Blackwells Capital Activist Presentation Deck

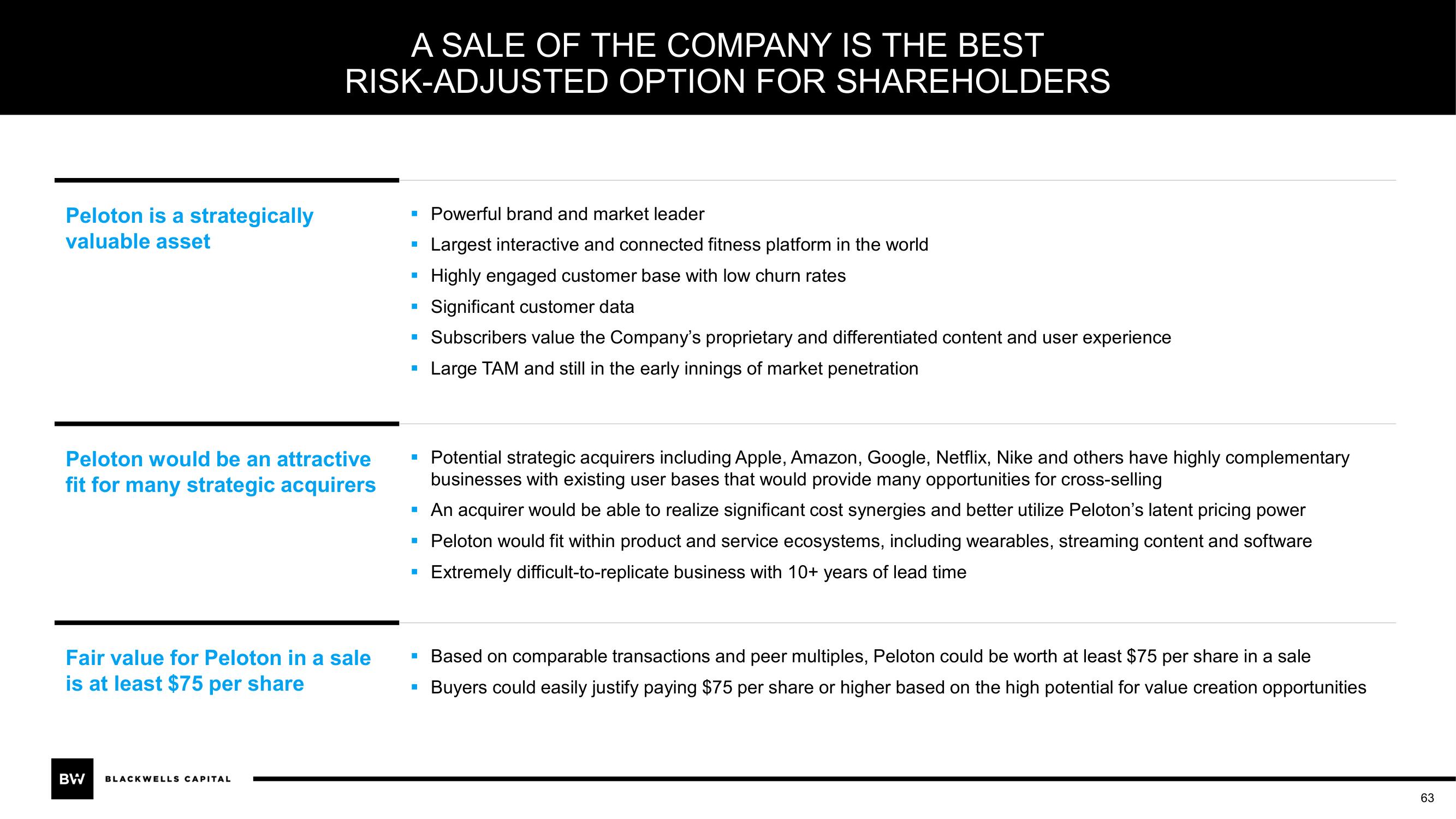

Peloton is a strategically

valuable asset

A SALE OF THE COMPANY IS THE BEST

RISK-ADJUSTED OPTION FOR SHAREHOLDERS

Peloton would be an attractive

fit for many strategic acquirers

Fair value for Peloton in a sale

is at least $75 per share

BW BLACKWELLS CAPITAL

▪ Powerful brand and market leader

Largest interactive and connected fitness platform in the world

Highly engaged customer base with low churn rates

H

I

Significant customer data

▪ Subscribers value the Company's proprietary and differentiated content and user experience

Large TAM and still in the early innings of market penetration

H

I

▪ Potential strategic acquirers including Apple, Amazon, Google, Netflix, Nike and others have highly complementary

businesses with existing user bases that would provide many opportunities for cross-selling

▪ An acquirer would be able to realize significant cost synergies and better utilize Peloton's latent pricing power

■ Peloton would fit within product and service ecosystems, including wearables, streaming content and software

Extremely difficult-to-replicate business with 10+ years of lead time

H

1

Based on comparable transactions and peer multiples, Peloton could be worth at least $75 per share in a sale

Buyers could easily justify paying $75 per share or higher based on the high potential for value creation opportunities

63View entire presentation