Ares US Real Estate Opportunity Fund III

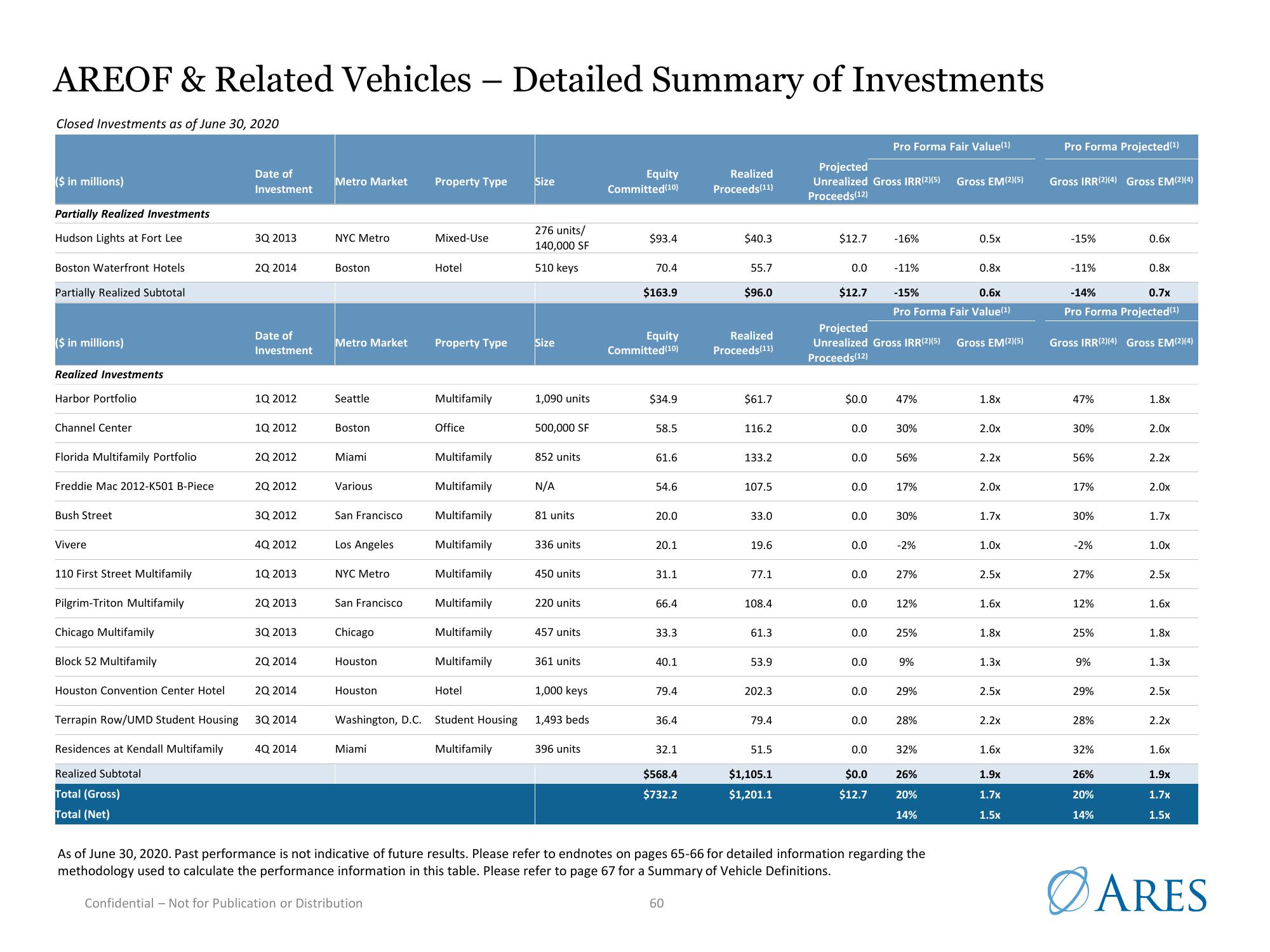

AREOF & Related Vehicles - Detailed Summary of Investments

Closed Investments as of June 30, 2020

($ in millions)

Partially Realized Investments

Hudson Lights at Fort Lee

Boston Waterfront Hotels

Partially Realized Subtotal

($ in millions)

Realized Investments

Harbor Portfolio

Channel Center

Florida Multifamily Portfolio

Freddie Mac 2012-K501 B-Piece

Bush Street

Vivere

110 First Street Multifamily

Pilgrim-Triton Multifamily

Chicago Multifamily

Block 52 Multifamily

Houston Convention Center Hotel

Date of

Investment

3Q 2013

2Q 2014

Date of

Investment

1Q 2012

1Q 2012

2Q 2012

2Q 2012

3Q 2012

4Q 2012

1Q 2013

2Q 2013

3Q 2013

2Q 2014

2Q 2014

Terrapin Row/UMD Student Housing

Residences at Kendall Multifamily 4Q 2014

Realized Subtotal

Total (Gross)

Total (Net)

3Q 2014

Metro Market

NYC Metro

Boston

Metro Market

Seattle

Boston

Miami

Various

San Francisco

Los Angeles

NYC Metro

San Francisco

Chicago

Houston

Houston

Washington, D.C.

Miami

Property Type

Mixed-Use

Hotel

Property Type

Multifamily

Office

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Multifamily

Hotel

Student Housing

Multifamily

Size

276 units/

140,000 SF

510 keys

Size

1,090 units

500,000 SF

852 units

N/A

81 units

336 units

450 units

220 units

457 units

361 units

1,000 keys

1,493 beds

396 units

Equity

Committed (10)

$93.4

70.4

$163.9

Equity

Committed (10)

$34.9

58.5

61.6

54.6

20.0

20.1

31.1

66.4

33.3

40.1

79.4

36.4

32.1

$568.4

$732.2

Realized

Proceeds (11)

60

$40.3

55.7

$96.0

Realized

Proceeds(11)

$61.7

116.2

133.2

107.5

33.0

19.6

77.1

108.4

61.3

53.9

202.3

79.4

51.5

$1,105.1

$1,201.1

Projected

Unrealized Gross IRR(2)(5) Gross EM(2)(5)

Proceeds(12)

$12.7

0.0

$12.7

$0.0

0.0

0.0

Projected

Unrealized Gross IRR(2)(5)

Proceeds(12)

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

0.0

Pro Forma Fair Value(¹)

0.0

$0.0

$12.7

-16%

-11%

-15%

0.6x

Pro Forma Fair Value(¹)

47%

30%

56%

17%

30%

-2%

27%

12%

25%

9%

29%

28%

32%

26%

20%

14%

As of June 30, 2020. Past performance is not indicative of future results. Please refer to endnotes on pages 65-66 for detailed information regarding the

methodology used to calculate the performance information in this table. Please refer to page 67 for a Summary of Vehicle Definitions.

Confidential - Not for Publication or Distribution

0.5x

0.8x

Gross EM(2)(5)

1.8x

2.0x

2.2x

2.0x

1.7x

1.0x

2.5x

1.6x

1.8x

1.3x

2.5x

2.2x

1.6x

1.9x

1.7x

1.5x

Pro Forma Projected (1)

Gross IRR(2)(4) Gross EM(2)(4)

-15%

-11%

-14%

0.7x

Pro Forma Projected (¹)

47%

Gross IRR(2)(4) Gross EM(2)(4)

30%

56%

17%

30%

-2%

27%

12%

25%

9%

29%

28%

0.6x

32%

0.8x

26%

20%

14%

1.8x

2.0x

2.2x

2.0x

1.7x

1.0x

2.5x

1.6x

1.8x

1.3x

2.5x

2.2x

1.6x

1.9x

1.7x

1.5x

ARESView entire presentation