Lyft Results Presentation Deck

Key Highlights Q4'20

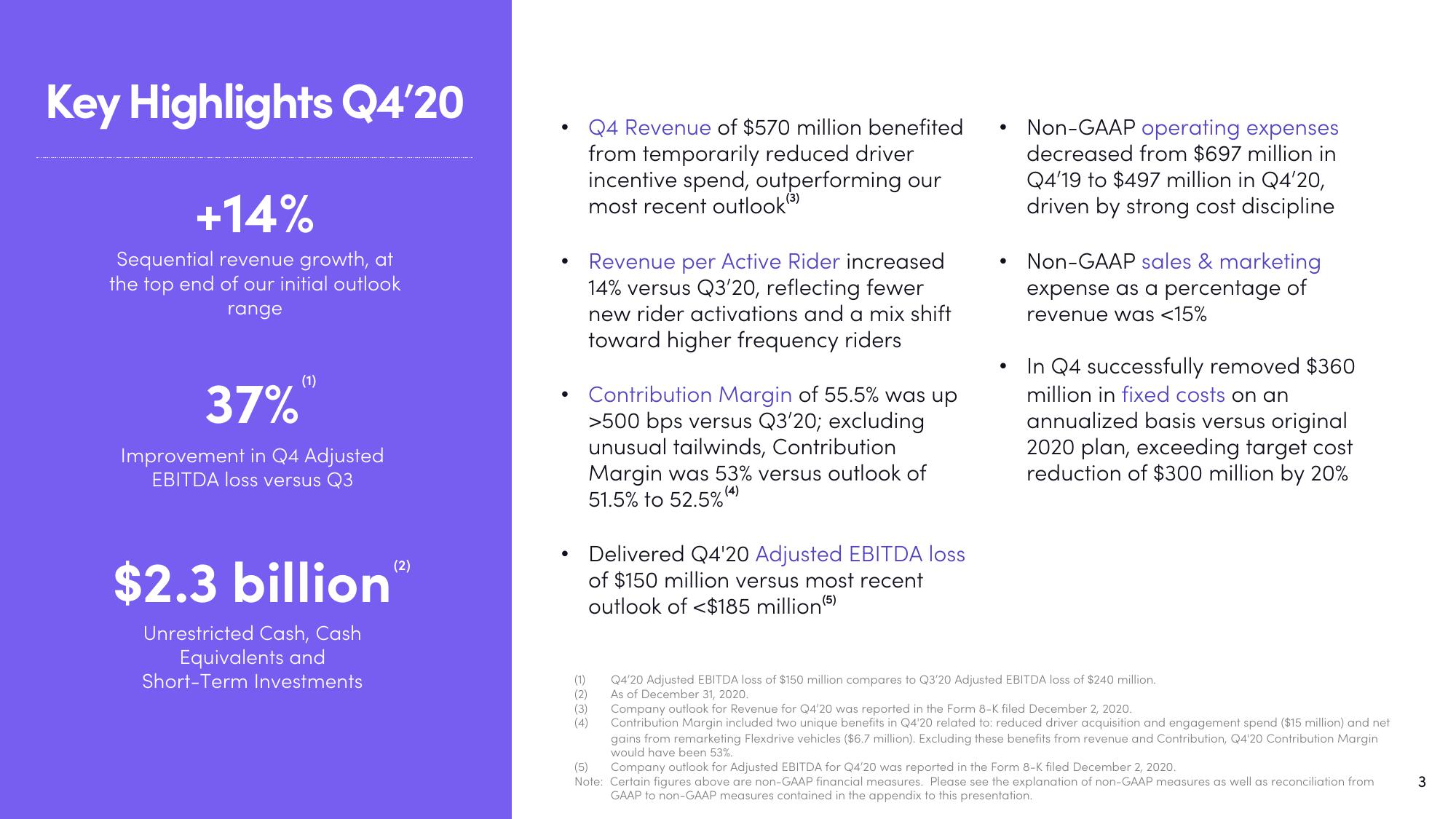

+14%

Sequential revenue growth, at

the top end of our initial outlook

range

(1)

37%

Improvement in Q4 Adjusted

EBITDA loss versus Q3

$2.3 billion

Unrestricted Cash, Cash

Equivalents and

Short-Term Investments

(2)

Q4 Revenue of $570 million benefited

from temporarily reduced driver

incentive spend, outperforming our

most recent outlook)

Revenue per Active Rider increased

14% versus Q3'20, reflecting fewer

new rider activations and a mix shift

toward higher frequency riders

Contribution Margin of 55.5% was up

>500 bps versus Q3'20; excluding

unusual tailwinds, Contribution

Margin was 53% versus outlook of

51.5% to 52.5%(4)

Delivered Q4'20 Adjusted EBITDA loss

of $150 million versus most recent

outlook of <$185 million (5)

●

●

●

Non-GAAP operating expenses

decreased from $697 million in

Q4'19 to $497 million in Q4'20,

driven by strong cost discipline

Non-GAAP sales & marketing

expense as a percentage of

revenue was <15%

In Q4 successfully removed $360

million in fixed costs on an

annualized basis versus original

2020 plan, exceeding target cost

reduction of $300 million by 20%

(1) Q4'20 Adjusted EBITDA loss of $150 million compares to Q3'20 Adjusted EBITDA loss of $240 million.

As of December 31, 2020.

(2)

(3)

(4)

Company outlook for Revenue for Q4'20 was reported in the Form 8-K filed December 2, 2020.

Contribution Margin included two unique benefits in Q4'20 related to: reduced driver acquisition and engagement spend ($15 million) and net

gains from remarketing Flexdrive vehicles ($6.7 million). Excluding these benefits from revenue and Contribution, Q4'20 Contribution Margin

would have been 53%.

(5)

Company outlook for Adjusted EBITDA for Q4'20 was reported in the Form 8-K filed December 2, 2020.

Note: Certain figures above are non-GAAP financial measures. Please see the explanation of non-GAAP measures as well as reconciliation from

GAAP to non-GAAP measures contained in the appendix to this presentation.

3View entire presentation