct lending issuers reported by S&P Global at the time of underwriting. Individual issuances had characteristics materially different from those described above at underwriting, & their

characteristics also may have changed materially & adversely post-underwriting. The terms set forth above reflect PIMCO's views of the characteristics of a representative referenced middle market direct loan issuance (at the time of underwriting), & were

not determined based on a formula or mathematical average.

The investment(s) above represents investments made by PIMCO private funds. There can be no guarantee that the investment identified above will achieve positive results. The investment shown above is presented for illustrative purposes only, as a

general example of the types of investments that may be acquired by certain PIMCO private funds, as well as PIMCO's capabilities in sourcing, modeling and managing such investments. PIMCO may invest significantly in asset types not referred to in the

above. There can be no guarantee that any PIMCO fund will continue to have access to comparable investments, or that PIMCO will continue to utilize similar strategies or techniques in connection with these investments. The information presented herein is

as of a specific date, may have changed since such time and is subject to future change. Refer to Appendix for additional investment strategy, outlook, sample investments and risk information.

PIMCO

7View entire presentation