Silicon Valley Bank Results Presentation Deck

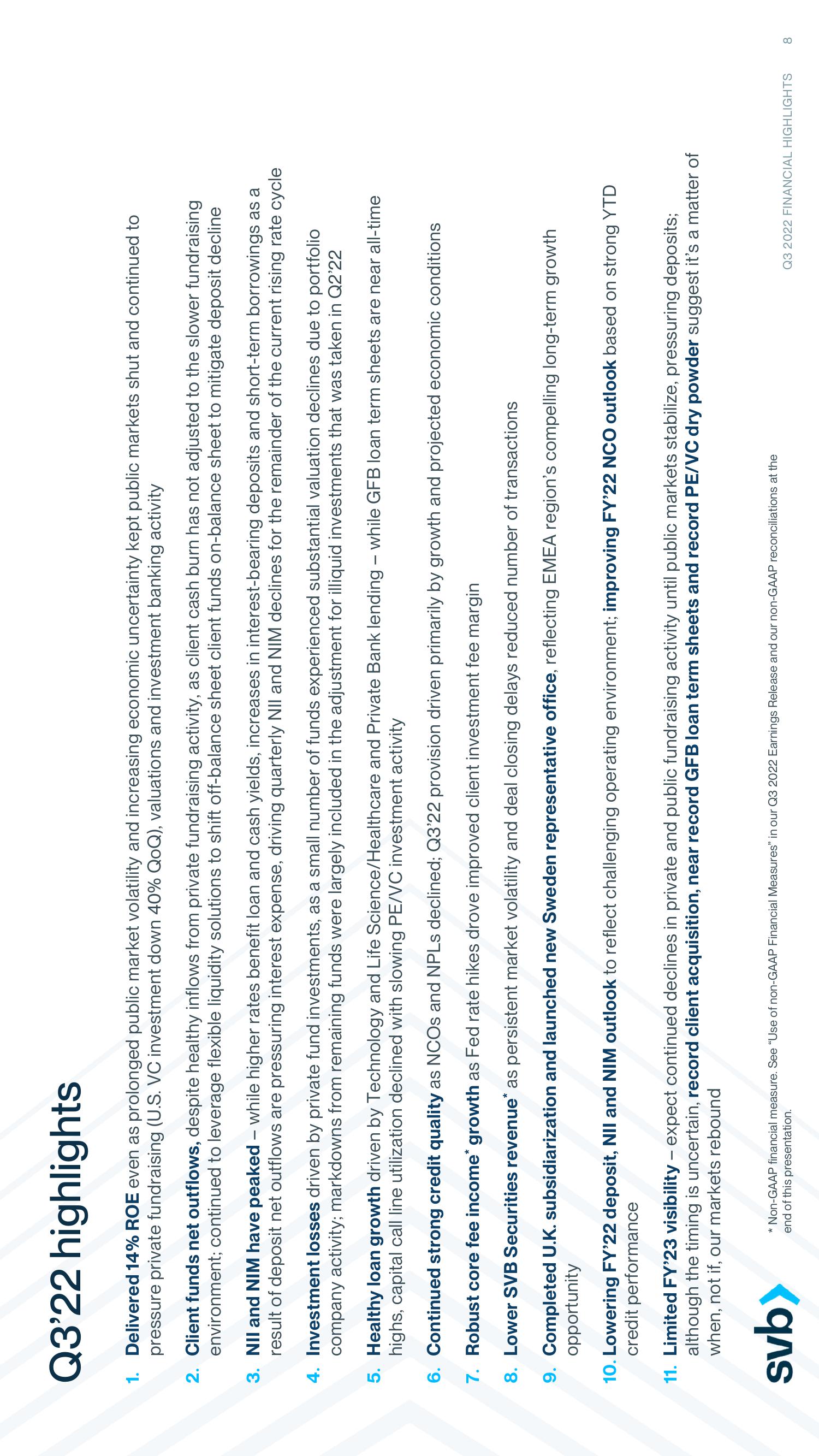

Q3'22 highlights

1. Delivered 14% ROE even as prolonged public market volatility and increasing economic uncertainty kept public markets shut and continued to

pressure private fundraising (U.S. VC investment down 40% QoQ), valuations and investment banking activity

2. Client funds net outflows, despite healthy inflows from private fundraising activity, as client cash burn has not adjusted to the slower fundraising

environment; continued to leverage flexible liquidity solutions to shift off-balance sheet client funds on-balance sheet to mitigate deposit decline

3. NII and NIM have peaked - while higher rates benefit loan and cash yields, increases in interest-bearing deposits and short-term borrowings as a

result of deposit net outflows are pressuring interest expense, driving quarterly NII and NIM declines for the remainder of the current rising rate cycle

4. Investment losses driven by private fund investments, as a small number of funds experienced substantial valuation declines due to portfolio

company activity; markdowns from remaining funds were largely included in the adjustment for illiquid investments that was taken in Q2'22

5. Healthy loan growth driven by Technology and Life Science/Healthcare and Private Bank lending - while GFB loan term sheets are near all-time

highs, capital call line utilization declined with slowing PE/VC investment activity

6. Continued strong credit quality as NCOs and NPLs declined; Q3'22 provision driven primarily by growth and projected economic conditions

7. Robust core fee income* growth as Fed rate hikes drove improved client investment fee margin

8. Lower SVB Securities revenue* as persistent market volatility and deal closing delays reduced number of transactions

9. Completed U.K. subsidiarization and launched new Sweden representative office, reflecting EMEA region's compelling long-term growth

opportunity

10. Lowering FY'22 deposit, NII and NIM outlook to reflect challenging operating environment; improving FY'22 NCO outlook based on strong YTD

credit performance

11. Limited FY'23 visibility - expect continued declines in private and public fundraising activity until public markets stabilize, pressuring deposits;

although the timing is uncertain, record client acquisition, near record GFB loan term sheets and record PE/VC dry powder suggest it's a matter of

when, not if, our markets rebound

svb>

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q3 2022 Earnings Release and our non-GAAP reconciliations at the

end of this presentation.

Q3 2022 FINANCIAL HIGHLIGHTS

8View entire presentation