Mesirow Private Equity

History of Consistent Outperformance

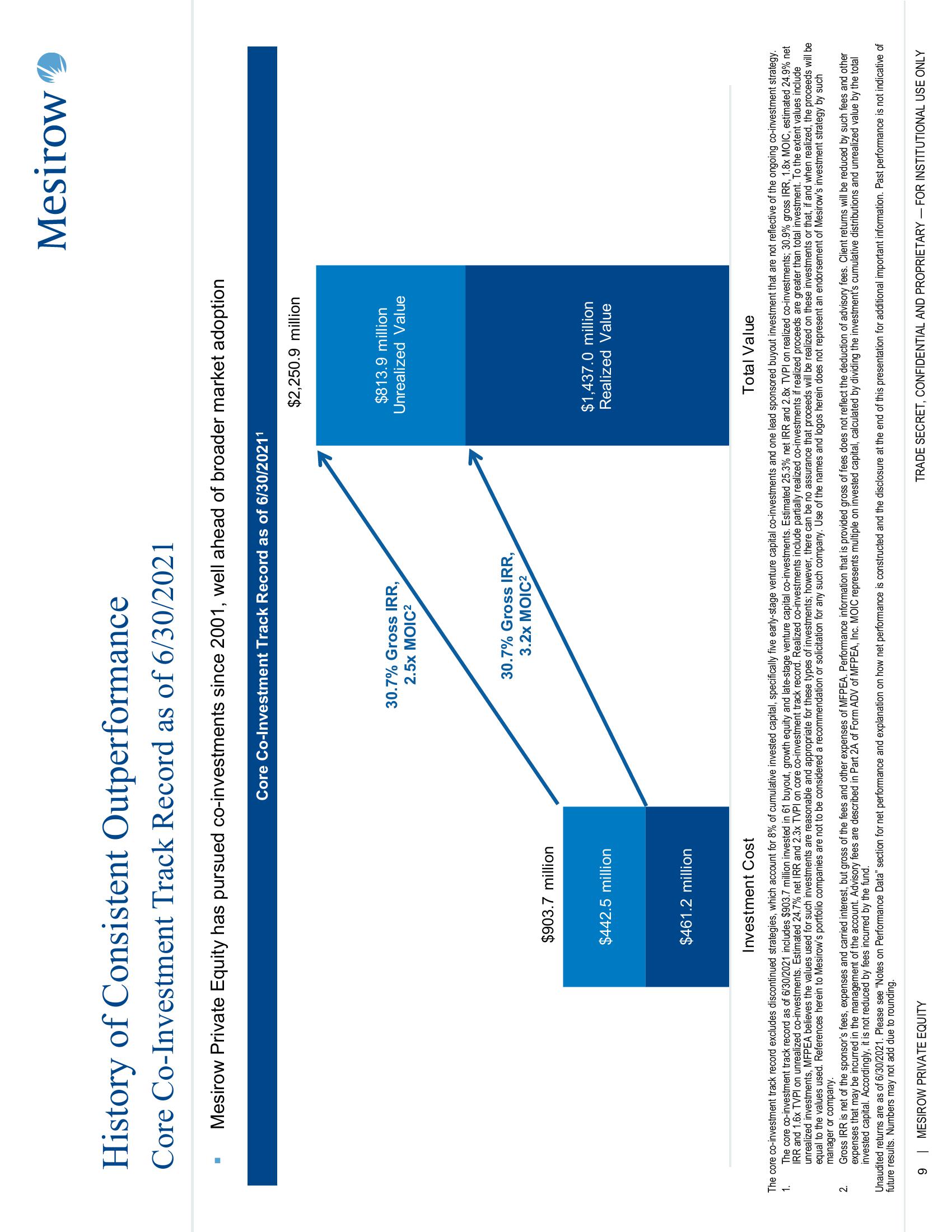

Core Co-Investment Track Record as of 6/30/2021

2.

Mesirow Private Equity has pursued co-investments since 2001, well ahead of broader market adoption

$903.7 million

$442.5 million

9 | MESIROW PRIVATE EQUITY

$461.2 million

Core Co-Investment Track Record as of 6/30/20211

30.7% Gross IRR,

2.5x MOIC²

30.7% Gross IRR,

3.2x MOIC²

$2,250.9 million

$813.9 million

Unrealized Value

$1,437.0 million

Realized Value

Investment Cost

Total Value

The core co-investment track record excludes discontinued strategies, which account for 8% of cumulative invested capital, specifically five early-stage venture capital co-investments and one lead sponsored buyout investment that are not reflective of the ongoing co-investment strategy.

1. The core co-investment track record as of 6/30/2021 includes $903.7 million invested in 61 buyout, growth equity and late-stage venture capital co-investments. Estimated 25.3% net IRR and 2.8x TVPI on realized co-investments; 30.9% gross IRR, 1.8x MOIC, estimated 24.9% net

IRR and 1.6x TVPI on unrealized co-investments. Estimated 24.7% net IRR and 2.3x TVPI on core co-investment track record. Realized co-investments include partially realized co-investments if realized proceeds are greater than total investment. To the extent values include

unrealized investments, MFPEA believes the values used for such investments are reasonable and appropriate for these types of investments; however, there can be no assurance that proceeds will be realized on these investments or that, if and when realized, the proceeds will be

equal to the values used. References herein to Mesirow's portfolio companies are not to be considered a recommendation or solicitation for any such company. Use of the names and logos herein does not represent an endorsement of Mesirow's investment strategy by such

manager or company.

Gross IRR is net of the sponsor's fees, expenses and carried interest, but gross of the fees and other expenses of MFPEA. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other

expenses that may be incurred in the management of the account. Advisory fees are described in Part 2A of Form ADV of MFPEA, Inc. MOIC represents multiple on invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total

invested capital. Accordingly, it is not reduced by fees incurred by the fund.

Mesirow

Unaudited returns are as of 6/30/2021. Please see "Notes on Performance Data" section for net performance and explanation on how net performance is constructed and the disclosure at the end of this presentation for additional important information. Past performance is not indicative of

future results. Numbers may not add due to rounding.

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation