Kinnevik Results Presentation Deck

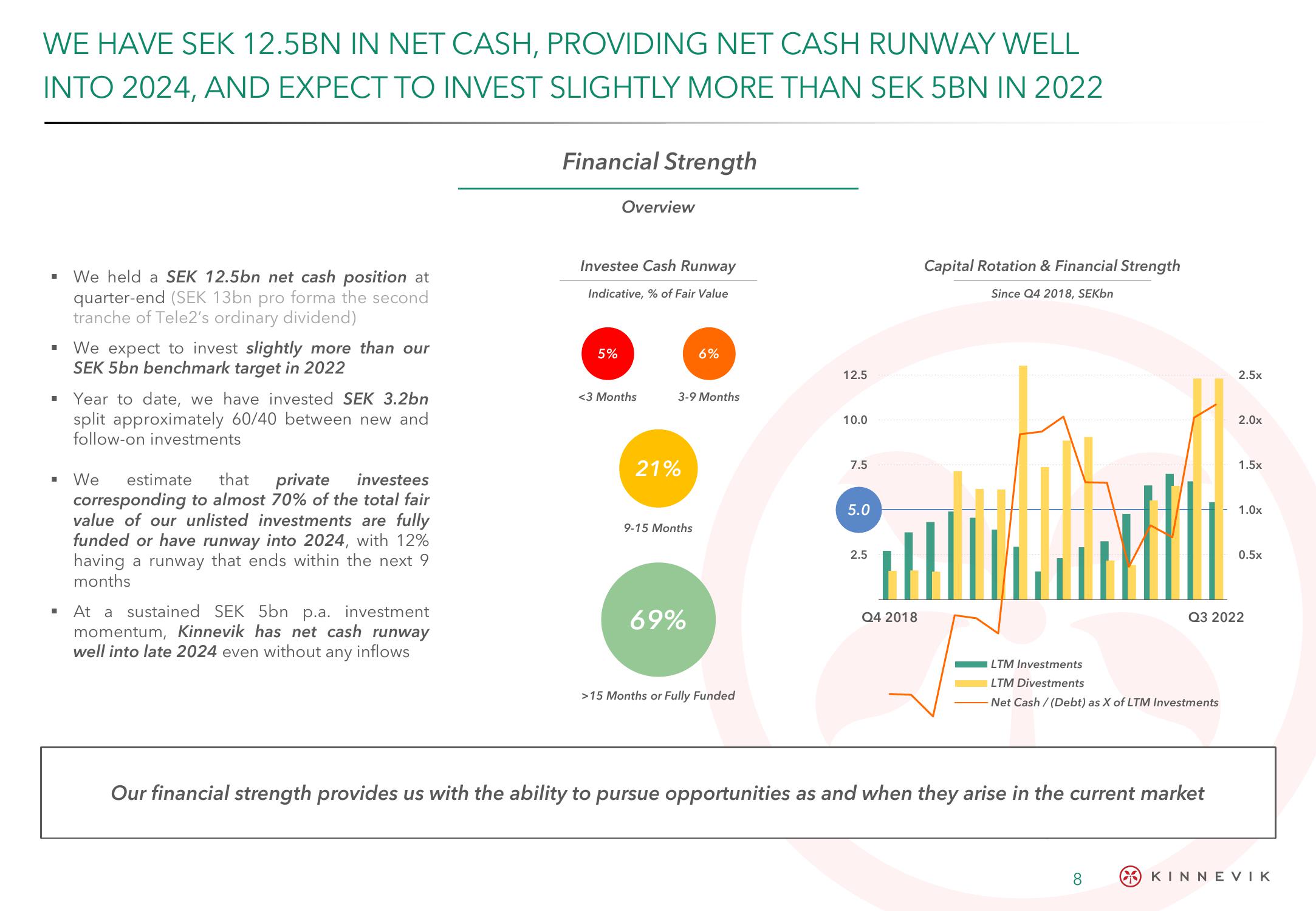

WE HAVE SEK 12.5BN IN NET CASH, PROVIDING NET CASH RUNWAY WELL

INTO 2024, AND EXPECT TO INVEST SLIGHTLY MORE THAN SEK 5BN IN 2022

■

■

■

We held a SEK 12.5bn net cash position at

quarter-end (SEK 13bn pro forma the second

tranche of Tele2's ordinary dividend)

We expect to invest slightly more than our

SEK 5bn benchmark target in 2022

Year to date, we have invested SEK 3.2bn

split approximately 60/40 between new and

follow-on investments

We estimate that private investees

corresponding to almost 70% of the total fair

value of our unlisted investments are fully

funded or have runway into 2024, with 12%

having a runway that ends within the next 9

months

At a sustained SEK 5bn p.a. investment

momentum, Kinnevik has net cash runway

well into late 2024 even without any inflows

Financial Strength

Overview

Investee Cash Runway

Indicative, % of Fair Value

5%

<3 Months

3-9 Months

21%

9-15 Months

6%

69%

>15 Months or Fully Funded

12.5

10.0

7.5

5.0

2.5

Q4 2018

Capital Rotation & Financial Strength

Since Q4 2018, SEKbn

LTM Investments

LTM Divestments

-Net Cash/(Debt) as X of LTM Investments

Our financial strength provides us with the ability to pursue opportunities as and when they arise in the current market

8

2.5x

2.0x

1.5x

1.0x

Q3 2022

0.5x

KINNEVIKView entire presentation