J.P.Morgan Investment Banking

APPENDIX

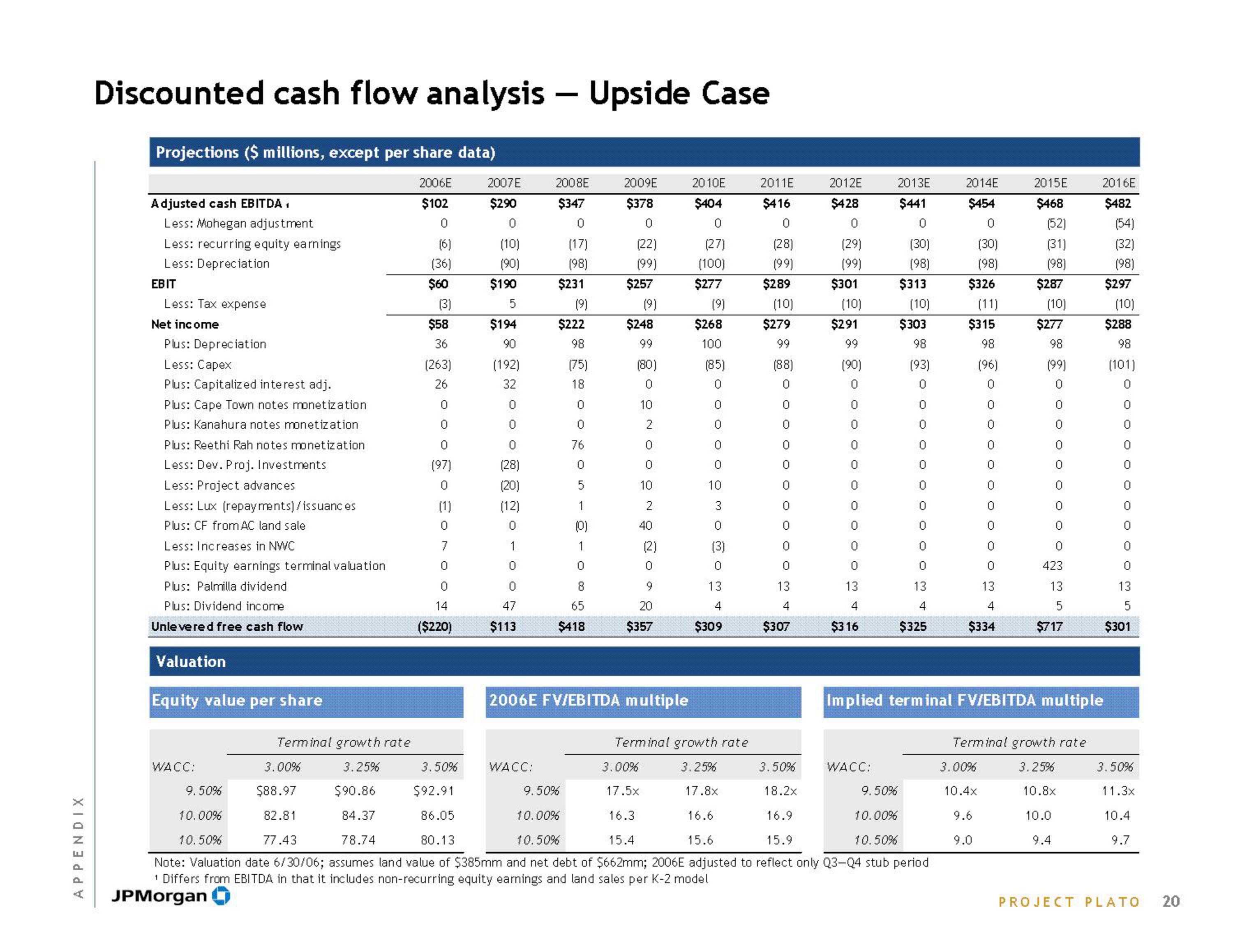

Discounted cash flow analysis - Upside Case

Projections ($ millions, except per share data)

2006E

$102

0

(6)

(36)

Adjusted cash EBITDA,

Less: Mohegan adjustment

Less: recurring equity earnings

Less: Depreciation

EBIT

Less: Tax expense

Net income

Plus: Depreciation

Less: Capex

Plus: Capitalized interest adj.

Plus: Cape Town notes monetization

Plus: Kanahura notes monetization

Plus: Reethi Rah notes monetization

Less: Dev. Proj. Investments

Less: Project advances

Less: Lux (repayments) / issuances

Plus: CF from AC land sale

Less: Increases in NWC

Plus: Equity earnings terminal valuation

Plus: Palmilla dividend

Plus: Dividend income

Unle vered free cash flow

Valuation

Equity value per share

WACC:

$60

(3)

$58

36

(263)

26

0

0

0

(97)

0

3.00%

$88.97

82.81

77.43

(1)

0

7

0

0

14

($220)

2007 E

$290

0

(10)

(90)

$190

5

$194

90

(192)

32

0

0

0

(28)

(20)

(12)

0

1

0

0

47

$113

2008E

$347

0

(17)

(98)

WACC:

$231

(9)

$222

98

(75)

18

0

pogon - 2-000

0

76

0

5

1

(0)

1

8

65

$418

2009E

$378

0

(22)

(99)

$257

(9)

$248

99

(80)

0

10

2

0

0

10

2

40

(2)

0

9

20

$357

2006E FV/EBITDA multiple

2010E

$404

0

(27)

(100)

$277

(9)

$268

100

(85)

0

ܘ ܘ ܘ ܘ ܘ ܚ ܘ ܝ ܘ ܚ

10

13

$309

2011E

$416

0

(28)

(99)

$289

(10)

$279

99

(88)

0

0

0

0

0

0

0

0

0

0

13

4

$307

2012E

$428

0

(29)

(99)

$301

(10)

$291

99

(90)

0

0

0

ooooooom

13

4

$316

Terminal growth rate

Terminal growth rate

3.25%

3.50%

3.00%

3.25%

3.50%

9.50%

$90.86

$92.91

9.50%

17.5x

17.8x

18.2x

9.50%

10.00%

84.37

86.05

10.00%

16.3

16.6

16.9

10.00%

10.50%

78.74

80.13

10.50%

15.4

15.6

15.9

10.50%

Note: Valuation date 6/30/06; assumes land value of $385mm and net debt of $662mm; 2006E adjusted to reflect only Q3-Q4 stub period

¹ Differs from EBITDA in that it includes non-recurring equity earnings and land sales per K-2 model

JPMorgan

2013E

$441

0

(30)

(98)

$313

(10)

$303

98

(93)

0

0

0

0

0

0

0

0

0

0

13

4

$325

g

WACC:

2014E

$454

0

(30)

(98)

$326

(11)

$315

98

(96)

0

0

0

0

0

0

0

0

0

0

13

4

$334

2015E

$468

(52)

(31)

(98)

3.00%

10.4x

9.6

9.0

$287

(10)

$277

98

(99)

0

0

0

0

0

0

0

0

0

423

13

5

$717

Implied terminal FV/EBITDA multiple

Terminal growth rate

3.25%

2016E

$482

(54)

(32)

(98)

10.8x

10.0

9.4

$297

(10)

$288

98

(101)

0

O O O O O O O OOMS

13

$301

3.50%

11.3x

10.4

9.7

PROJECT PLATO 20View entire presentation