Melrose Mergers and Acquisitions Presentation Deck

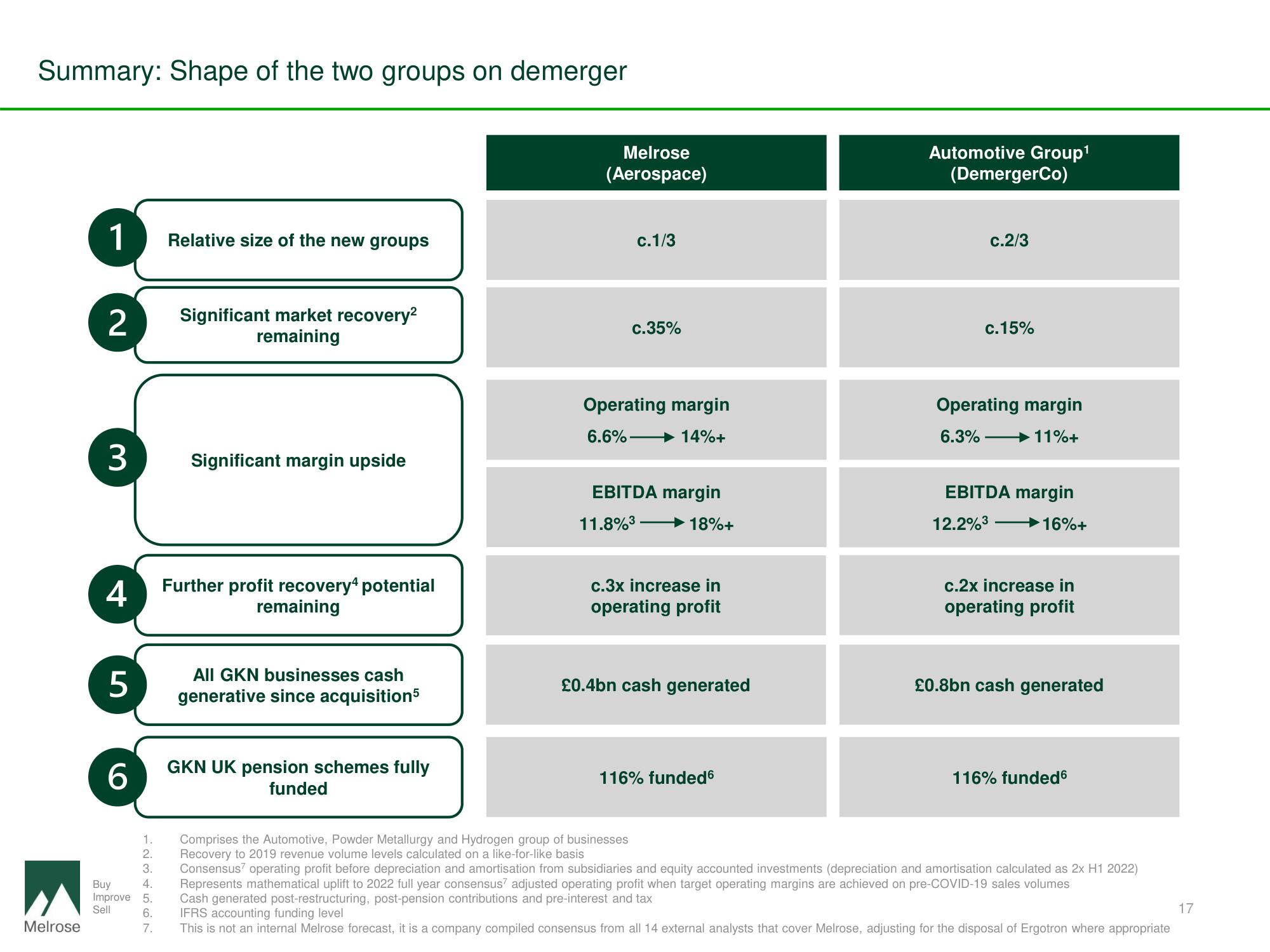

Summary: Shape of the two groups on demerger

Melrose

1

2

3

4

5

6

1.

2.

3.

Buy

4.

Improve 5.

Sell

6.

7.

Relative size of the new groups

Significant market recovery²

remaining

Significant margin upside

Further profit recovery4 potential

remaining

All GKN businesses cash

generative since acquisition5

GKN UK pension schemes fully

funded

Melrose

(Aerospace)

c.1/3

c.35%

Operating margin

6.6% 14%+

EBITDA margin

11.8%³- →18%+

c.3x increase in

operating profit

£0.4bn cash generated

Comprises the Automotive, Powder Metallurgy and Hydrogen group of businesses

Recovery to 2019 revenue volume levels calculated on a like-for-like basis

116% funded6

Automotive Group¹

(DemergerCo)

c.2/3

c.15%

Operating margin

6.3% 11%+

EBITDA margin

-16%+

12.2%³-

c.2x increase in

operating profit

£0.8bn cash generated

116% funded6

Consensus operating profit before depreciation and amortisation from subsidiaries and equity accounted investments (depreciation and amortisation calculated as 2x H1 2022)

Represents mathematical uplift to 2022 full year consensus7 adjusted operating profit when target operating margins are achieved on pre-COVID-19 sales volumes

Cash generated post-restructuring, post-pension contributions and pre-interest and tax

IFRS accounting funding level

This is not an internal Melrose forecast, it is a company compiled consensus from all 14 external analysts that cover Melrose, adjusting for the disposal of Ergotron where appropriate

17View entire presentation