Avantor Mergers and Acquisitions Presentation Deck

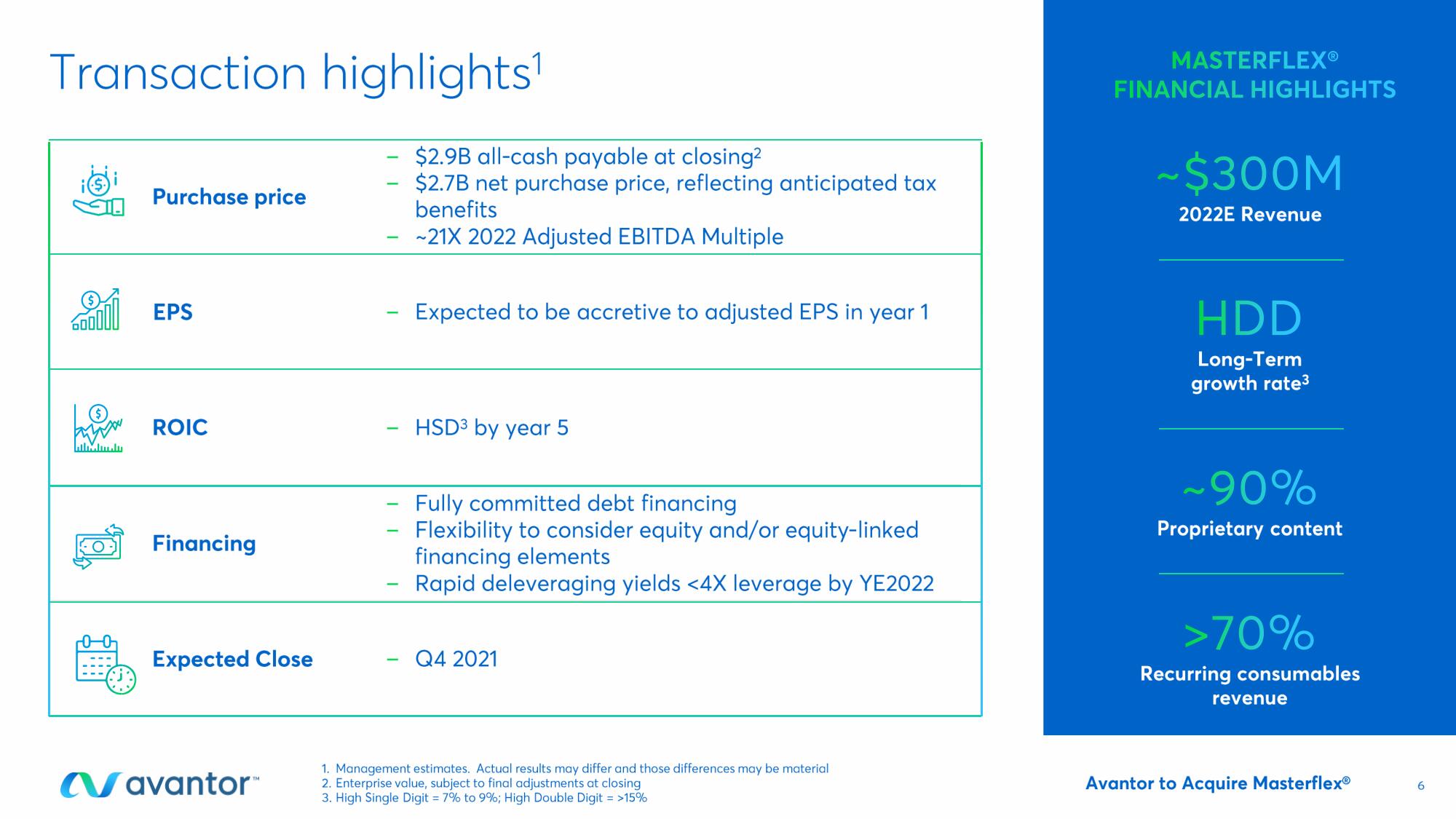

Transaction highlights¹

www

سلسلللنا

Purchase price

EPS

ROIC

Financing

Expected Close

Navantor™

-

$2.9B all-cash payable at closing²

$2.7B net purchase price, reflecting anticipated tax

benefits

~21X 2022 Adjusted EBITDA Multiple

Expected to be accretive to adjusted EPS in year 1

HSD3 by year 5

Fully committed debt financing

Flexibility to consider equity and/or equity-linked

financing elements

Rapid deleveraging yields <4X leverage by YE2022

Q4 2021

1. Management estimates. Actual results may differ and those differences may be material

2. Enterprise value, subject to final adjustments at closing

3. High Single Digit = 7% to 9%; High Double Digit = >15%

MASTERFLEX®

FINANCIAL HIGHLIGHTS

~$300M

2022E Revenue

HDD

Long-Term

growth rate3

~90%

Proprietary content

>70%

Recurring consumables

revenue

Avantor to Acquire Masterflex®View entire presentation