Nikola SPAC Presentation Deck

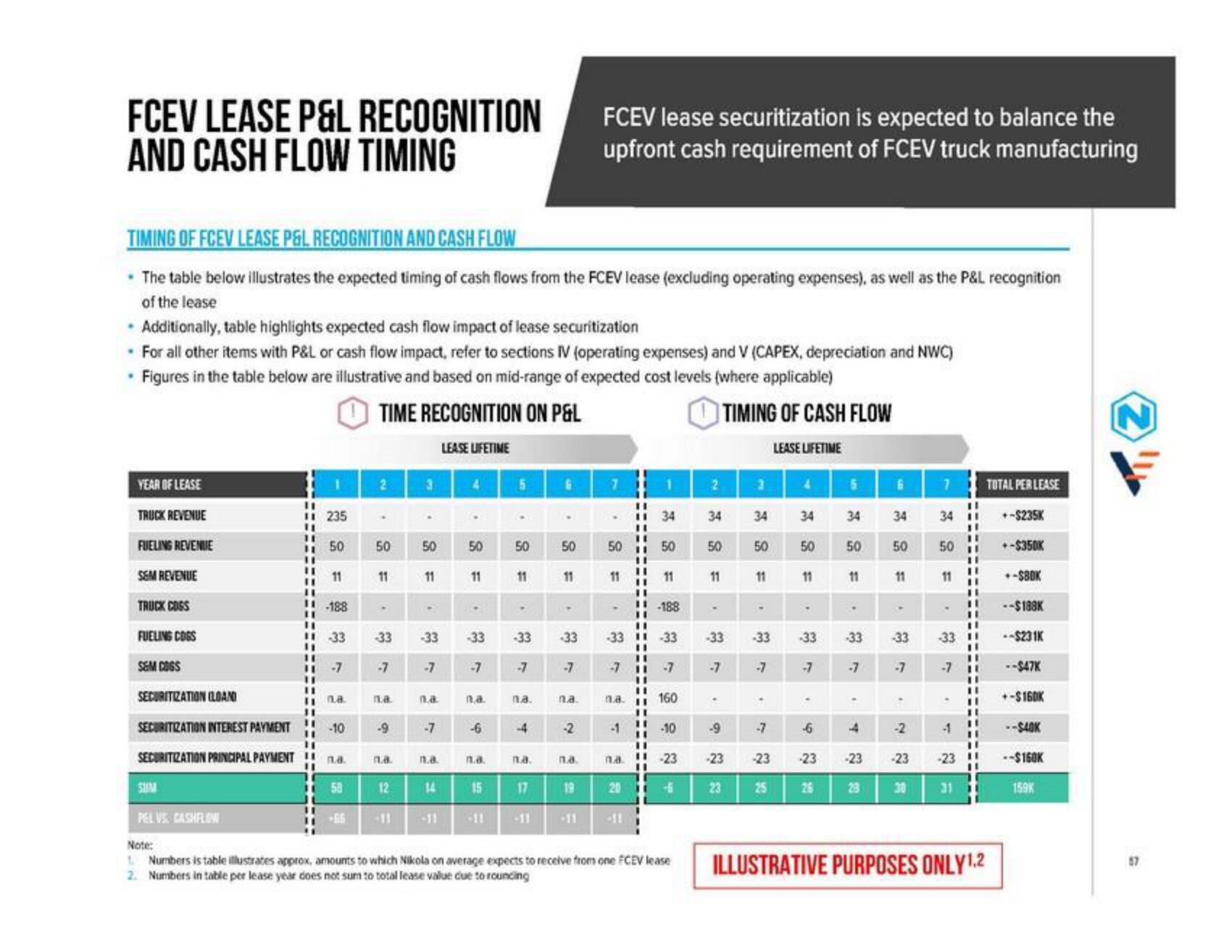

FCEV LEASE P&L RECOGNITION

AND CASH FLOW TIMING

TIMING OF FCEV LEASE P&L RECOGNITION AND CASH FLOW

• The table below illustrates the expected timing of cash flows from the FCEV lease (excluding operating expenses), as well as the P&L recognition

of the lease

• Additionally, table highlights expected cash flow impact of lease securitization

• For all other items with P&L or cash flow impact, refer to sections IV (operating expenses) and V (CAPEX, depreciation and NWC)

• Figures in the table below are illustrative and based on mid-range of expected cost levels (where applicable)

TIME RECOGNITION ON P&L

TIMING OF CASH FLOW

LEASE LIFETIME

LEASE LIFETIME

YEAR OF LEASE

TRUCK REVENUE

FUELING REVENUE

SEM REVENUE

TRUCK COGS

FUELING COSS

S&M COGS

SECURITIZATION (LOAN

SECURITIZATION INTEREST PAYMENT

SECURITIZATION PRINCIPAL PAYMENT

SUM

PEL VS CASHFLOW

11

1

235

50

11

-188

11 33

11 na

-10

n.a.

58

+66

2 3

50

11

-33

-7

na.

-9

1.a.

12

50

11

-33

-7

n.a.

-7

n.a.

14

-11

50

11

-33

-7

n.a.

-6

n.a.

15

5

50

11

-33

-7

na.

-4

na.

17

50

11

-33

na.

-2

FCEV lease securitization is expected to balance the

upfront cash requirement of FCEV truck manufacturing

na.

19

50

11

-7

na.

-1

n.a.

1

-3311-33

20

34

50

11

-188

160

-10

-23

-fi

Note:

1. Numbers is table illustrates approx, amounts to which Nikola on average expects to receive from one FCEV lease

2. Numbers in table per lease year does not sum to total lease value due to rouncing

2

34

50

11

-

-33

-9

-23

23

3

34

34

50 50

11

-

-33

-7

-23

4

25

11

.

-33

-6

-23

26

5

34

50

11

.

-33

-

4

-23

23

6

34

50

11

▼

-33

-2

-23

30

7 TOTAL PER LEASE

11

34 11

11

11

50

11

-33 11

-1

11

"1

-7 11

11

-23

11

31

ILLUSTRATIVE PURPOSES ONLY 1.2

+-$235K

+-$350K

+-$80K

--$188K

--$231K

--$47K

+-$160K

--$40K

--$160K

159K

N

57View entire presentation