Main Street Capital Investor Day Presentation Deck

Dividend Paying BDCs Public

for > 2 Years

(1)

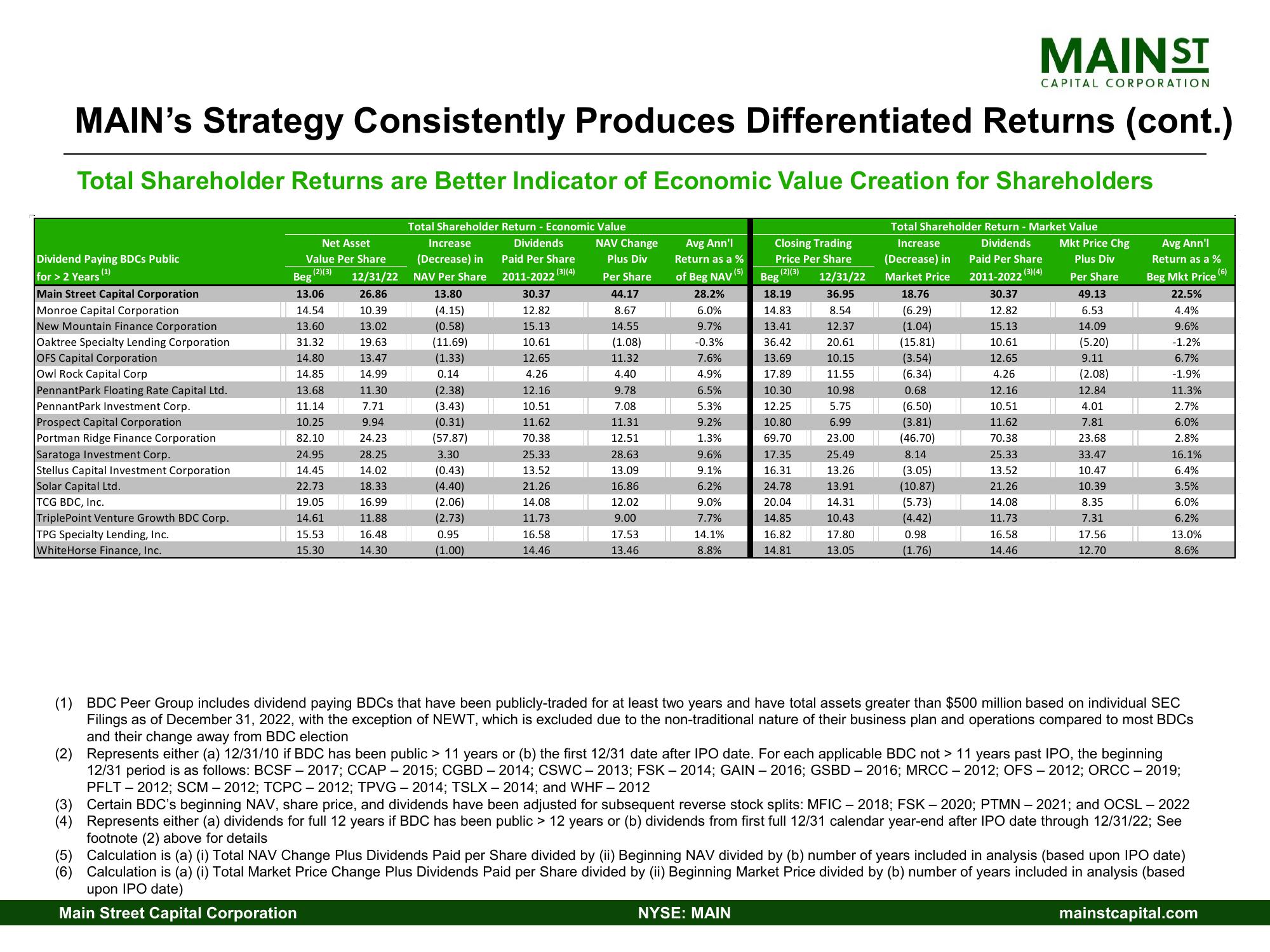

MAIN's Strategy Consistently Produces Differentiated Returns (cont.)

Total Shareholder Returns are Better Indicator of Economic Value Creation for Shareholders

Total Shareholder Return - Market Value

Increase

Dividends

(Decrease) in Paid Per Share

(3) (4)

Market Price 2011-2022

18.76

30.37

(6.29)

12.82

(1.04)

15.13

10.61

12.65

4.26

12.16

10.51

11.62

70.38

25.33

13.52

21.26

14.08

11.73

16.58

14.46

Main Street Capital Corporation

Monroe Capital Corporation

New Mountain Finance Corporation

Oaktree Specialty Lending Corporation

OFS Capital Corporation

Owl Rock Capital Corp

Pennant Park Floating Rate Capital Ltd.

PennantPark Investment Corp.

Prospect Capital Corporation

Portman Ridge Finance Corporation

Saratoga Investment Corp.

Stellus Capital Investment Corporation

Solar Capital Ltd.

TCG BDC, Inc.

TriplePoint Venture Growth BDC Corp.

TPG Specialty Lending, Inc.

WhiteHorse Finance, Inc.

Net Asset

Value Per Share

(2)(3)

Beg 12/31/22

13.06

26.86

14.54

10.39

13.60

13.02

31.32

19.63

14.80

13.47

14.85

14.99

13.68

11.14

10.25

82.10

24.95

14.45

22.73

19.05

14.61

15.53

15.30

11.30

7.71

9.94

24.23

28.25

14.02

18.33

16.99

11.88

16.48

14.30

Total Shareholder Return - Economic Value

Dividends

Paid Per Share

2011-2022 (3)(4)

30.37

Increase

(Decrease) in

NAV Per Share

13.80

(4.15)

(0.58)

(11.69)

(1.33)

0.14

(2.38)

(3.43)

(0.31)

(57.87)

3.30

(0.43)

(4.40)

(2.06)

(2.73)

0.95

(1.00)

12.82

15.13

10.61

12.65

4.26

12.16

10.51

11.62

70.38

25.33

13.52

21.26

14.08

11.73

16.58

14.46

NAV Change

Plus Div

Per Share

44.17

8.67

14.55

(1.08)

11.32

4.40

9.78

7.08

11.31

12.51

28.63

13.09

16.86

12.02

9.00

17.53

13.46

Avg Ann'l

Return as a %

of Beg NAV (5)

28.2%

6.0%

9.7%

-0.3%

7.6%

4.9%

6.5%

5.3%

9.2%

1.3%

9.6%

9.1%

6.2%

9.0%

7.7%

14.1%

8.8%

Closing Trading

Price Per Share

(2)(3)

Beg

12/31/22

18.19

36.95

14.83

8.54

13.41

12.37

36.42

20.61

13.69

10.15

17.89

11.55

10.98

5.75

6.99

23.00

25.49

13.26

13.91

14.31

10.43

17.80

13.05

10.30

12.25

10.80

69.70

17.35

16.31

24.78

20.04

14.85

16.82

14.81

(15.81)

(3.54)

(6.34)

0.68

(6.50)

(3.81)

NYSE: MAIN

(46.70)

8.14

MAINST

(3.05)

(10.87)

(5.73)

(4.42)

0.98

(1.76)

CAPITAL CORPORATION

Mkt Price Chg

Plus Div

Per Share

49.13

6.53

14.09

(5.20)

9.11

(2.08)

12.84

4.01

7.81

23.68

33.47

10.47

10.39

8.35

7.31

17.56

12.70

Avg Ann'l

Return as a %

(6)

Beg Mkt Price

22.5%

4.4%

9.6%

-1.2%

6.7%

-1.9%

11.3%

2.7%

6.0%

2.8%

16.1%

6.4%

3.5%

6.0%

6.2%

13.0%

8.6%

(1) BDC Peer Group includes dividend paying BDCs that have been publicly-traded for at least two years and have total assets greater than $500 million based on individual SEC

Filings as of December 31, 2022, with the exception of NEWT, which is excluded due to the non-traditional nature of their business plan and operations compared to most BDCs

and their change away from BDC election

(2) Represents either (a) 12/31/10 if BDC has been public > 11 years or (b) the first 12/31 date after IPO date. For each applicable BDC not > 11 years past IPO, the beginning

12/31 period is as follows: BCSF - 2017; CCAP - 2015; CGBD 2014; CSWC-2013; FSK-2014; GAIN-2016; GSBD-2016; MRCC-2012; OFS - 2012; ORCC - 2019;

PFLT-2012; SCM-2012; TCPC - 2012; TPVG - 2014; TSLX - 2014; and WHF - 2012

Certain BDC's beginning NAV, share price, and dividends have been adjusted for subsequent reverse stock splits: MFIC - 2018; FSK - 2020; PTMN - 2021; and OCSL - 2022

(4) Represents either (a) dividends for full 12 years if BDC has been public > 12 years or (b) dividends from first full 12/31 calendar year-end after IPO date through 12/31/22; See

footnote (2) above for details

(5) Calculation is (a) (i) Total NAV Change Plus Dividends Paid per Share divided by (ii) Beginning NAV divided by (b) number of years included in analysis (based upon IPO date)

(6) Calculation is (a) (i) Total Market Price Change Plus Dividends Paid per Share divided by (ii) Beginning Market Price divided by (b) number of years included in analysis (based

upon IPO date)

Main Street Capital Corporation

mainstcapital.comView entire presentation