Main Street Capital Investor Day Presentation Deck

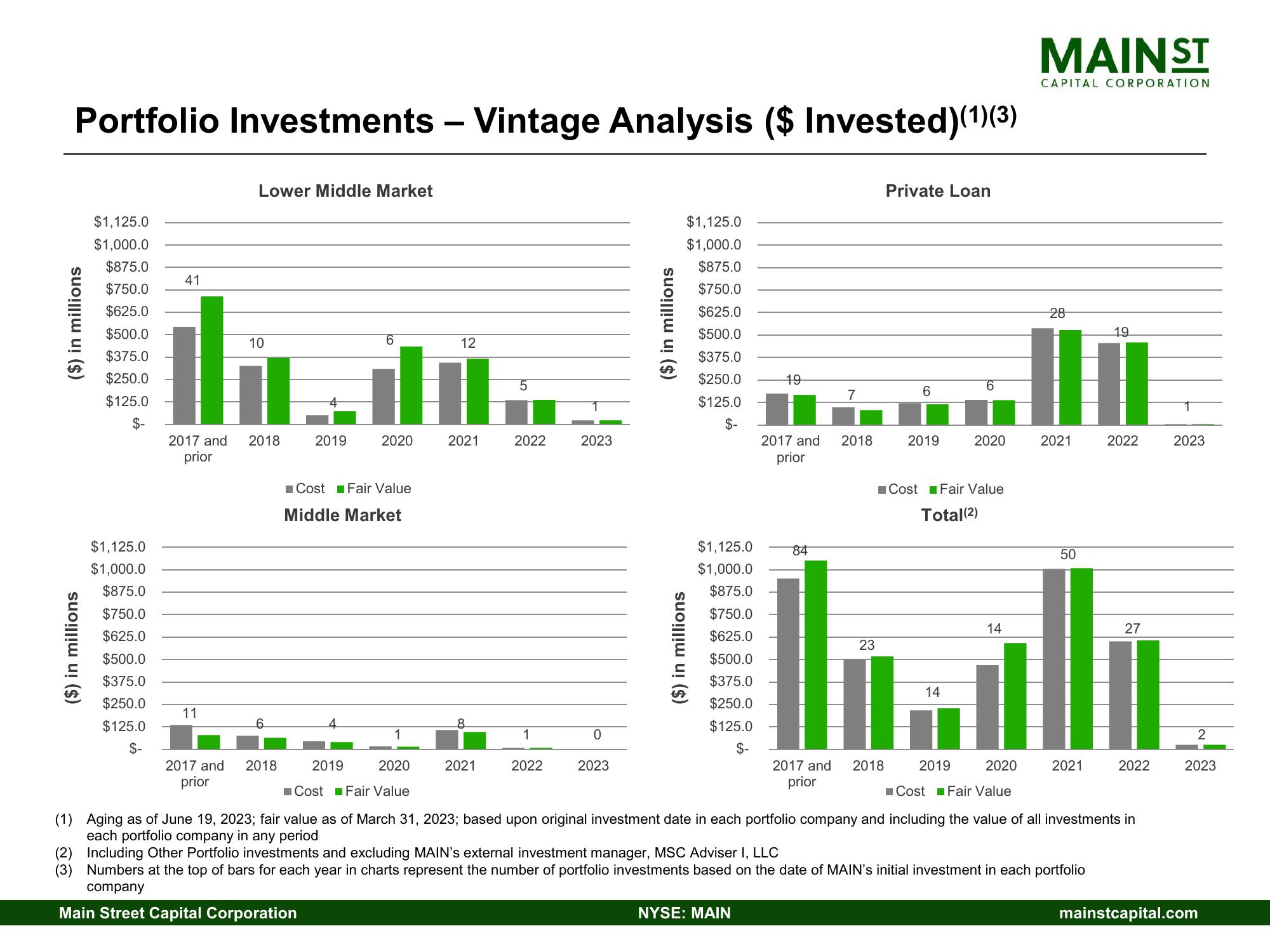

Portfolio Investments - Vintage Analysis ($ Invested)(1)(3)

($) in millions

($) in millions

$1,125.0

$1,000.0

$875.0

$750.0

$625.0

$500.0

$375.0

$250.0

$125.0

$-

$1,125.0

$1,000.0

$875.0

$750.0

$625.0

$500.0

$375.0

$250.0

$125.0

$-

41

2017 and

prior

11

2017 and

prior

Lower Middle Market

10

2018

6

2018

2019

6

2019

12

10

2020

Cost Fair Value

Middle Market

1

2020

Cost Fair Value

2021

8

2021

5

2022

1

2022

2023

0

2023

($) in millions

($) in millions

$1,125.0

$1,000.0

$875.0

$750.0

$625.0

$500.0

$375.0

$250.0

$125.0

$-

$1,125.0

$1,000.0

$875.0

$750.0

$625.0

$500.0

$375.0

$250.0

$125.0

$-

19

2017 and

prior

NYSE: MAIN

84

7

2018

23

Private Loan

2017 and 2018

prior

6

2019

I

Cost Fair Value

Total(2)

14

6

2020

2019

14

2020

Cost Fair Value

MAINST

CAPITAL CORPORATION

28

HI

2021

50

2021

(2) Including Other Portfolio investments and excluding MAIN's external investment manager, MSC Adviser I, LLC

(3) Numbers at the top of bars for each year in charts represent the number of portfolio investments based on the date of MAIN's initial investment in each portfolio

company

Main Street Capital Corporation

19

2022

27

(1) Aging as of June 19, 2023; fair value as of March 31, 2023; based upon original investment date in each portfolio company and including the value of all investments in

each portfolio company in any period

2022

2023

2

2023

mainstcapital.comView entire presentation