SmileDirectClub Investor Presentation Deck

Marketing & selling.

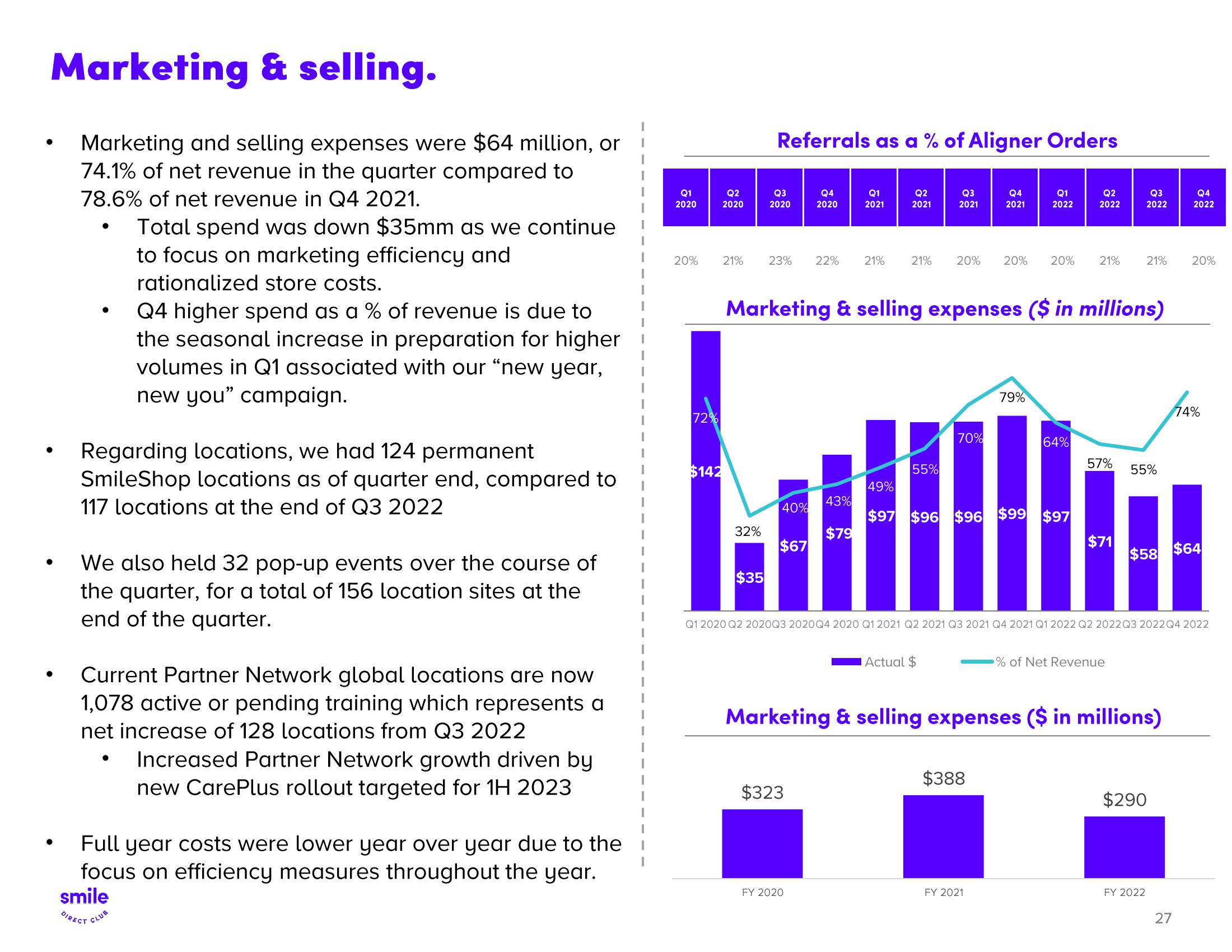

Marketing and selling expenses were $64 million, or

74.1% of net revenue in the quarter compared to

78.6% of net revenue in Q4 2021.

●

Total spend was down $35mm as we continue

to focus on marketing efficiency and

rationalized store costs.

Q4 higher spend as a % of revenue is due to

the seasonal increase in preparation for higher

volumes in Q1 associated with our "new year,

new you" campaign.

Regarding locations, we had 124 permanent

SmileShop locations as of quarter end, compared to

117 locations at the end of Q3 2022

We also held 32 pop-up events over the course of

the quarter, for a total of 156 location sites at the

end of the quarter.

Current Partner Network global locations are now

1,078 active or pending training which represents a

net increase of 128 locations from Q3 2022

Increased Partner Network growth driven by

new CarePlus rollout targeted for 1H 2023

Full year costs were lower year over year due to the

focus on efficiency measures throughout the year.

smile

DIRECT CLUB

Q1

2020

Q2

2020

72%

$142

20% 21% 23% 22% 21%

Referrals as a % of Aligner Orders

Q4

2020

32%

Q3

2020

$35

40%

$67

Q1

2021

43%

$323

$79

FY 2020

Q2

2021

21%

Marketing & selling expenses ($ in millions)

55%

Q3

2021

Actual $

20% 20% 20%

70%

Q4

2021

Q1

2022

79%

49%

$97 $96 $96 $99 $97

$388

FY 2021

64%

Q2

2022

21%

57%

$71

Q3

2022

% of Net Revenue

21%

Q1 2020 Q2 2020Q3 2020Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022Q3 2022 Q4 2022

Marketing & selling expenses ($ in millions)

55%

FY 2022

$58 $64

$290

Q4

2022

20%

27

74%View entire presentation