Affirm Investor Day Presentation Deck

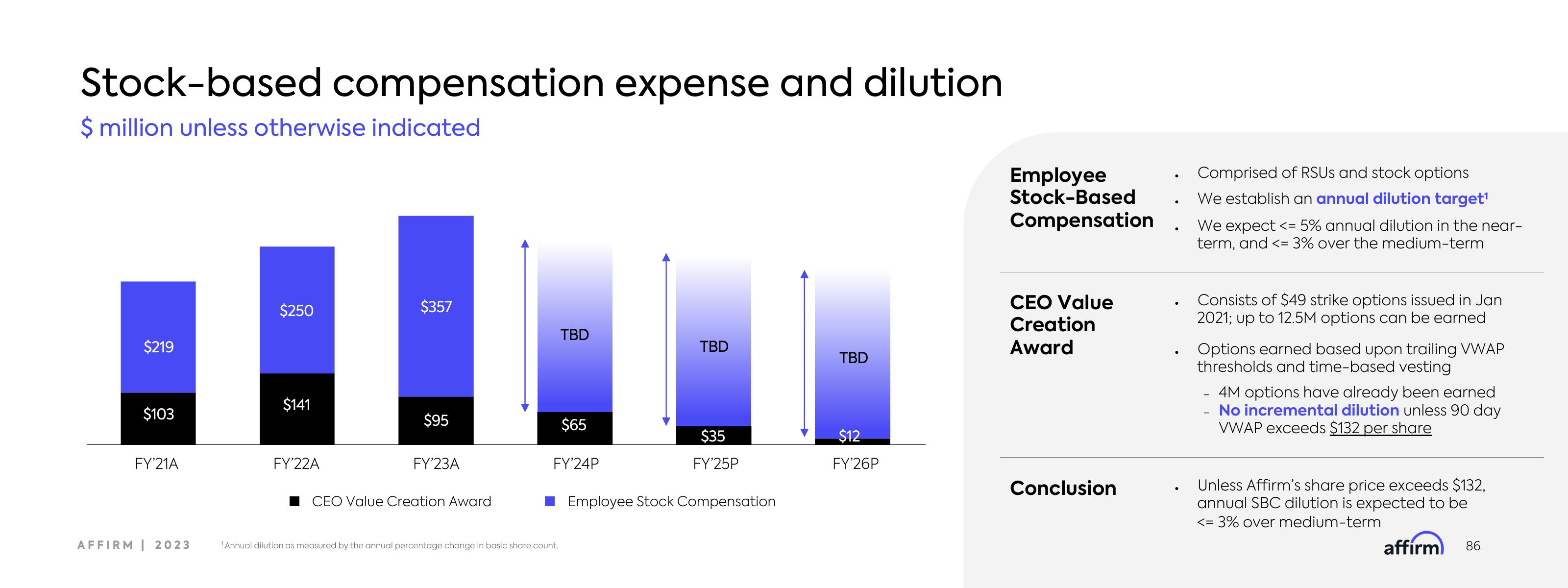

Stock-based compensation expense and dilution

$ million unless otherwise indicated

$219

$103

FY'21A

AFFIRM | 2023

$250

$141

FY'22A

$357

$95

FY'23A

CEO Value Creation Award

TBD

¹ Annual dilution as measured by the annual percentage change in basic share count.

$65

FY'24P

TBD

$35

FY'25P

Employee Stock Compensation

TBD

$12

FY'26P

Employee

Stock-Based

Compensation

CEO Value

Creation

Award

Conclusion

.

●

●

Comprised of RSUS and stock options

We establish an annual dilution target¹

We expect <= 5% annual dilution in the

term, and <= 3% over the medium-term

Consists of $49 strike options issued in Jan

2021; up to 12.5M options can be earned

Options earned based upon trailing VWAP

thresholds and time-based vesting

-

4M options have already been earned

No incremental dilution unless 90 day

VWAP exceeds $132 per share

Unless Affirm's share price exceeds $132,

annual SBC dilution is expected to be

<= 3% over medium-term

affirm 86

ar-View entire presentation