Allego Results Presentation Deck

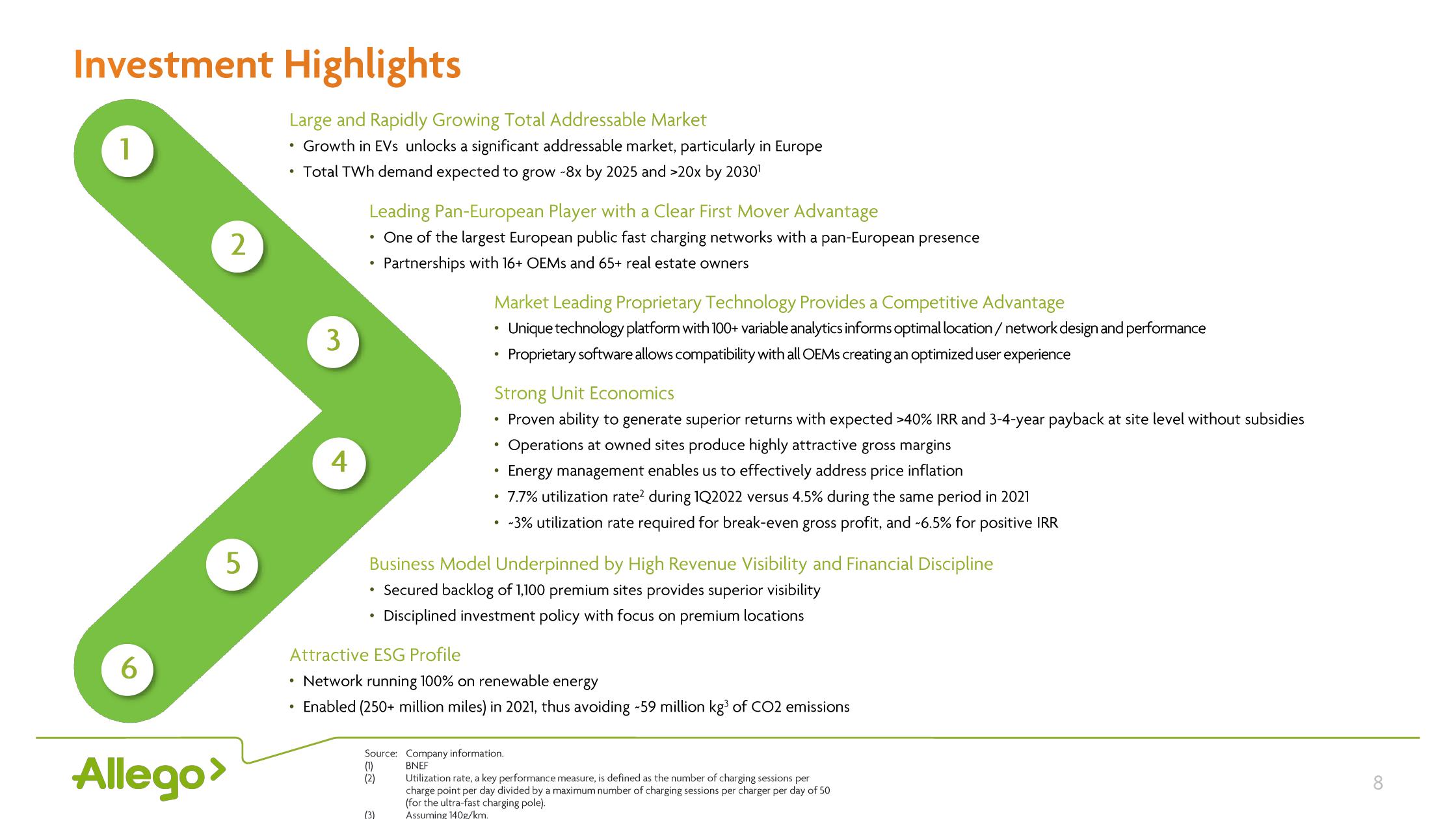

Investment Highlights

1

6

2

5

Allego>

Large and Rapidly Growing Total Addressable Market

• Growth in EVs unlocks a significant addressable market, particularly in Europe

Total TWh demand expected to grow -8x by 2025 and >20x by 2030¹

3

4

Leading Pan-European Player with a Clear First Mover Advantage

One of the largest European public fast charging networks with a pan-European presence

Partnerships with 16+ OEMs and 65+ real estate owners

Market Leading Proprietary Technology Provides a Competitive Advantage

Unique technology platform with 100+ variable analytics informs optimal location/network design and performance

Proprietary software allows compatibility with all OEMs creating an optimized user experience

●

(1)

(2)

Strong Unit Economics

Proven ability to generate superior returns with expected >40% IRR and 3-4-year payback at site level without subsidies

Operations at owned sites produce highly attractive gross margins

Energy management enables us to effectively address price inflation

• 7.7% utilization rate² during 1Q2022 versus 4.5% during the same period in 2021

• -3% utilization rate required for break-even gross profit, and -6.5% for positive IRR

Business Model Underpinned by High Revenue Visibility and Financial Discipline

• Secured backlog of 1,100 premium sites provides superior visibility

Disciplined investment policy with focus on premium locations

(3)

●

Attractive ESG Profile

• Network running 100% on renewable energy

• Enabled (250+ million miles) in 2021, thus avoiding -59 million kg³ of CO2 emissions

Source: Company information.

BNEF

Utilization rate, a key performance measure, is defined as the number of charging sessions per

charge point per day divided by a maximum number of charging sessions per charger per day of 50

(for the ultra-fast charging pole).

Assuming 140g/km.

8View entire presentation