Paysafe Results Presentation Deck

Q1 financial highlights

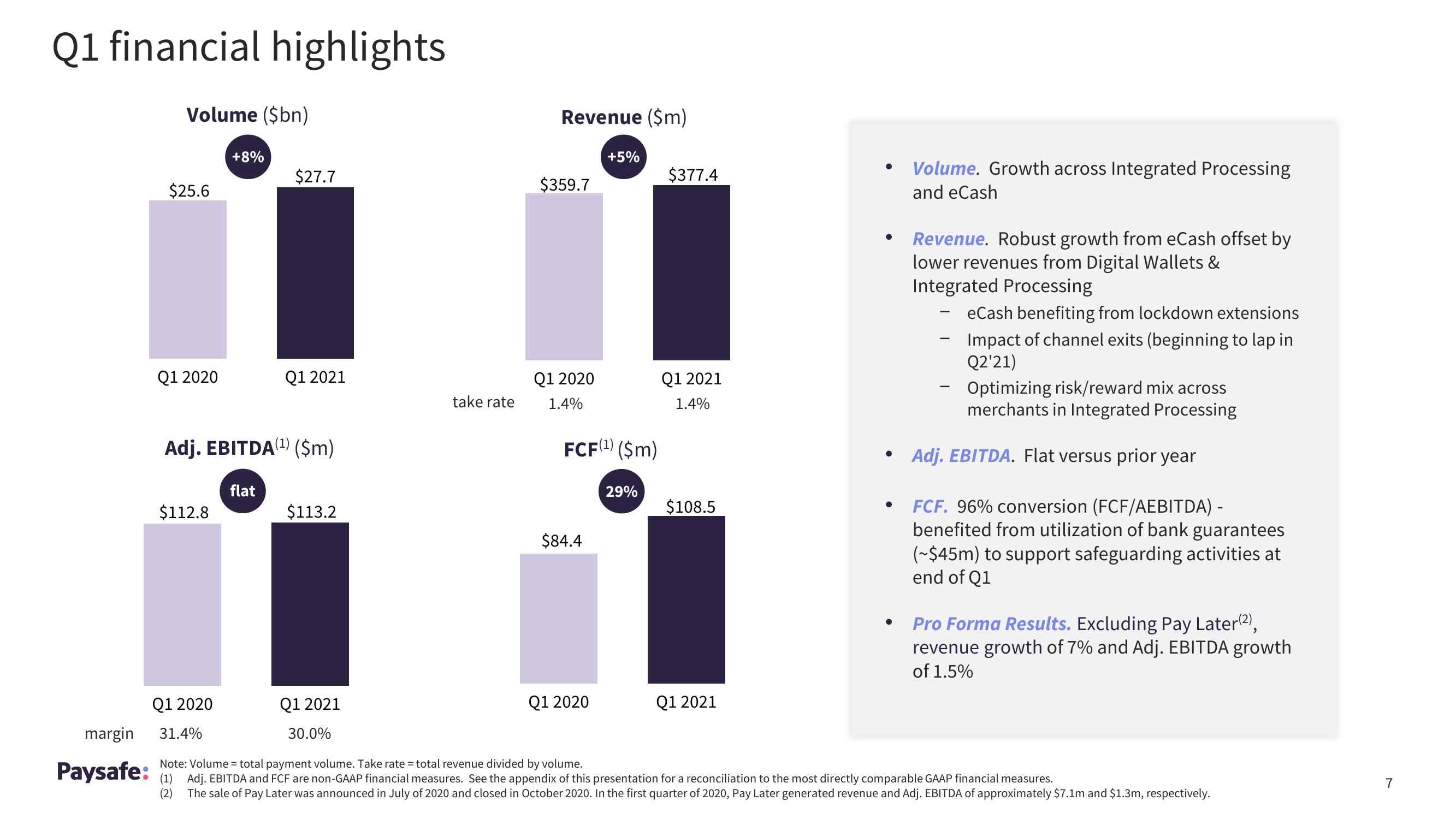

Volume ($bn)

$25.6

Q1 2020

$112.8

+8%

Q1 2020

Adj. EBITDA (¹) ($m)

$27.7

flat

Q1 2021

$113.2

Q1 2021

30.0%

take rate

Revenue ($m)

$359.7

Q1 2020

1.4%

FCF(¹) ($m)

$84.4

+5%

Q1 2020

29%

$377.4

Q1 2021

1.4%

$108.5

Q1 2021

●

●

Volume. Growth across Integrated Processing

and eCash

Revenue. Robust growth from eCash offset by

lower revenues from Digital Wallets &

Integrated Processing

eCash benefiting from lockdown extensions

Impact of channel exits (beginning to lap in

Q2'21)

Optimizing risk/reward mix across

merchants in Integrated Processing

Adj. EBITDA. Flat versus prior year

FCF. 96% conversion (FCF/AEBITDA) -

benefited from utilization of bank guarantees

(~$45m) to support safeguarding activities at

end of Q1

Pro Forma Results. Excluding Pay Later(²),

revenue growth of 7% and Adj. EBITDA growth

of 1.5%

margin 31.4%

Note: Volume = total volume. Take rate = total revenue divided by volume.

Paysafe: (d. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

(2) The sale of Pay Later was announced in July of 2020 and closed in October 2020. In the first quarter of 2020, Pay Later generated revenue and Adj. EBITDA of approximately $7.1m and $1.3m, respectively.

7View entire presentation