First Quarter 2017 Financial Review

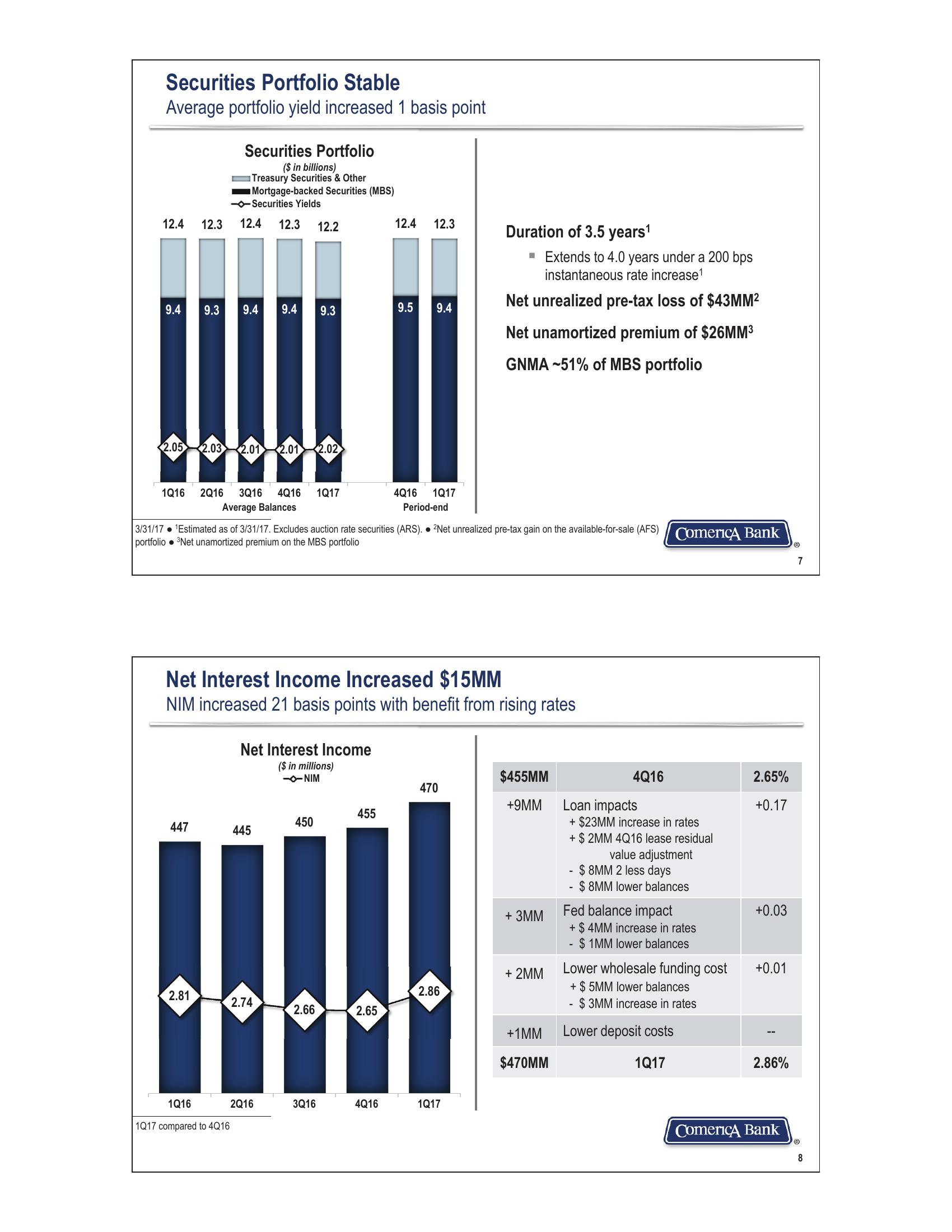

Securities Portfolio Stable

Average portfolio yield increased 1 basis point

Securities Portfolio

($ in billions)

Treasury Securities & Other

Mortgage-backed Securities (MBS)

-Securities Yields

12.4 12.3 12.4 12.3 12.2

12.4 12.3

Duration of 3.5 years¹

9.4

9.3 9.4 9.4 9.3

9.5

9.4

2.05

2.03

2.01 2.01

2.02

1Q16 2Q16

3Q16 4Q16

Average Balances

1Q17

4Q16

1Q17

Period-end

■ Extends to 4.0 years under a 200 bps

instantaneous rate increase1

Net unrealized pre-tax loss of $43MM²

Net unamortized premium of $26MM³

GNMA-51% of MBS portfolio

3/31/17 Estimated as of 3/31/17. Excludes auction rate securities (ARS). • 2Net unrealized pre-tax gain on the available-for-sale (AFS) Comerica Bank

portfolio Net unamortized premium on the MBS portfolio

Net Interest Income Increased $15MM

NIM increased 21 basis points with benefit from rising rates

Net Interest Income

($ in millions)

--NIM

$455MM

4Q16

470

+9MM

Loan impacts

455

450

+ $23MM increase in rates

447

445

+ $2MM 4Q16 lease residual

value adjustment

2.65%

+0.17

$8MM 2 less days

$ 8MM lower balances

+ 3MM

Fed balance impact

+0.03

+ $4MM increase in rates

-

$ 1MM lower balances

+ 2MM

Lower wholesale funding cost

+0.01

2.86

+$5MM lower balances

2.81

2.74

$3MM increase in rates

2.66

2.65

+1MM

Lower deposit costs

$470MM

1Q17

2.86%

1Q16

1Q17 compared to 4Q16

2Q16

3Q16

4Q16

1Q17

Ⓡ

7

Comerica Bank

Ⓡ

8View entire presentation