Trian Partners Activist Presentation Deck

Highly Cash-Generative

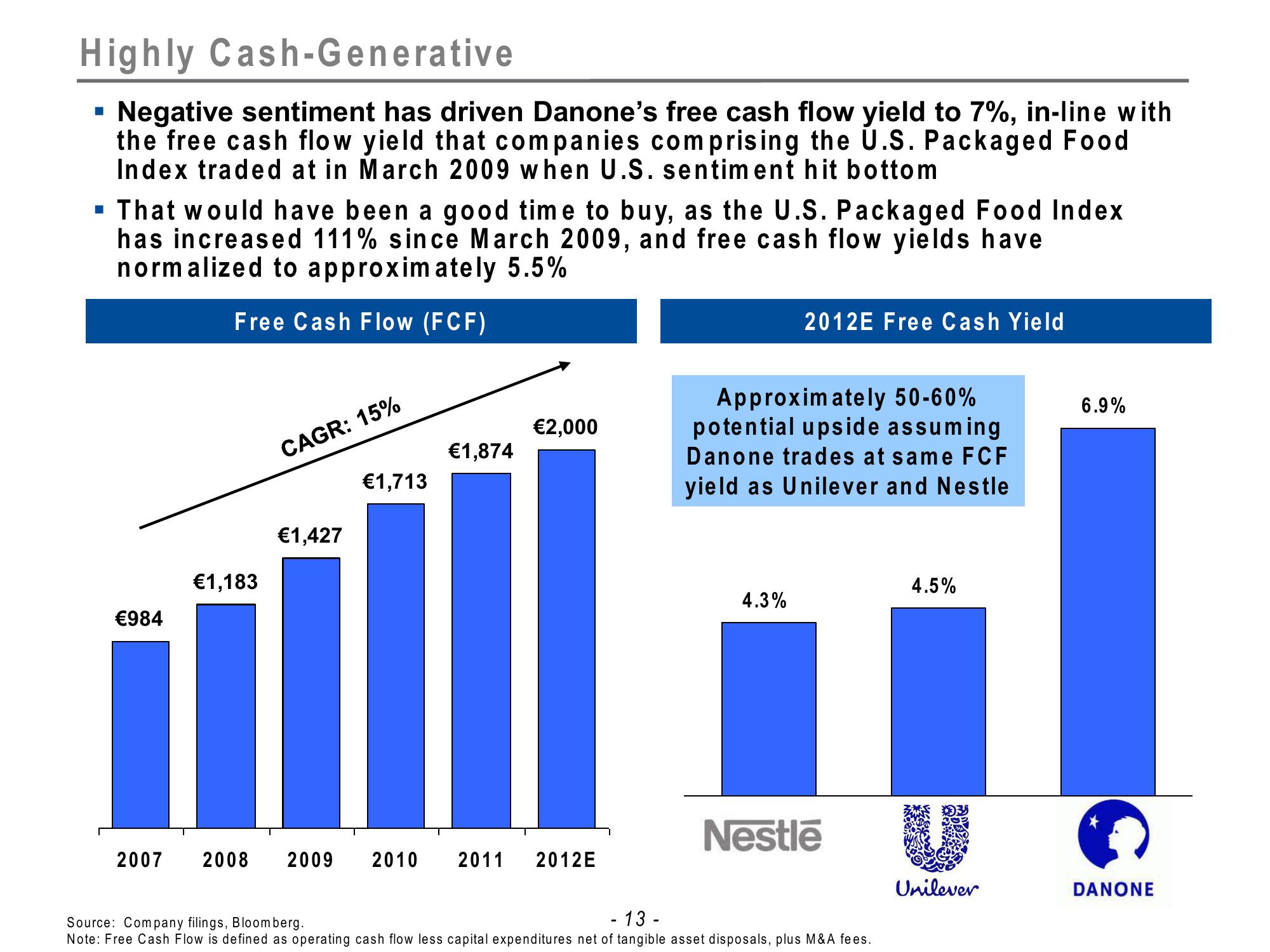

Negative sentiment has driven Danone's free cash flow yield to 7%, in-line with

the free cash flow yield that companies comprising the U.S. Packaged Food

Index traded at in March 2009 when U.S. sentiment hit bottom

■

▪ That would have been a good time to buy, as the U.S. Packaged Food Index

has increased 111% since March 2009, and free cash flow yields have

normalized to approximately 5.5%

Free Cash Flow (FCF)

€984

€1,183

CAGR: 15%

€1,427

€1,713

€1,874

€2,000

2007 2008 2009 2010 2011 2012E

2012E Free Cash Yield

Approximately 50-60%

potential upside assuming

Danone trades at same FCF

yield as Unilever and Nestle

4.3%

Nestlē

- 13 -

Source: Company filings, Bloomberg.

Note: Free Cash Flow is defined as operating cash flow less capital expenditures net of tangible asset disposals, plus M&A fees.

4.5%

Unilever

6.9%

DANONEView entire presentation