Hilltop Holdings Results Presentation Deck

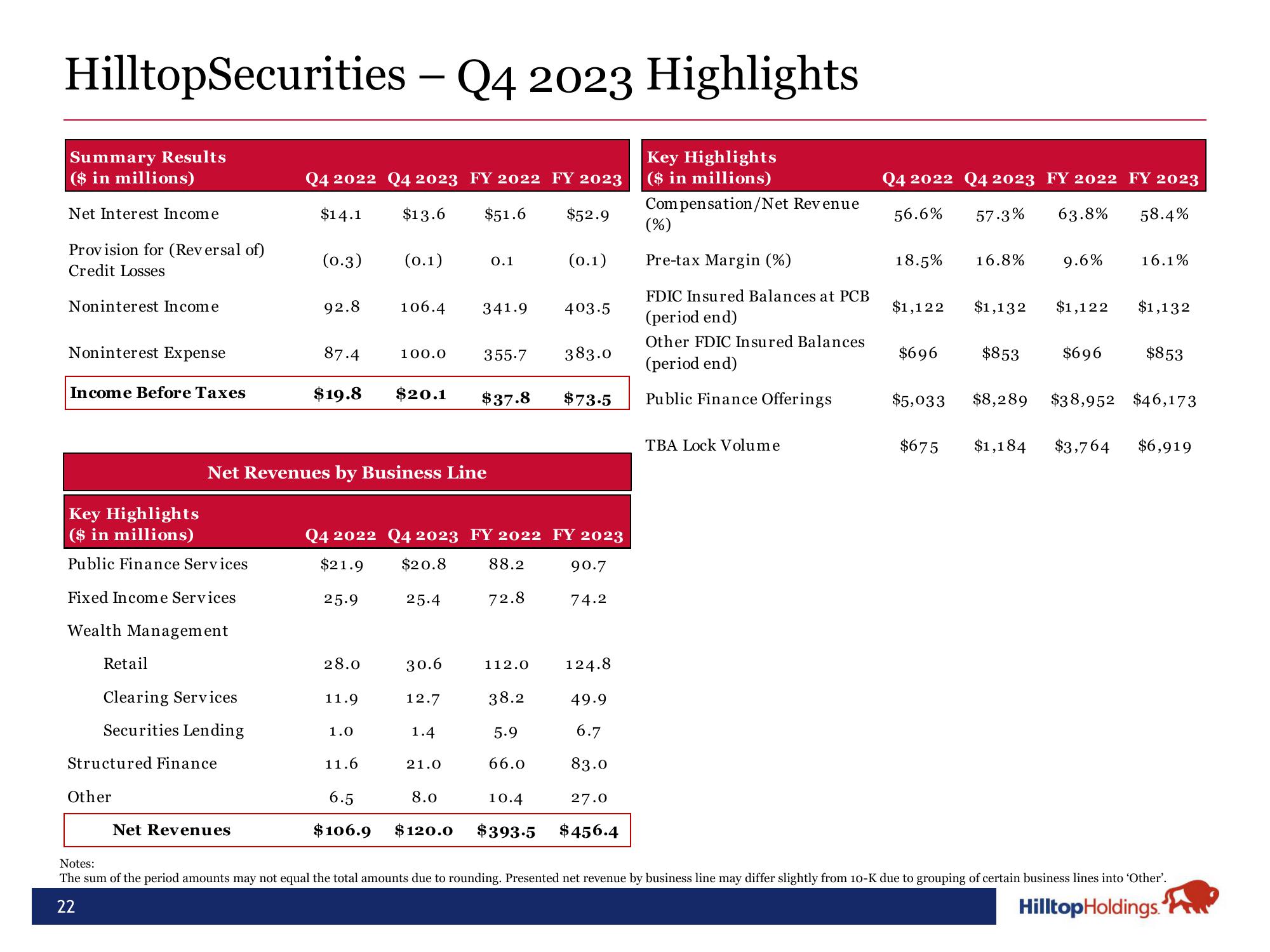

HilltopSecurities – Q4 2023 Highlights

Key Highlights

($ in millions)

Compensation/Net Revenue

Summary Results

($ in millions)

Net Interest Income

Provision for (Reversal of)

Credit Losses

Noninterest Income

Noninterest Expense

Income Before Taxes

Key Highlights

($ in millions)

Public Finance Services

Fixed Income Services

Wealth Management

Retail

Clearing Services

Securities Lending

Structured Finance

Other

Q4 2022 Q4 2023 FY 2022 FY 2023

$14.1 $13.6 $51.6 $52.9

Net Revenues

(0.3)

92.8

Net Revenues by Business Line

87.4

$19.8 $20.1

25.9

28.0

11.9

(0.1)

1.0

106.4

11.6

6.5

$106.9

100.0

Q4 2022 Q4 2023 FY 2022 FY 2023

$21.9 $20.8

88.2

90.7

25.4

74.2

30.6

12.7

1.4

0.1

341.9

21.0

$37.8

355.7 383.0

72.8

112.0

38.2

(0.1)

5.9

66.0

403.5

8.0

10.4

$120.0 $393.5

$73.5

124.8

49.9

6.7

83.0

27.0

$456.4

(%)

Pre-tax Margin (%)

FDIC Insured Balances at PCB

(period end)

Other FDIC Insured Balances

(period end)

Public Finance Offerings

TBA Lock Volume

Q4 2022 Q4 2023 FY 2022 FY 2023

56.6% 57.3% 63.8%

58.4%

18.5% 16.8%

$1,122

$5,033

$696 $853 $696

$675

9.6%

$1,132 $1,122

$8,289

16.1%

$1,132

$853

$38,952 $46,173

$1,184 $3,764 $6,919

Notes:

The sum of the period amounts may not equal the total amounts due to rounding. Presented net revenue by business line may differ slightly from 10-K due to grouping of certain business lines into 'Other'.

22

Hilltop Holdings.View entire presentation