Melrose Results Presentation Deck

Aerospace: highlights

Melrose

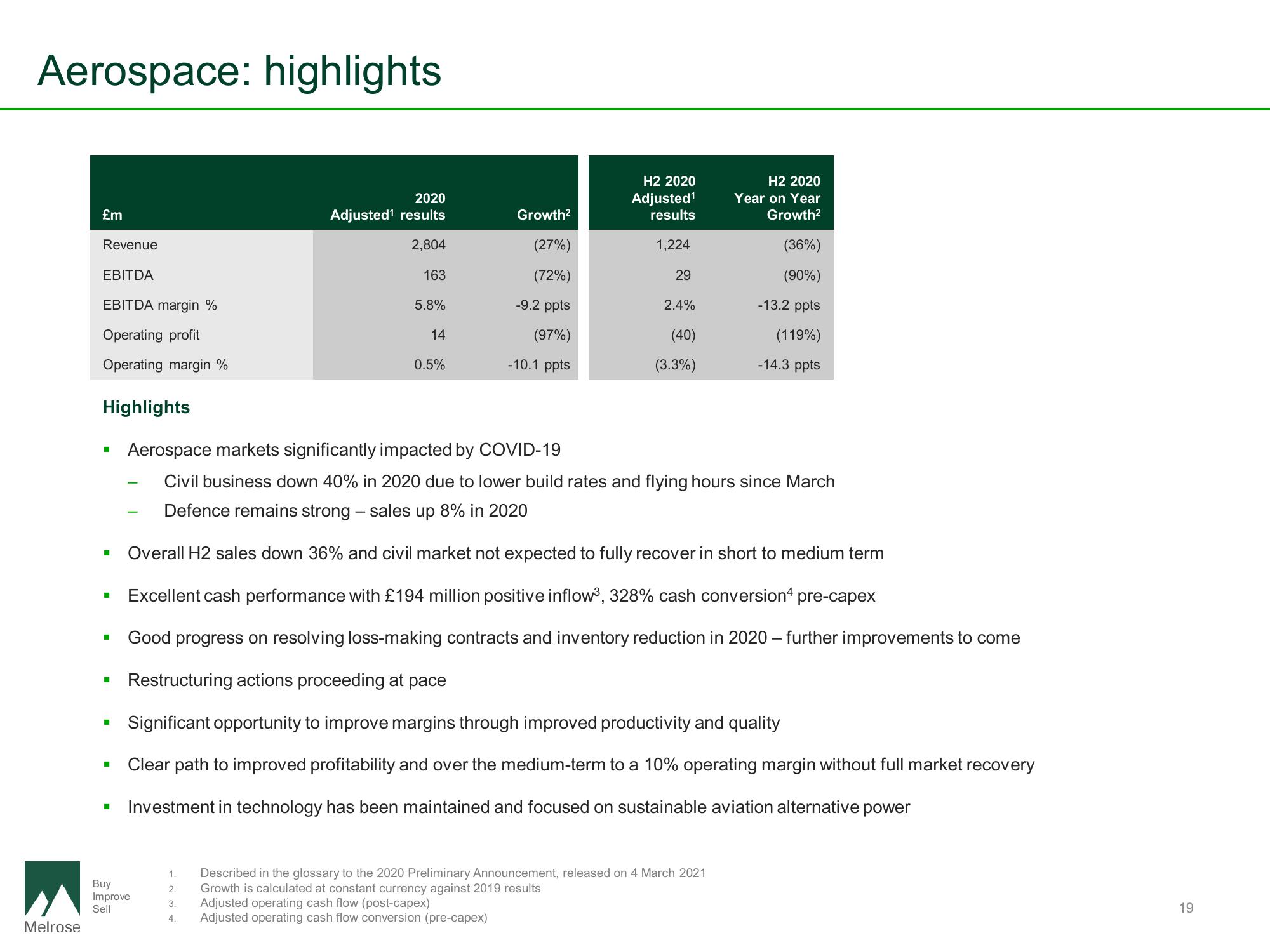

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

■

■

I

Buy

Improve

Sell

2020

Adjusted¹ results

2,804

163

1.

2.

3.

4.

5.8%

14

0.5%

Highlights

Aerospace markets significantly impacted by COVID-19

Civil business down 40% in 2020 due to lower build rates and flying hours since March

Defence remains strong - sales up 8% in 2020

Overall H2 sales down 36% and civil market not expected to fully recover in short to medium term

Excellent cash performance with £194 million positive inflow³, 328% cash conversion 4 pre-capex

Good progress on resolving loss-making contracts and inventory reduction in 2020 - further improvements to come

Restructuring actions proceeding at pace

Significant opportunity to improve margins through improved productivity and quality

Clear path to improved profitability and over the medium-term to a 10% operating margin without full market recovery

Investment in technology has been maintained and focused on sustainable aviation alternative power

Growth²

(27%)

(72%)

-9.2 ppts

(97%)

-10.1 ppts

H2 2020

Adjusted¹

results

1,224

29

2.4%

(40)

(3.3%)

H2 2020

Year on Year

Growth²

Described in the glossary to the 2020 Preliminary Announcement, released on 4 March 2021

Growth is calculated at constant currency against 2019 results

Adjusted operating cash flow (post-capex)

Adjusted operating cash flow conversion (pre-capex)

(36%)

(90%)

-13.2 ppts

(119%)

-14.3 ppts

19View entire presentation