UBS Fixed Income Presentation Deck

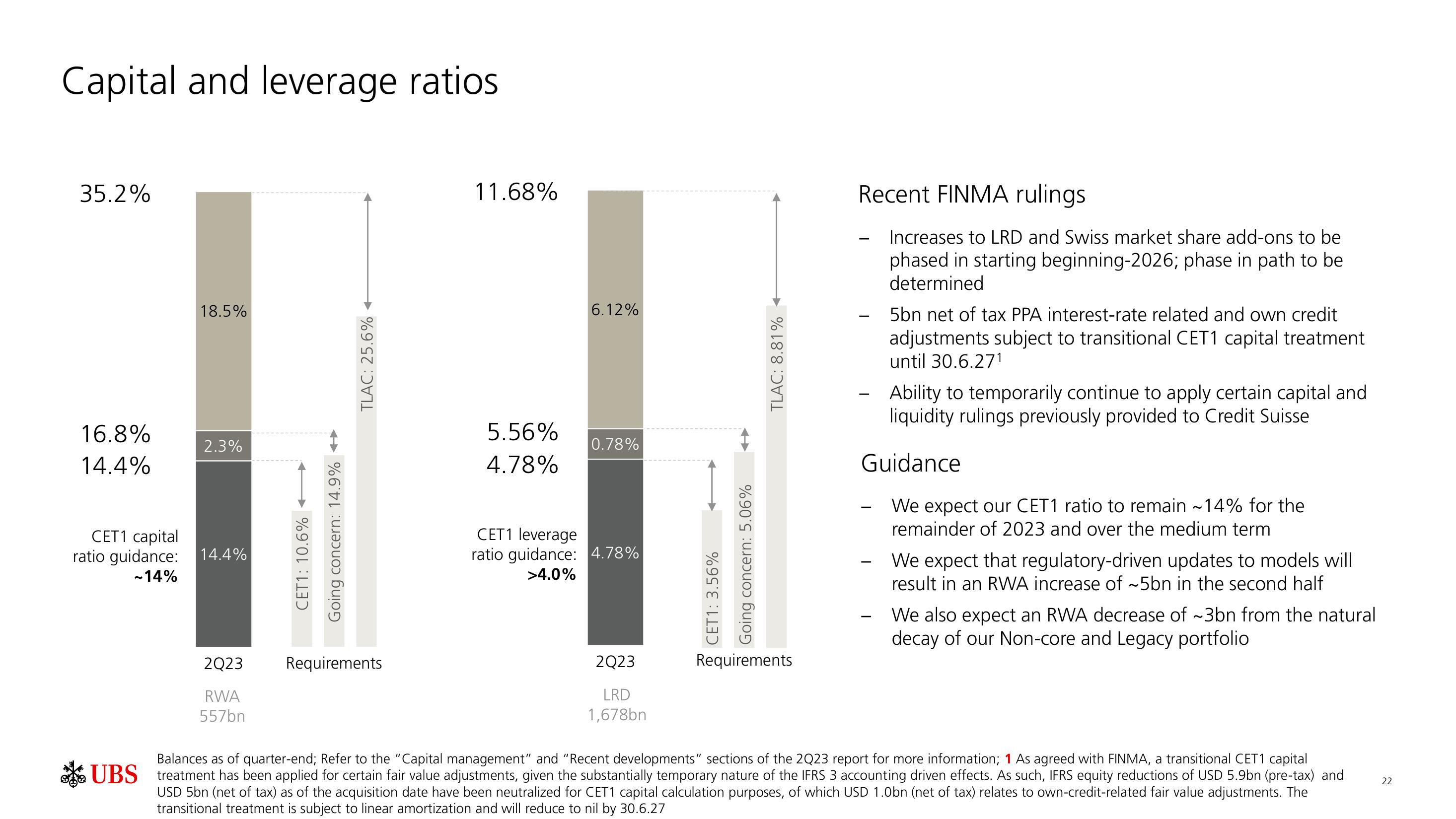

Capital and leverage ratios.

35.2%

16.8%

14.4%

CET1 capital

ratio guidance:

~14%

18.5%

2.3%

14.4%

2Q23

RWA

557bn

CET1: 10.6%

Going concern: 14.9%

TLAC: 25.6%

Requirements

11.68%

5.56%

4.78%

6.12%

0.78%

CET1 leverage

ratio guidance: 4.78%

>4.0%

2Q23

LRD

1,678bn

CET1: 3.56%

Going concern: 5.06%

TLAC: 8.81%

Requirements

Recent FINMA rulings

Increases to LRD and Swiss market share add-ons to be

phased in starting beginning-2026; phase in path to be

determined

-

5bn net of tax PPA interest-rate related and own credit

adjustments subject to transitional CET1 capital treatment

until 30.6.27¹

Ability to temporarily continue to apply certain capital and

liquidity rulings previously provided to Credit Suisse

Guidance

We expect our CET1 ratio to remain ~14% for the

remainder of 2023 and over the medium term

I

We expect that regulatory-driven updates to models will

result in an RWA increase of ~5bn in the second half

We also expect an RWA decrease of ~3bn from the natural

decay of our Non-core and Legacy portfolio

Balances as of quarter-end; Refer to the "Capital management" and "Recent developments" sections of the 2Q23 report for more information; 1 As agreed with FINMA, a transitional CET1 capital

UBS treatment has been applied for certain fair value adjustments, given the substantially temporary nature of the IFRS 3 accounting driven effects. As such, IFRS equity reductions of USD 5.9bn (pre-tax) and

USD 5bn (net of tax) as of the acquisition date have been neutralized for CET1 capital calculation purposes, of which USD 1.0bn (net of tax) relates to own-credit-related fair value adjustments. The

transitional treatment is subject to linear amortization and will reduce to nil by 30.6.27

22View entire presentation