Main Street Capital Investor Day Presentation Deck

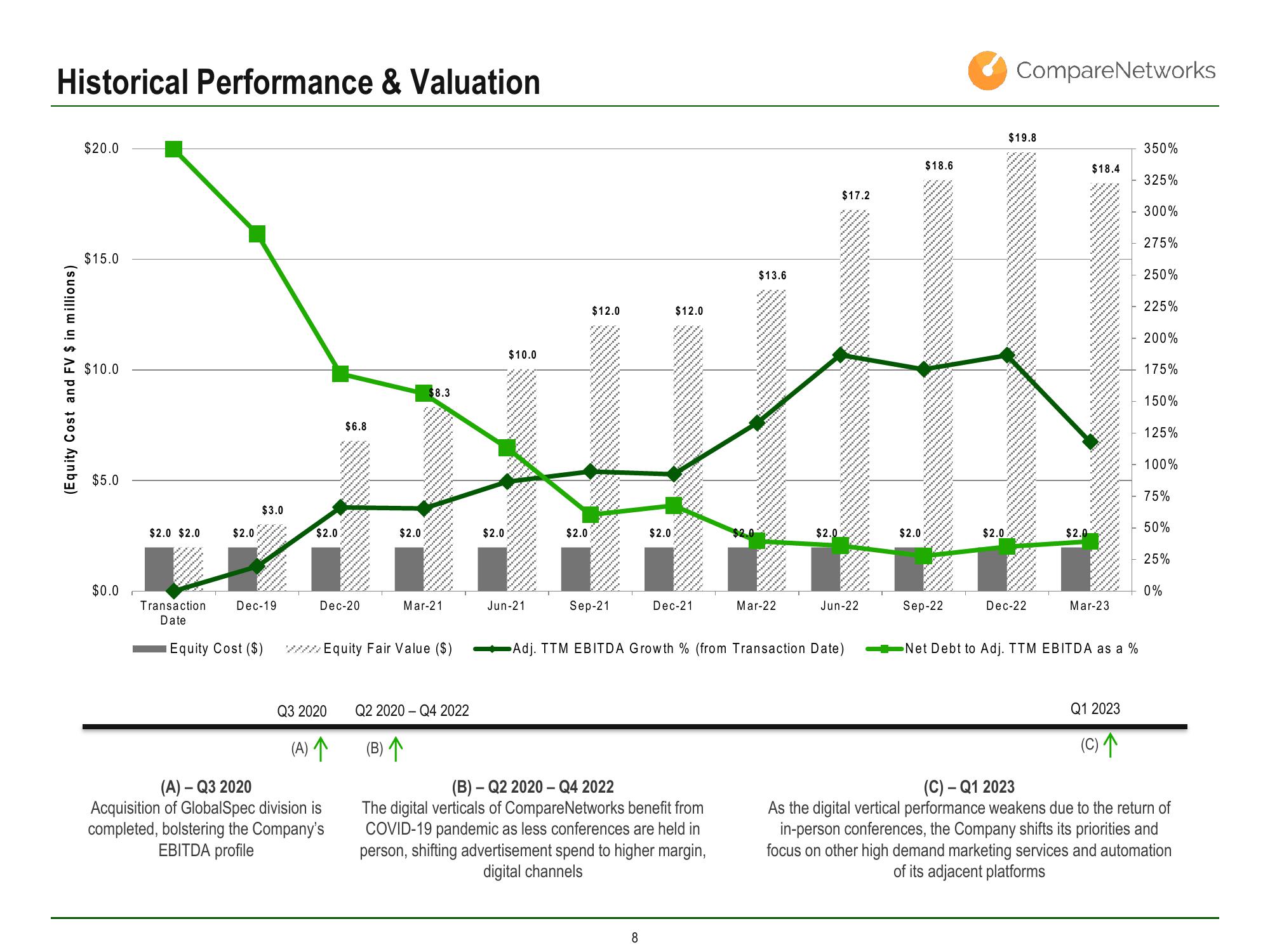

Historical Performance & Valuation

(Equity Cost and FV $ in millions)

$20.0

$15.0

$10.0

$5.0

$0.0

$2.0 $2.0

Transaction

Date

$2.0

$3.0

w

*********

**

****

22222

*xxx

Dec-19

Equity Cost ($)

$2.0

$6.8

Hot

Dec-20

(A) -Q3 2020

Acquisition of GlobalSpec division is

completed, bolstering the Company's

EBITDA profile

......

****

$2.0

$8.3

Mar-21

www.Equity Fair Value ($)

Q3 2020 Q2 2020-Q4 2022

(A) 个

(B) 个

$2.0

$10.0

********

Jun-21

********

*********

$12.0

$2.0

+5

******

M

Sep-21

*****

******

******

********

$2.0

$12.0

8

M

..........

.....

*******

*****.....

******

bemor

****

*********

Dec-21

www.

(B)-Q2 2020-Q4 2022

The digital verticals of Compare Networks benefit from

COVID-19 pandemic as less conferences are held in

person, shifting advertisement spend to higher margin,

digital channels

$13.6

*****

-2222

*****

******

*********

*xx.

****

************

Mar-22

*******

wwwwww

n****

www

with

*****

$2.0

$17.2

***

WAY.

Adj. TTM EBITDA Growth % (from Transaction Date)

*****

Jun-22

***.....

....…....

$18.6

$2.0

*****

MS JE

*****

******

******

Sep-22

*******

.........

$2.0

$19.8

M

CompareNetworks

9.15.00

****

.......

trees w

******..

*******

b

www.

Dec-22

$2.0

$18.4

Mar-23

Net Debt to Adj. TTM EBITDA as a %

Q1 2023

(C)个

350%

325%

300%

275%

250%

225%

200%

175%

150%

125%

100%

75%

50%

25%

0%

(C) - Q1 2023

As the digital vertical performance weakens due to the return of

in-person conferences, the Company shifts its priorities and

focus on other high demand marketing services and automation

of its adjacent platformsView entire presentation