Cannae SPAC Presentation Deck

изпит

INTERACTIVE

●

AUSTERLITZ

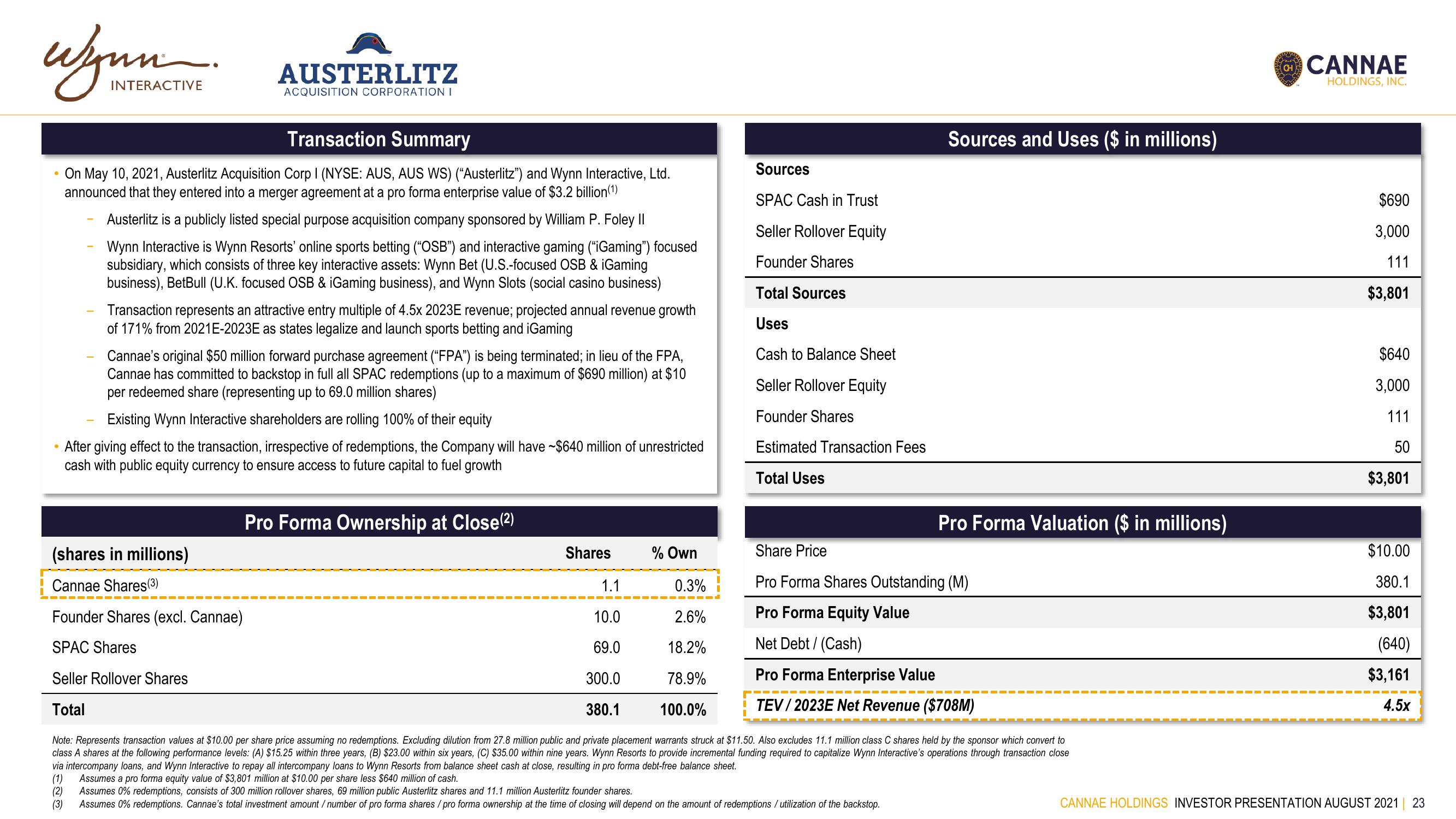

Transaction Summary

On May 10, 2021, Austerlitz Acquisition Corp I (NYSE: AUS, AUS WS) ("Austerlitz") and Wynn Interactive, Ltd.

announced that they entered into a merger agreement at a pro forma enterprise value of $3.2 billion(¹)

ACQUISITION CORPORATION I

Austerlitz is a publicly listed special purpose acquisition company sponsored by William P. Foley II

Wynn Interactive is Wynn Resorts' online sports betting ("OSB") and interactive gaming ("iGaming") focused

subsidiary, which consists of three key interactive assets: Wynn Bet (U.S.-focused OSB & iGaming

business), BetBull (U.K. focused OSB & iGaming business), and Wynn Slots (social casino business)

Transaction represents an attractive entry multiple of 4.5x 2023E revenue; projected annual revenue growth

of 171% from 2021E-2023E as states legalize and launch sports betting and iGaming

(shares in millions)

Cannae Shares(³)

‒‒‒‒‒‒ – – – I

Cannae's original $50 million forward purchase agreement ("FPA") is being terminated; in lieu of the FPA,

Cannae has committed to backstop in full all SPAC redemptions (up to a maximum of $690 million) at $10

per redeemed share (representing up to 69.0 million shares)

Existing Wynn Interactive shareholders are rolling 100% of their equity

After giving effect to the transaction, irrespective of redemptions, the Company will have ~$640 million of unrestricted

cash with public equity currency to ensure access to future capital to fuel growth

Founder Shares (excl. Cannae)

SPAC Shares

Seller Rollover Shares

Total

Pro Forma Ownership at Close(²)

Shares

% Own

Sources

SPAC Cash in Trust

Seller Rollover Equity

Founder Shares

Total Sources

Uses

Cash to Balance Sheet

Seller Rollover Equity

Founder Shares

Estimated Transaction Fees

Total Uses

0.3%

2.6%

18.2%

78.9%

100.0%

Sources and Uses ($ in millions)

Pro Forma Valuation ($ in millions)

1.1

10.0

69.0

300.0

380.1

Note: Represents transaction values at $10.00 per share price assuming no redemptions. Excluding dilution from 27.8 million public and private placement warrants struck at $11.50. Also excludes 11.1 million class C shares held by the sponsor which convert to

class A shares at the following performance levels: (A) $15.25 within three years, (B) $23.00 within six years, (C) $35.00 within nine years. Wynn Resorts to provide incremental funding required to capitalize Wynn Interactive's operations through transaction close

via intercompany loans, and Wynn Interactive to repay all intercompany loans to Wynn Resorts from balance sheet cash at close, resulting in pro forma debt-free balance sheet.

(1) Assumes a pro forma equity value of $3,801 million at $10.00 per share less $640 million of cash.

(2) Assumes 0% redemptions, consists of 300 million rollover shares, 69 million public Austerlitz shares and 11.1 million Austerlitz founder shares.

(3) Assumes 0% redemptions. Cannae's total investment amount / number of pro forma shares/pro forma ownership at the time of closing will depend on the amount of redemptions / utilization of the backstop.

Share Price

Pro Forma Shares Outstanding (M)

Pro Forma Equity Value

Net Debt / (Cash)

Pro Forma Enterprise Value

TEV/2023E Net Revenue ($708M)

CH

CANNAE

HOLDINGS, INC.

$690

3,000

111

$3,801

$640

3,000

111

50

$3,801

$10.00

380.1

$3,801

(640)

$3,161

4.5x

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 23View entire presentation