Evolv SPAC Presentation Deck

Transaction Summary

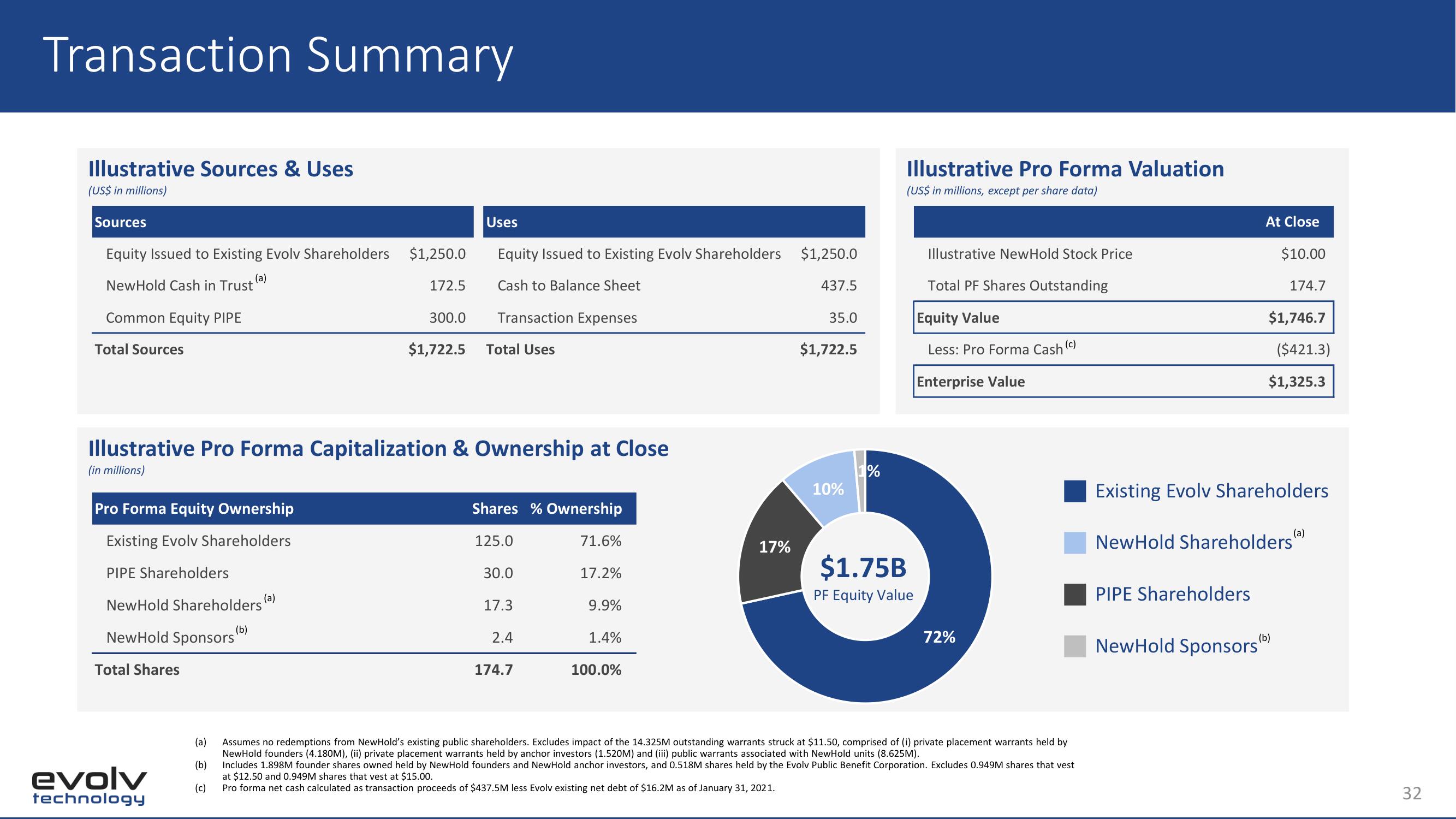

Illustrative Sources & Uses

(US$ in millions)

Sources

Equity Issued to Existing Evolv Shareholders

(a)

NewHold Cash in Trust

Common Equity PIPE

Total Sources

Pro Forma Equity Ownership

Existing Evolv Shareholders

PIPE Shareholders

NewHold Shareholders (a)

NewHold Sponsors

Total Shares

evolv

technology

$1,250.0

(b)

172.5

300.0

Illustrative Pro Forma Capitalization & Ownership at Close

(in millions)

$1,722.5

Uses

Equity Issued to Existing Evolv Shareholders

Cash to Balance Sheet

Transaction Expenses

Total Uses

Shares % Ownership

125.0

30.0

17.3

2.4

174.7

71.6%

17.2%

9.9%

1.4%

100.0%

17%

$1,250.0

437.5

35.0

$1,722.5

10%

1%

Illustrative Pro Forma Valuation

(US$ in millions, except per share data)

$1.75B

PF Equity Value

Illustrative NewHold Stock Price

Total PF Shares Outstanding

Equity Value

Less: Pro Forma Cash

(c)

Enterprise Value

72%

(a)

(b)

Includes 1.898M founder shares owned held by NewHold founders and NewHold anchor investors, and 0.518M shares held by the Evolv Public Benefit Corporation. Excludes 0.949M shares that vest

at $12.50 and 0.949M shares that vest at $15.00.

(c) Pro forma net cash calculated as transaction proceeds of $437.5M less Evolv existing net debt of $16.2M as of January 31, 2021.

Assumes no redemptions from NewHold's existing public shareholders. Excludes impact of the 14.325M outstanding warrants struck at $11.50, comprised of (i) private placement warrants held by

NewHold founders (4.180M), (ii) private placement warrants held by anchor investors (1.520M) and (iii) public warrants associated with NewHold units (8.625M).

At Close

PIPE Shareholders

$10.00

174.7

$1,746.7

($421.3)

$1,325.3

Existing Evolv Shareholders

NewHold Shareholdersa

NewHold Sponsors(b)

(a)

32View entire presentation