3M Results Presentation Deck

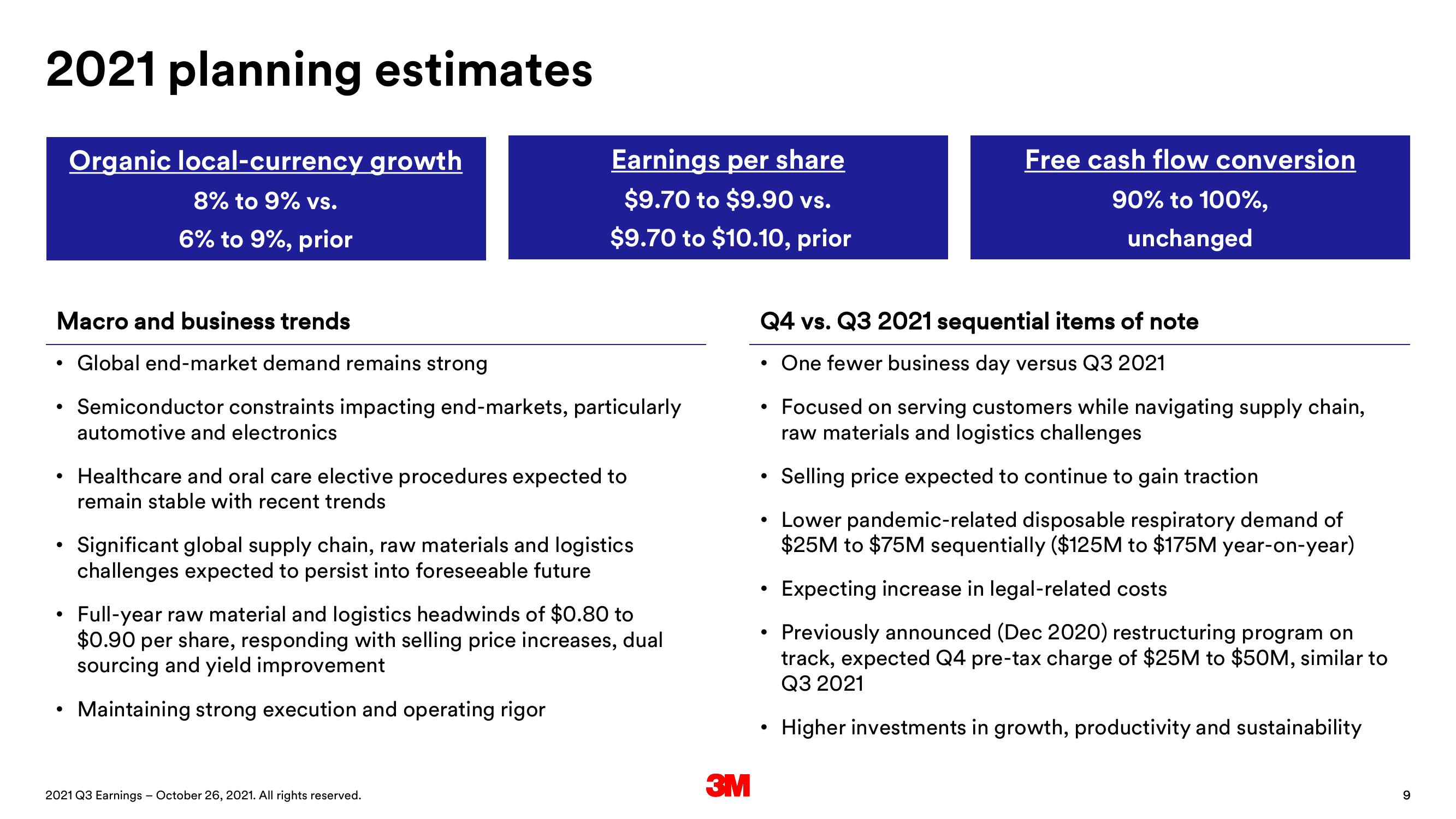

2021 planning estimates

●

Macro and business trends

Global end-market demand remains strong

Semiconductor constraints impacting end-markets, particularly

automotive and electronics

●

●

●

●

Organic local-currency growth

8% to 9% vs.

6% to 9%, prior

●

Earnings per share

$9.70 to $9.90 vs.

$9.70 to $10.10, prior

Healthcare and oral care elective procedures expected to

remain stable with recent trends

Significant global supply chain, raw materials and logistics

challenges expected to persist into foreseeable future

Full-year raw material and logistics headwinds of $0.80 to

$0.90 per share, responding with selling price increases, dual

sourcing and yield improvement

Maintaining strong execution and operating rigor

2021 Q3 Earnings - October 26, 2021. All rights reserved.

3M

Q4 vs. Q3 2021 sequential items of note

One fewer business day versus Q3 2021

• Focused on serving customers while navigating supply chain,

raw materials and logistics challenges

●

●

Selling price expected to continue to gain traction.

Lower pandemic-related disposable respiratory demand of

$25M to $75M sequentially ($125M to $175M year-on-year)

Expecting increase in legal-related costs

• Previously announced (Dec 2020) restructuring program on

track, expected Q4 pre-tax charge of $25M to $50M, similar to

Q3 2021

Higher investments in growth, productivity and sustainability

●

Free cash flow conversion

90% to 100%,

unchanged

●

●

9View entire presentation