Nuvei Results Presentation Deck

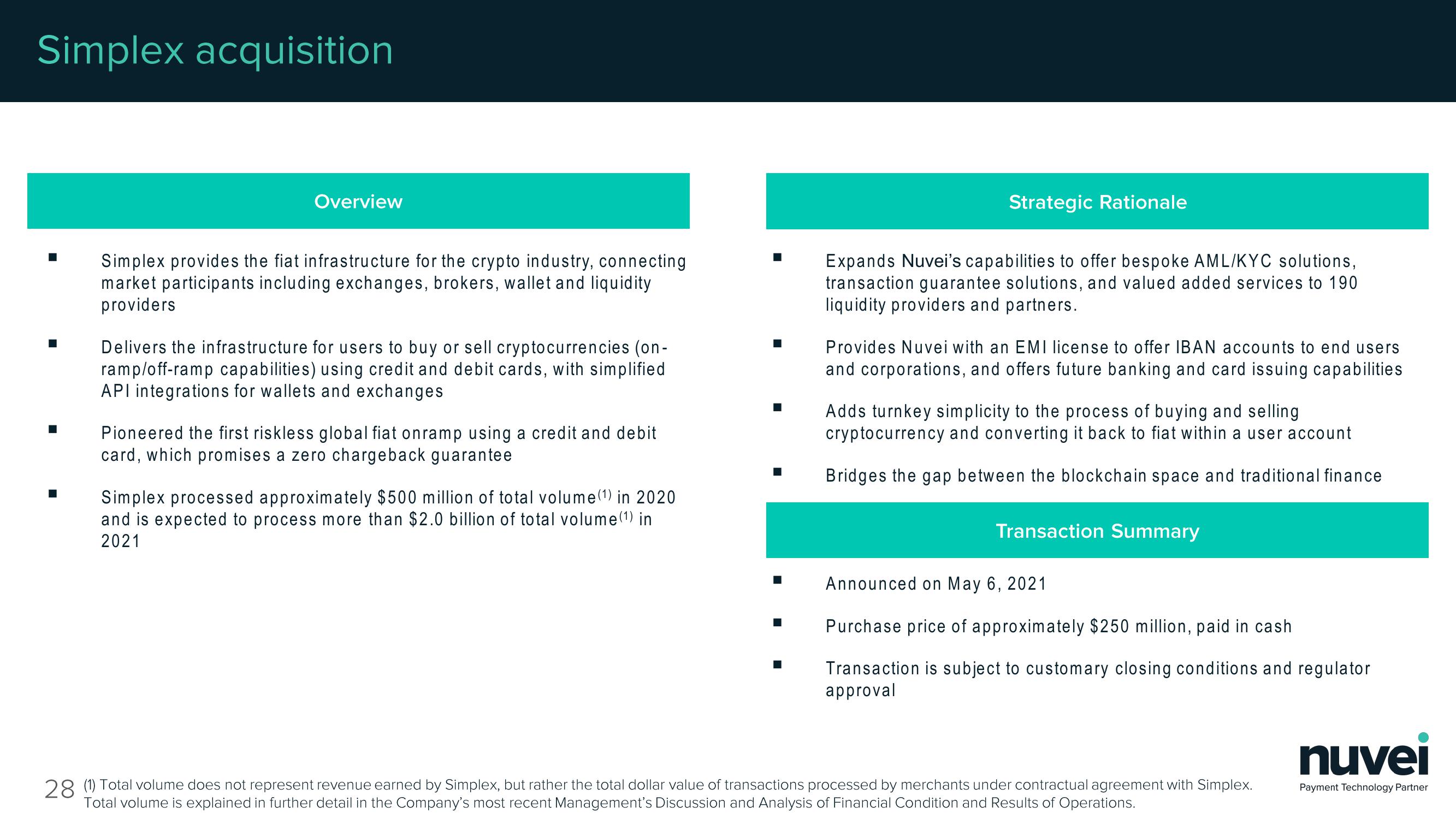

Simplex acquisition

Overview

Simplex provides the fiat infrastructure for the crypto industry, connecting

market participants including exchanges, brokers, wallet and liquidity

providers

Delivers the infrastructure for users to buy or sell cryptocurrencies (on-

ramp/off-ramp capabilities) using credit and debit cards, with simplified

API integrations for wallets and exchanges

Pioneered the first riskless global fiat onramp using a credit and debit

card, which promises a zero chargeback guarantee

Simplex processed approximately $500 million of total volume (1) in 2020

and is expected to process more than $2.0 billion of total volume (¹) in

2021

Strategic Rationale

Expands Nuvei's capabilities to offer bespoke AML/KYC solutions,

transaction guarantee solutions, and valued added services to 190

liquidity providers and partners.

Provides Nuvei with an EMI license to offer IBAN accounts to end users

and corporations, and offers future banking and card issuing capabilities

Adds turnkey simplicity to the process of buying and selling

cryptocurrency and converting it back to fiat within a user account

Bridges the gap between the blockchain space and traditional finance

Transaction Summary

Announced on May 6, 2021

Purchase price of approximately $250 million, paid in cash

Transaction is subject to customary closing conditions and regulator

approval

28 (1) Total volume does not represent revenue earned by Simplex, but rather the total dollar value of transactions processed by merchants under contractual agreement with Simplex.

Total volume is explained in further detail in the Company's most recent Management's Discussion and Analysis of Financial Condition and Results of Operations.

nuvei

Payment Technology PartnerView entire presentation